Discount retailers offer a wide range of value and luxury brands for shoppers looking to get more (or better) for less. After a wild year of a pandemic that disparately impacted consumers of all financial backgrounds, CivicScience checked in with where Americans are going to look for deals on apparel, footwear, and home goods in the coming months.

In a CivicScience survey of 1,700 U.S. adults, 7% said they plan to shop at discount stores like TJ Maxx or Ross more than usual over the next six months. While the majority said they will shop at these stores just as often (75%), 18% will do so less often than usual.

This is actually good news for discount retailers, at least in comparison to consumer sentiment in October of 2020 when 32% of respondents said they would shop at discount retailers less than usual. With that perspective, one can assume most consumers are going back to these stores, a great number of which don’t do any business online.

It is clear that discount retail stores provide an economical shopping option for Americans. CivicScience data on employment status show U.S. adults who experienced unemployment within the last year are more than twice as likely as the employed to say they’ll be shopping at discount retailers more over the next six months. Likely related to overall reduced spending, more than one-third of this group also say they will be shopping at discount retailers less.

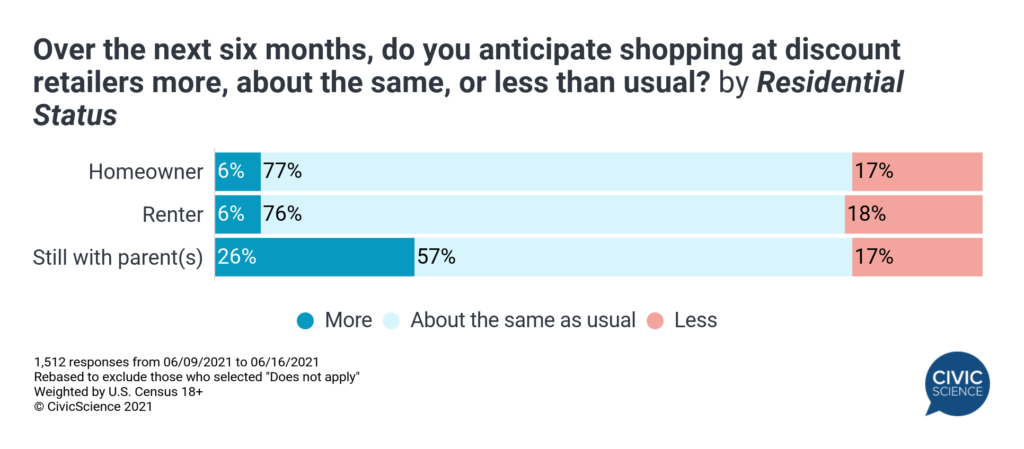

Residential status is also revealing. Homeowners and renters show nearly identical levels of intent to shop at discount retailers over the next six months, but consumers who are still living at home with parents over-index in likelihood to shop for off-price goods more over the coming months.

Store Popularity

Among the discount retailers studied, TJ Maxx and Marshalls are the most popular. Ross and Burlington nearly tie for second-most popular followed by Nordstrom Rack and Saks OFF 5TH.

Apparel and home goods are the top two product categories that consumers look for at any discount retailer. Footwear is the next most popular category followed by bags and jewelry, respectively.

While overall shopping at discount retail stores is still down due to the pandemic, visits to these stores are almost where they were pre-pandemic. With apparel being the focus right now, it’s safe to say people are anticipating wardrobe updates in the coming months.

Stay tuned for next week’s report on how consumers feel about their wardrobes and if apparel markets can expect a significant jump in shoppers who want to make major wardrobe updates.