This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Crypto’s on the way up. Earlier this month, CivicScience data found the percentage of Americans investing in cryptocurrencies is up over three points from 2022 to 11% while all other forms of investment fell. What might be the reason for consumers becoming more willing to invest in crypto?

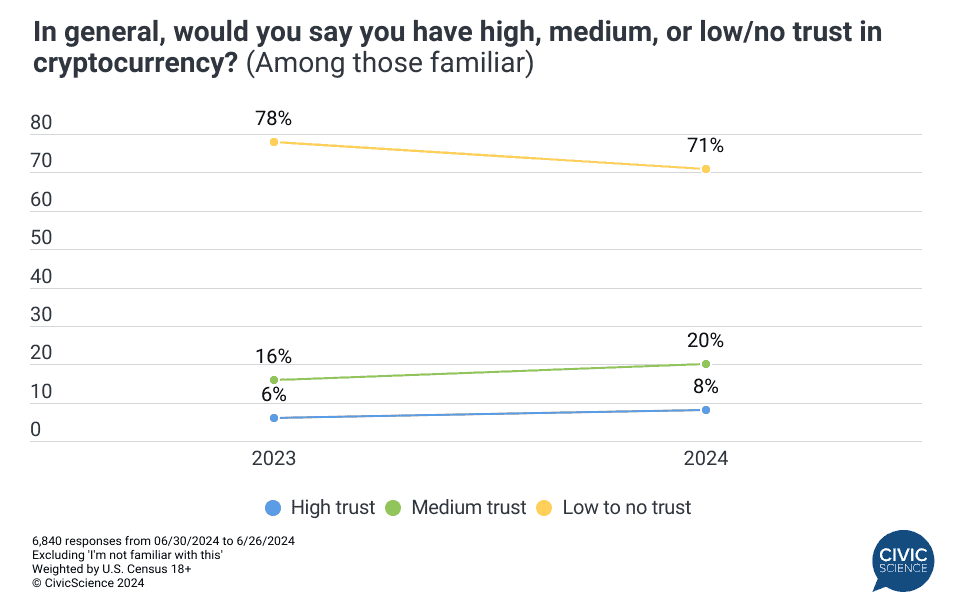

Rising trust likely has a role to play, as ongoing CiviciscScience tracking of consumer trust in cryptocurrency shows that those who have at least a medium level of trust have risen by five percentage points to 28% since late June 2023. Still, despite the increasing trust, the vast majority (71%) of consumers who are aware of it remain skeptical with little to no trust.

Weigh In: Is it worth investing in crypto, in your opinion?

Bitcoin ETFs Also Likely Factor In

In January, the Securities and Exchange Commission approved the first set of bitcoin ETFs, which offer a potentially more accessible option for investors looking to get into cryptocurrency. Initial CivicScience polling in October found that 19% of those familiar with bitcoin ETFs were at least ‘somewhat’ likely to invest in one when it gained approval. That percentage has now jumped ten points to 29% in the latest June data1.

What Are the Motivators and Detractors of Crypto Investing?

