The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

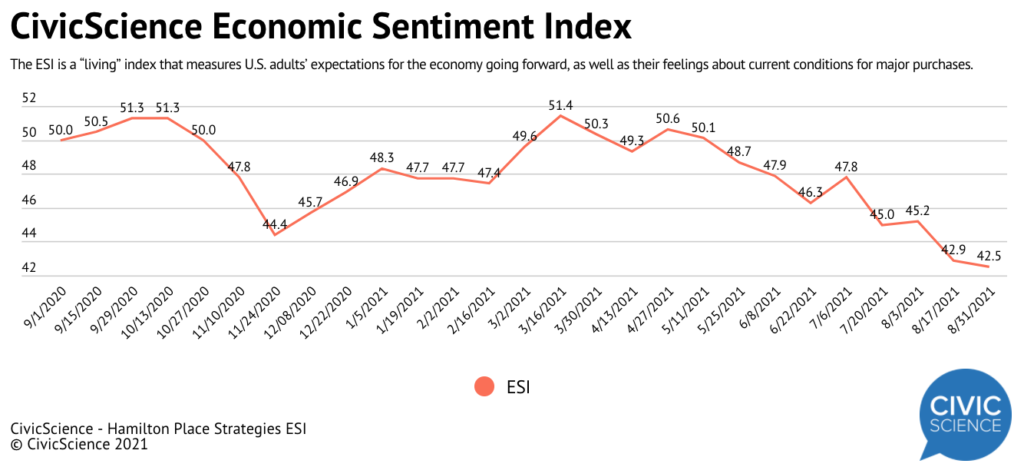

Economic sentiment continued its decline over the past two weeks, with consumers expressing a particular lack of confidence in the overall U.S. economy. The HPS-CivicScience Economic Sentiment Index (ESI) dropped 0.4 points to 42.5, nudging closer to the all-time low of 40.1 reached in March 2020 when the COVID-19 pandemic hit the United States.

Of the ESI’s five indicators, confidence in the overall U.S. economy fell the most over the past two weeks, dropping 2.5 points to 38.0—down 18.6 points from the 2021 high reached in March. The drop comes as the Delta variant continues to make its presence felt nationally and globally. Restaurant dining, office occupancy, and airline travel all saw declines in recent weeks compared to earlier this summer. Concerns about inflation, meanwhile, show no signs of letting up: The PCE Index was up 4.2% in the 12 months ended July 2021, the highest rate since 1991. The ESI’s other indicators made the following moves:

– Confidence in personal finances dropped 1.7 points to 55.3

– Confidence in making a major purchase dropped 0.8 points to 3.7

– Confidence in the housing market rose 2.1 points to 30.4 but remains near all-time lows

– Confidence in finding a new job rose 0.5 points to 57.0