CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

In a world where political and financial headlines shift daily, brands, advertisers, and media publishers striving to reach the right audiences must rise above the noise by tapping into how consumers feel and what those feelings reveal about their spending intent.

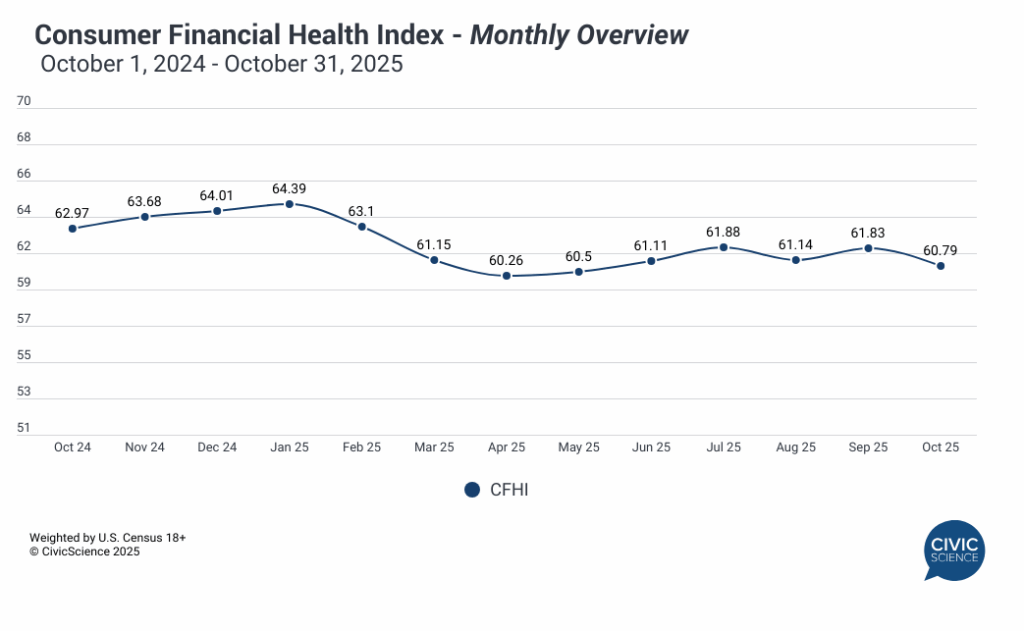

The CivicScience Consumer Financial Health Index (CFHI) offers a real-time glimpse at consumers’ self-reported financial outlook in response to events in the world at large. These insights equip decision-makers with the knowledge they need to strengthen messaging, anticipate their audience’s spending habits, and chart a confident path forward in an ever-changing market.

The latest monthly reading shows that after a slight rebound in September, consumer financial health dropped 1.04 points to 60.79 points in October. This is the lowest point that the index has reached since April 2025, and is down 2.18 points since October 2024. The decrease affected almost all age groups, but was particularly pronounced among adults 55 and older. Conversely, Gen Z adults experienced a modest 0.57-point uptick.

Answer our Poll: Do you feel comfortable or uncomfortable with your current financial situation?

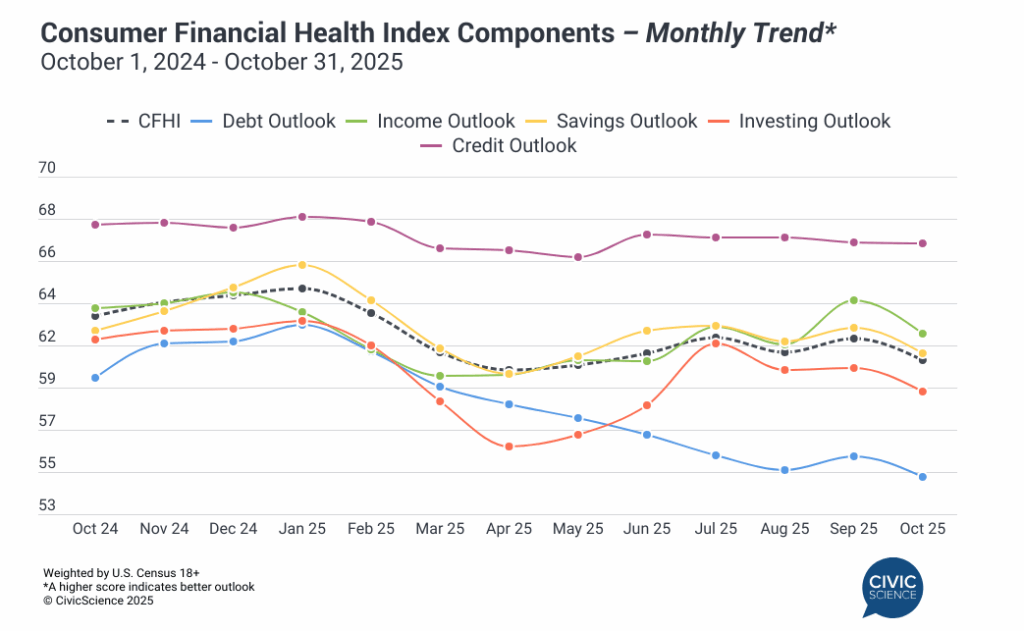

Income Outlook Leads Latest Index Drop

A breakdown of the index’s components reveals that the same indicator – income outlook – that drove the uptick in September led the downturn in October. The income outlook dropped by 1.72 points, followed by notable decreases in both consumer savings outlook (1.27 points) and investing outlook (1.08 points). Although debt outlook saw its first increase back in September, October reversed those gains with a decrease of 1.04 points, solidifying its place as the lowest-scoring component. Meanwhile, credit outlook held fairly steady, with a slight dip.

Despite a brief positive bump in September, October erased any signs of potential optimism as the general environment of uncertainty remains. Shifts in financial outlook like these highlight how consumer behavior can (and does) change quickly, leaving little room for static strategies. Brands and advertisers with access to real-time consumer-declared intent, like CivicScience clients, can anticipate these shifts, refine messaging, and position themselves to capture attention, share, and loyalty in Q4 and beyond.