Consumer behavior does not exist in a silo; their decisions are impacted by forces outside the narrow purview of any industry or brand. So how do brands better understand their current and potential customers to ensure they make the right business decisions? In essence, they need consumer-centric information that is trustworthy, timely, and relevant. This is why we partnered with some of our best clients to create The CivicScience 360 Report.

The 360 Report scans the CivicScience database of thousands of always-on questions. It discovers key insights for your brand by comparing them to competitive and consumer segments, identifying differences and similarities, and alerting you to shifts in categories like financial outlook, media consumption, and health and wellness. So you never miss an opportunity or threat.

We ran The 360 Report for Netflix users and compared them to Paramount+ users to provide a sample of this product. Below you’ll find insights from three of the report’s verticals.

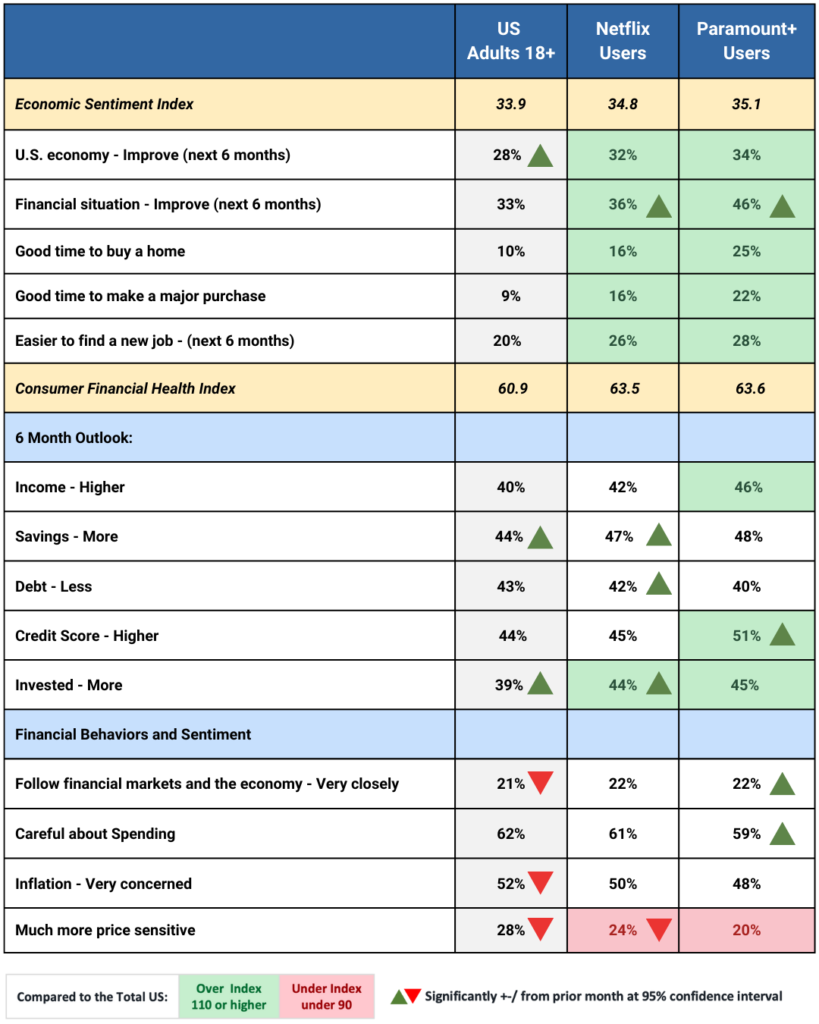

Financial Outlook

While confidence in the U.S. economy across the board remains low, the Economic Sentiment Index for Netflix and Paramount+ users indicates that both groups are currently more hopeful than the average U.S. adult. They skew higher in their sentiment on the job and housing market and in making a major purchase. Customers of both streaming providers showed improvement in the outlook of their financial situation, but Paramount+ viewers are much more likely to have this optimistic view. Nearly half (46%) think their financial situation will improve in the next six months, 13 points higher than the average U.S. adult and 10 points higher than Netflix users.

CivicScience’s Consumer Financial Health Index shows that both streaming providers’ customers are financially healthier than the average U.S. adult. They are more likely to think that their income, savings, credit score, and investments will improve in the next six months.

There is still significant concern around inflation for all consumers. However, price sensitivity is starting to decrease, and Netflix and Paramount+ viewers are slightly less price sensitive than the average U.S. adult.

