It can be argued that financial literacy is a necessity and not a luxury. A recent study by the National Financial Educators Council revealed that Americans who lack knowledge about personal finances lose an average of $1,819 annually. This might seem like a small amount in the short-term, but in the long-term, it adds up – especially with the rising cost of living and the potential to make unsound financial decisions due to poor financial literacy.

Take Our Poll: How would you rank your financial literacy?

In 2024, it’s becoming increasingly apparent that individuals need to be financially literate, considering the rapidly changing economic landscape and ever-evolving financial markets. CivicScience has been closely monitoring consumer financial literacy trends, discovering a slight loss in self-reported literacy from 2023 to 2024. Here’s a closer look at where things stand:

Fewer Consumers Feel Financially Literate

Data collected in January show the majority of U.S. adults feel they are ‘somewhat’ financially literate. Those who say they are ‘very’ financially literate declined a point to 29% from 2023, while those ‘not at all’ financially literate rose two points to 12%.

In general, financial literacy tends to increase with age and experience, although nuances exist. Gen Z adults aged 18-24 have the most financial literacy trouble: 1-in-5 rate themselves as ‘not at all’ financially literate. However, 27% report being ‘very’ financially literate, which is slightly higher than Millennials aged 25-44. Yet it’s Gen Xers aged 45-54 who are the most likely to be ‘very’ financially literate, a full seven points higher than their older counterparts.

The findings suggest that financial literacy needs to be a topic with more discussion, especially for young adults. It’s clear that financial literacy has not improved year-over-year, even though there are more resources than ever surrounding becoming financially literate.

Impact on Financial Stress

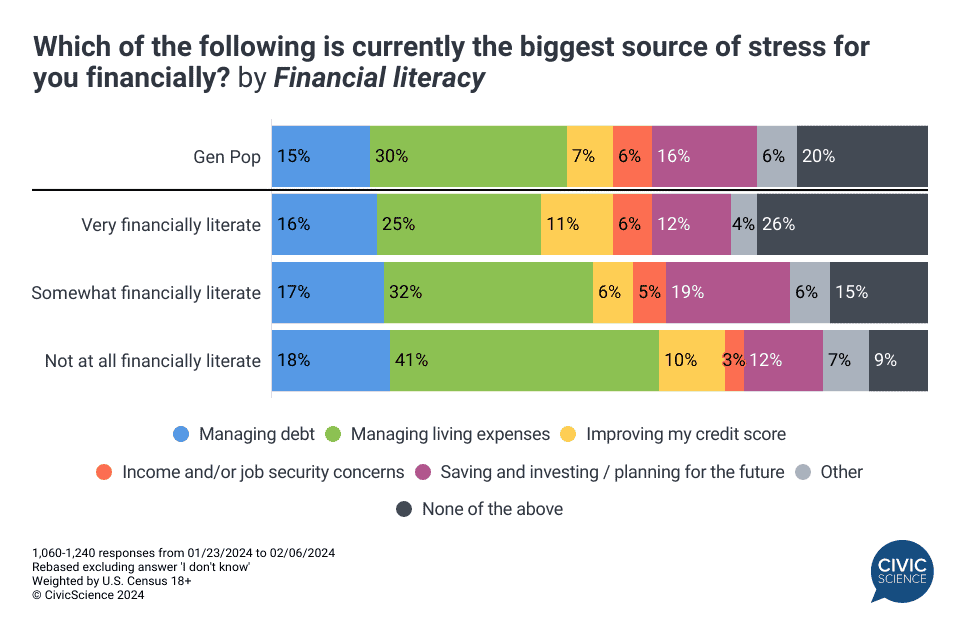

In the last few years, several studies have been released questioning whether higher levels of financial literacy lead to lower levels of financial stress. CivicScience data show financial stress is a marker of financial literacy – 91% of those who are not financially literate report they have at least one source of financial stress, compared to 74% of those who are highly literate.

