Thanks to several major hacking and leaking incidents, from healthcare to telecommunications, the last six months or so have been rough in terms of cybersecurity and consumer data. Dell is the most recent company to join the list after suffering a major data breach, thrusting cybersecurity concerns back into the spotlight.

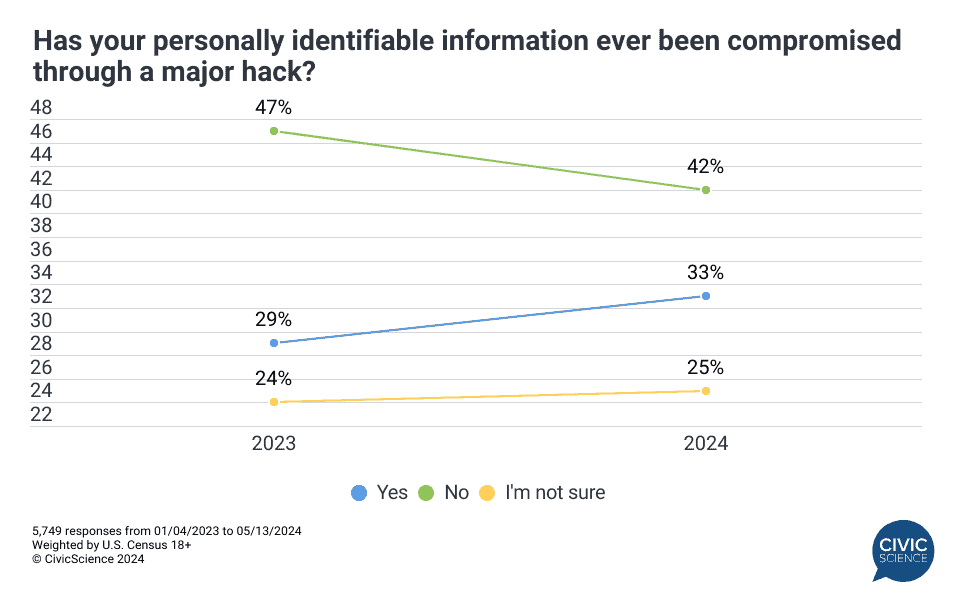

New CivicScience data show that one-third of Americans report having had some element of their personal identifiable information compromised in a data breach. The problem appears to be worsening, as that percentage has risen four percentage points since January 2023.

It’s one thing to have personal data stolen in a data leak, but it’s another to have someone act on that data to steal their identity. Additional data show that 28% of Americans report having been a victim of identity theft, while another 15% aren’t sure whether they’ve been a victim yet (n=1,838 responses from 05/09/2024 to 05/013/2024).

Take Our Poll: Have you ever been affected by a data breach?

Ongoing CivicScience tracking shows the percentage of consumers who are at least ‘somewhat’ concerned for their data being stolen from the companies they use has held relatively steady but currently stands at an overwhelming majority of 89% so far in Q2 2024 (excluding those unsure). Personal financial data is by far the most likely category of data Americans are concerned about being compromised (n=1,625 responses from 05/09/2024 to 05/13/2024).

