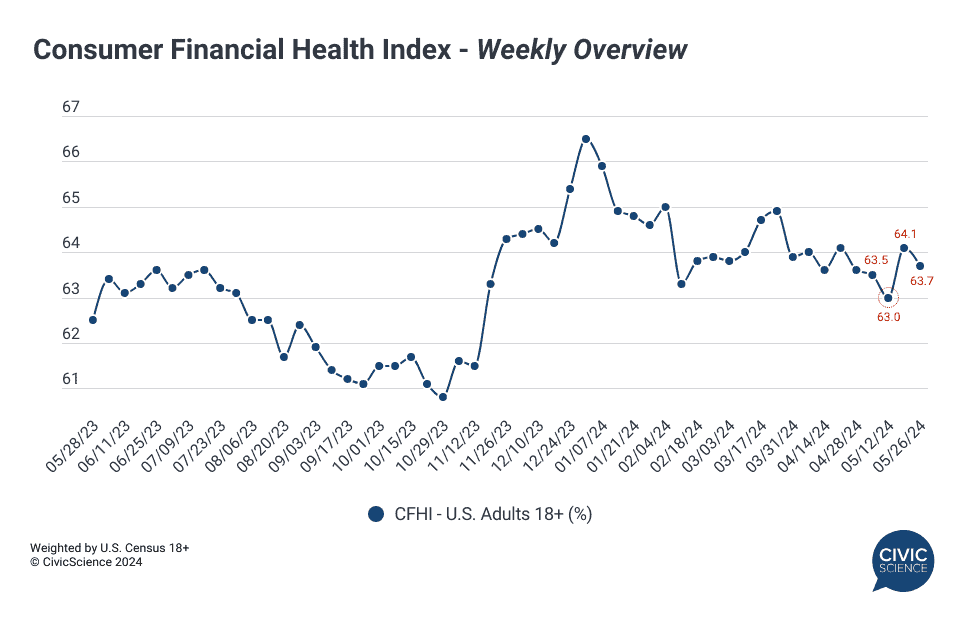

Measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI) has a pulse on how U.S. consumers expect their personal financial situation to change in the next six months.

As seen so far in 2024, consumers continue to feel extreme fluctuations from one week to the next when it comes to expectations for their financial well-being. The latest reading shows that weekly financial outlook hit a yearly low of 63.0% by mid-May, before recovering the second half of the month.

Take Our Poll: Do you have a financial plan?

As a monthly average, consumer financial health declined in May to 63.6%, although it did so at a slightly slower rate than from March to April. What’s driving the decline? A look at the individual markers behind the collective score indicates that consumers are feeling much less secure about the short-term (6-month) outlook on their savings and investments – outlook on savings specifically took the biggest hit month to month, plummeting 1.9 points to a yearly low and dragging down the collective monthly score. Consumer optimism toward income also remained low in May, which follows its precipitous decline since the start of the year.

On the upside, Americans are feeling more hopeful about their credit scores, as well as their debt outlook.

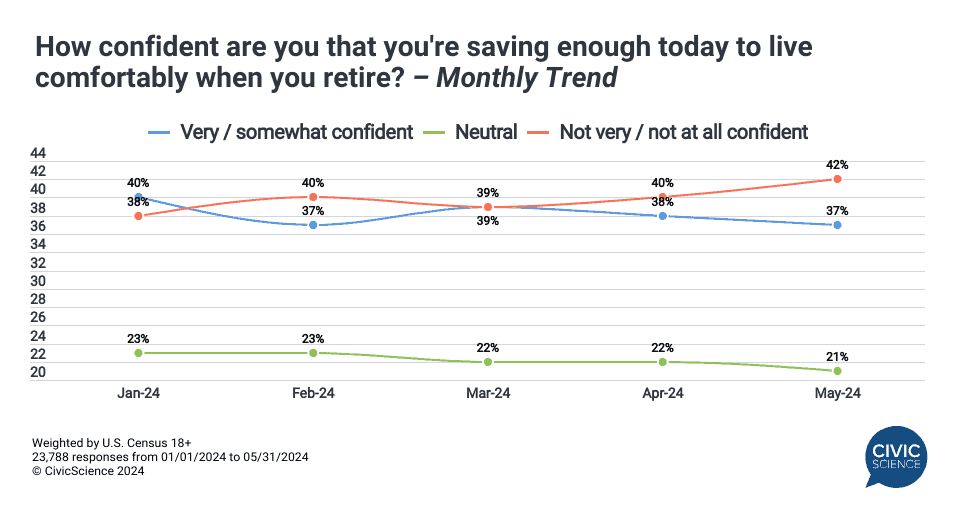

Additional data from CivicScience show that many Americans are growing increasingly dissatisfied with their current level of savings within the context of retirement – in May, a total of 42% reported they were not confident they were saving enough today to retire comfortably, up from 38% in January.

These concerns are further echoed by CivicScience data published this week which found that roughly 1-in-2 adults aged 55 and older plan to keep working in their retirement years. At the same time, U.S. workers reported heightened concerns over employment and layoffs, and declining confidence in the job market.

Weigh In: Do you follow a monthly budget to help keep an eye on your finances?

Attitudes change before behaviors do. To stay ahead of how your customers, key consumer segments, and competitor’s customers are feeling about their finances, get in touch. Learn more about the CFHI here.