More specifically, the type of stress varies with levels of literacy. Managing living expenses is the biggest stressor for both very financially literate individuals and those who don’t feel financially literate, but it’s significantly higher for those without financial literacy. Consumers feel nearly equally stressed by managing debt.

For Americans, financial stress in 2024 has shifted in certain areas from early 2023, particularly:

- Living expenses – consumers are experiencing more financial stress (30%) over managing living expenses like rent, gas, and groceries than in 2023 (26%).

- Credit – credit scores are a bigger concern than in 2023, with more people focusing on improving theirs.

- Saving and investing – last year, 23% of people cited saving and investing stress as their main stressor, while in 2024, only 16% feel the same.

The Link Between Financial Literacy and Security

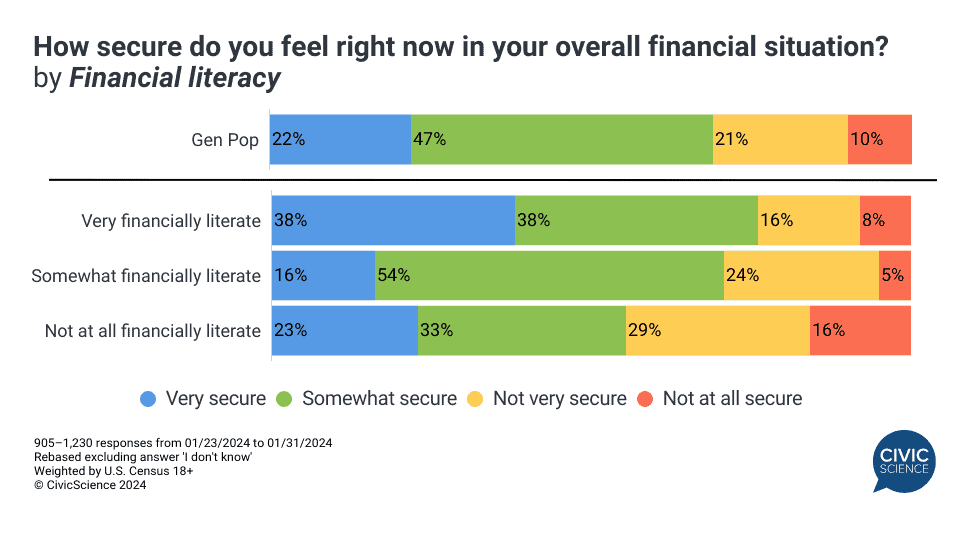

Recent statistics have revealed that fewer than 1-in-3 Americans feel completely financially secure. New CivicScience data show that most U.S. adults feel ‘somewhat’ to ‘very’ secure in their overall financial situation (69%). On the other hand, nearly 1-in-3 do not feel secure, with 10% who report feeling ‘not at all’ secure.

Financial security and financial literacy go hand-in-hand. After all, how can you be financially secure if you don’t possess the knowledge to make smart financial decisions? This point is shown by CivicScience data indicating that a total of 45% of consumers who don’t feel at all financially literate also don’t feel financially secure, compared to 24% of those who rate themselves as highly literate.

Additional Insights from the CivicScience InsightStore™

A few key insights into how financial literacy relates to other important aspects of the lives of consumers:

- Among those who feel they are not financially literate at all, 46% are confident that they’re saving enough to live comfortably during retirement, while 34% are not confident.

- Those not at all financially literate are nearly twice as likely to say they are uncomfortable with the amount of debt they have.

- Interestingly, 47% of those who are not financially literate believe they manage their money well. Unsurprisingly, 75% of those who are very financially literate feel the same way.

Join the Conversation: Does thinking about your personal finances tend to stress you out? 😖

Ultimately, it seems that in 2024, financial literacy is not improving. Most people are also not feeling wholly secure in their financial standings overall. Data suggest that those who are not financially literate may feel overconfident about their financial skills, such as money management, which could be detrimental to their financial health in the long run.