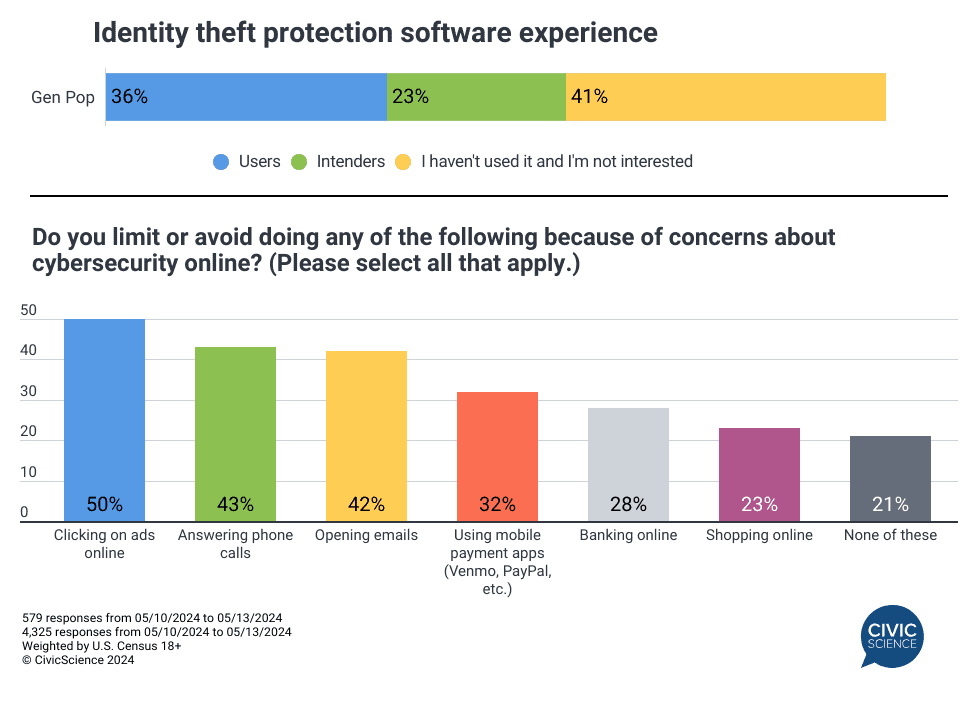

What are consumers doing in the face of such strong levels of concern for the security of their data? Data show that just 36% of Americans utilize identity theft protection software, down from 40% in October 2023, and another 23% are considering signing up for one (among those aware of these services). In terms of behaviors, additional data find more than 40% of consumers are pumping the breaks on clicking online ads, answering the phone, and opening emails as ways to limit cybersecurity threats. Using mobile apps, on the other hand, is seen as less risky compared to last year, falling seven percentage points to 32%.

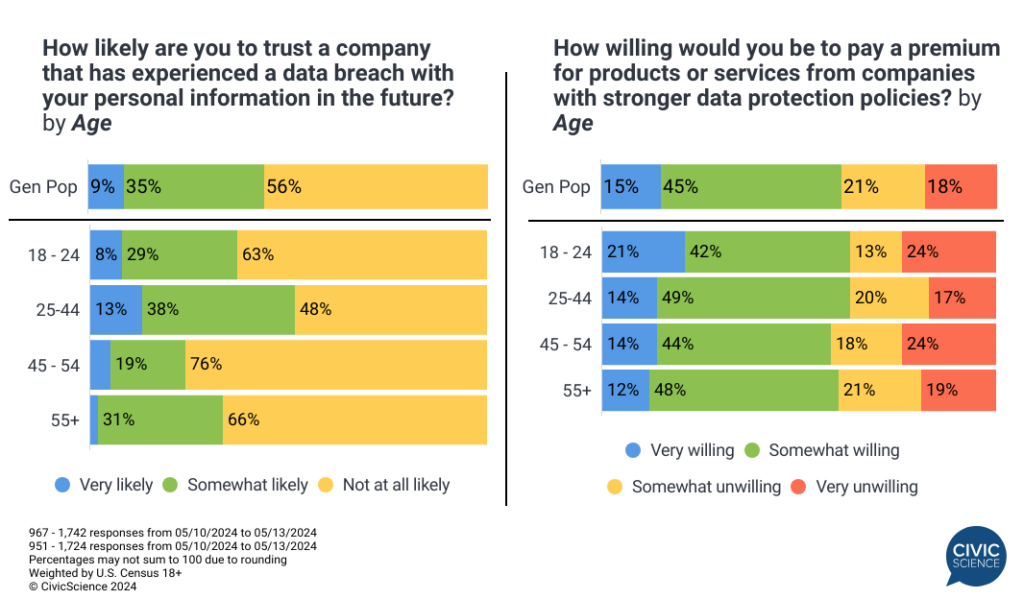

Unsurprisingly, a data breach can significantly erode consumer confidence in a company’s ability to protect their personal data in the future. While the majority of consumers (56%) express a complete lack of trust in a company post-breach, there’s a notable generational divide. Those between the ages of 25 and 44 are more likely to be forgiving and willing to consider trusting the company again. Conversely, adults aged 45-54 overwhelmingly lack confidence in the company’s ability to handle their personal data again following a breach.

Additional CivicScience data show the majority (60%) would pay more to patronize a business they know has more robust data protection standards. That said, respondents aged 45-54 – the age group least likely to trust a company post-breach – are also the least willing to pay more to potentially mitigate the risk of a breach.

Weigh In: How confident do you feel about the level of protection surrounding your personal data?

As data breaches continue to plague a variety of industries, Americans are deeply apprehensive about the safety of their personal information and reluctant to trust companies that have been compromised. It is certainly not an issue to ignore as the increased prevalence of data breaches drives shifts in consumer behavior and even makes them willing to pay more to have peace of mind regarding more stringent data security measures from the companies they patronize.

CivicScience clients are able to leverage the InsightStore™ database of over 500k ongoing polling questions to identify more in-depth and actionable insights. Get in touch to see more insights we don’t publish.