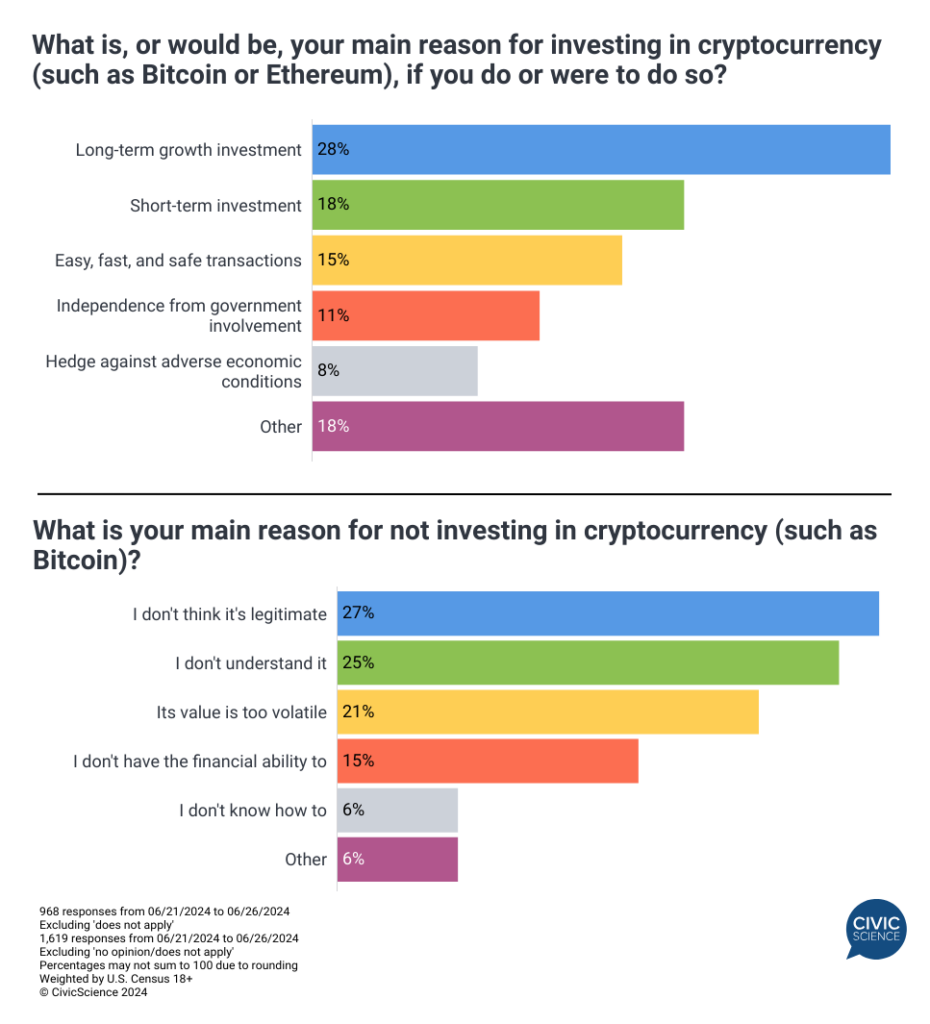

CivicScience data allow for an even deeper exploration into the minds of crypto investors and their motivations for investing in the non-traditional asset. Investment strategy takes precedence – long-term investing is the most likely motivator for investing in crypto, followed by short-term investing. Fewer investors are driven by a desire for independence from government involvement or as a hedge against economic instability.

Conversely, among the key roadblocks that consumers say are holding them back from investing in crypto are a lack of understanding and concern over its volatility and, most notably, a belief that it is not a legitimate form of investment.

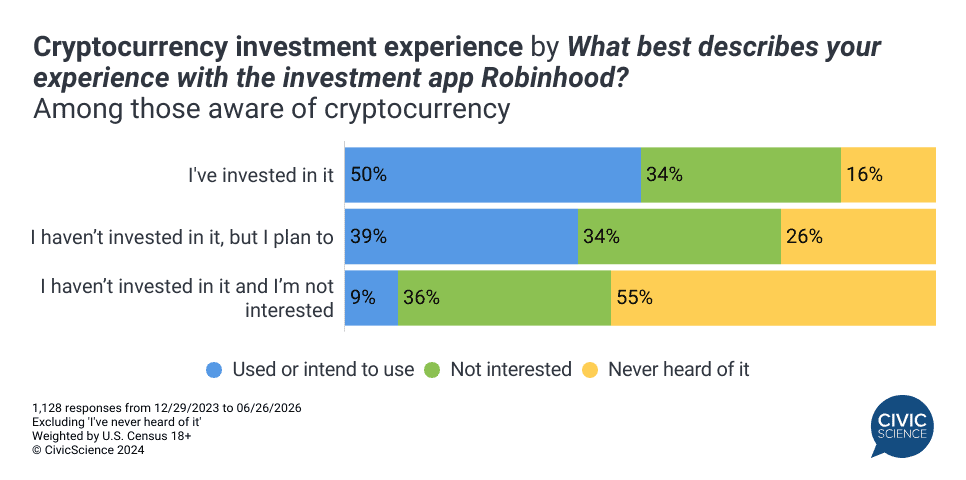

Another possible driver of the recent growth in crypto investing is the increasing popularity of the investment app Robinhood. According to CivicScience tracking, the percentage of U.S. adults who use or intend to use Robinhood has risen to 23%, up from 17% in 2021. Additionally, the app has substantial growth potential, with 45% of adults still reporting they have never heard of Robinhood2.

This growth is significant because Robinhood provides its users with the ability to invest in cryptocurrencies at the palm of their hands, while the platform has experienced a substantial increase in crypto investment volume this year. Robinhood is doubling down on this boom and upping its crypto offerings with a recent $200 million acquisition of the crypto exchange Bitstamp. CivicScience data show this is likely a smart move for Robinhood as 1-in-2 of all crypto investors report they either already use or plan to use the app.

Cast Your Vote: Do you think cryptocurrencies have a promising future?

While many Americans remain cautious about cryptocurrency and Bitcoin has faced recent turbulence, the sector shows signs of growth. Increased trust and the expanding use of platforms like Robinhood pave the way for a more robust crypto investment landscape.