The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

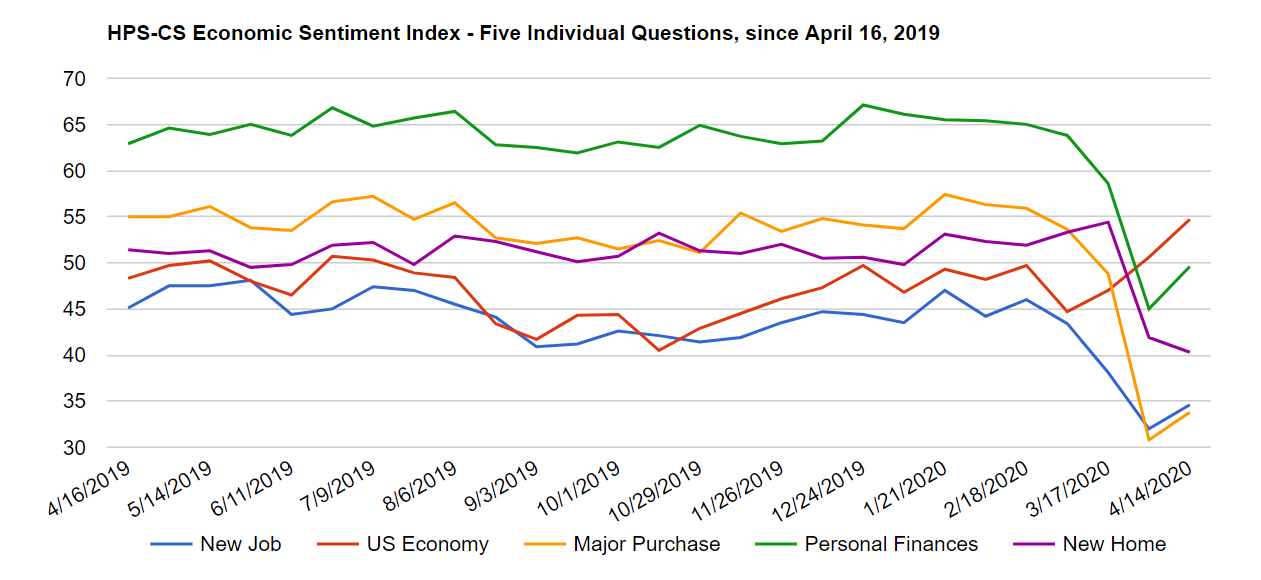

Consumer economic sentiment rebounded slightly from a historic low over the last two weeks as the stock market showed signs of recovery and as government officials began discussing when and how to reopen the economy. Following the last reading’s record-shattering drop, the HPS-CivicScience Economic Sentiment Index (ESI) inched upwards, rising 2.5 points to 42.6. The newest reading now marks the second-lowest reading in the ESI’s history.

Four of the ESI’s five indicators rose over the past two weeks. Leading the upswing were strong gains in confidence toward personal finances and the overall economy, which rose by 4.6 and 4.1 points, respectively, to 49.6 and 54.7. Confidence in the overall economy is now at its highest level since June 2018. Also posting gains were confidence in making a major purchase and confidence in finding a new job, which inched upwards by 3.0 points and 2.6 points, respectively. The one metric to decline was confidence in the housing market, which sank 1.6 points to a new all-time low of 40.3.

Changes in economic sentiment coincided with mixed economic news. Reports last week indicated that the White House is pushing to open the economy by May 1, in an effort to mitigate the economic damage caused by lockdowns. By the close of trading last Thursday, U.S. stocks posted their biggest weekly gains since 1974, rising 12% in four days. But the fallout of COVID-19 continues to be felt throughout the economy. Almost 17 million Americans have filed for unemployment insurance since mid-March, and more than 2 million American mortgage holders – representing 4% of all U.S. home loans – are now in forbearance, a metric that is rising exponentially.

Check out the full reading.