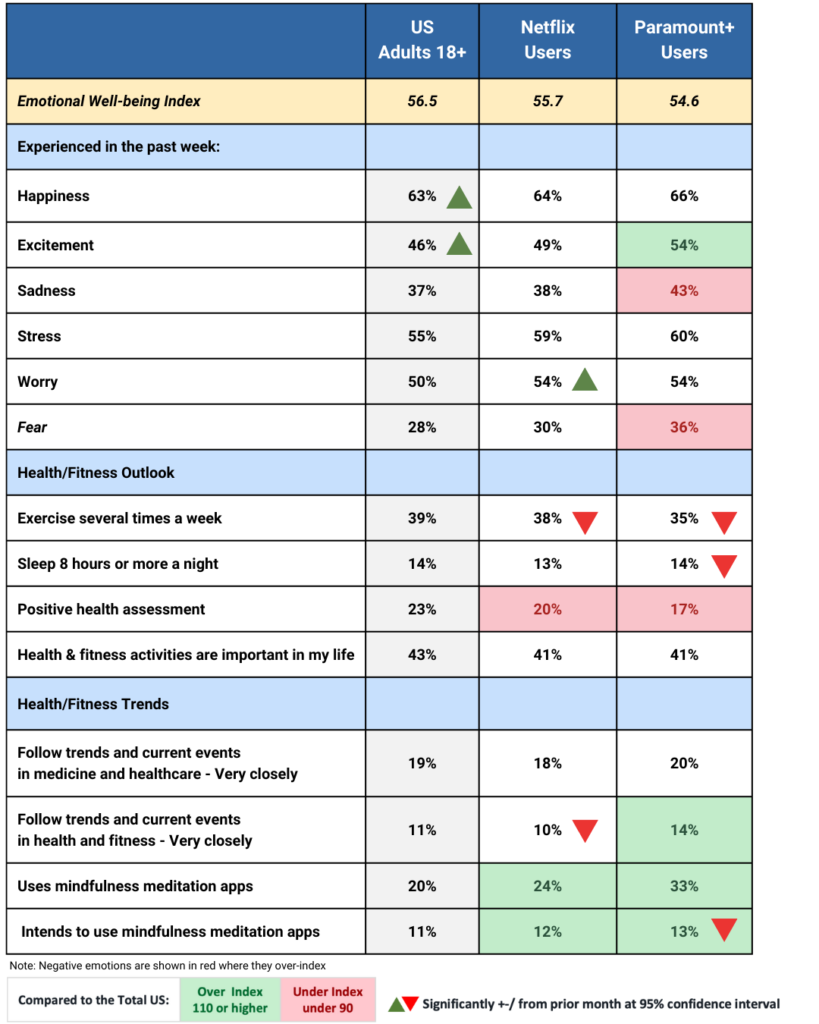

Health & Wellness

While financial wellness may be higher among these streaming providers’ customers, the same can’t be said about their emotional well-being. This is particularly true for Paramount+ viewers. While they are experiencing more excitement than the average adult, they are also experiencing more sadness and fear. Paramount+ viewers align closely with younger consumers (18-34), who exhibit heightened emotions, both negative and positive. This emotional awareness could explain why they are more likely to use (33%) or intend to use mindful/meditation apps to help manage these feelings.

Regarding physical health, both streaming providers’ customers appear to be generally on par with the average adult, albeit slightly lower regarding their subjective health assessment. Exercising was down from the prior month for both, and sleep was also down for Paramount+ users. Perhaps too many late nights were spent watching Yellowstone? Sadly, across the board, only 14% of U.S. adults claim to get 8 hours of sleep each night.

Media Consumption

Regarding traditional media consumption, Netflix users look similar to the general population. This isn’t surprising given the high percentage of U.S. adults that subscribe to Netflix. Paramount+ users look slightly different; their daily cable viewing is significantly lower and down from the prior month. While overall newspaper readership is low, Paramount+ users are more likely to read a national newspaper daily.

Two out of five U.S. consumers say that streaming is the primary way they watch TV. Paramount+ users are aligned with the national average, and Netflix users skew higher at nearly half (48%). Again, unsurprisingly, both streaming providers’ audiences are likelier than the average adult to stream audio via streaming apps like Spotify and online.

There continues to be a shift in how people consume media. Traditional channels are becoming less engaging, which is validated by the media habits of younger adults (18-34.) Streaming video and audio have become commonplace, and new providers are entering the market continually. Streaming providers will need to understand their customers and their competitors’ customers now more than ever if they want to stay in the media mix.

[Data not shown]

About the 360 Report

The 360 Report covers topics and categories beyond what is shown above. The report covers industry-specific categories, emerging trends, shopping behaviors, social issues/concerns, and more.

Only CivicScience paints an always-on, ever-evolving, 360-degree picture of your current and potential customers – ensuring you never miss an opportunity or risk.

The 360 Report:

- Delivers a complete and timely view of trends and shifts in consumer attitudes, lifestyle, and intent.

- Predicts consumer behavior and powers more forward-looking strategies and marketing investments, maximizing growth and profitability.

- Provides invaluable, timely knowledge to accelerate decision-making and give you a unique competitive edge.

- Alerts you to trends and changes as they happen, ensuring you never miss an opportunity or threat.

Ready to build your custom 360 Report? Start here.