CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

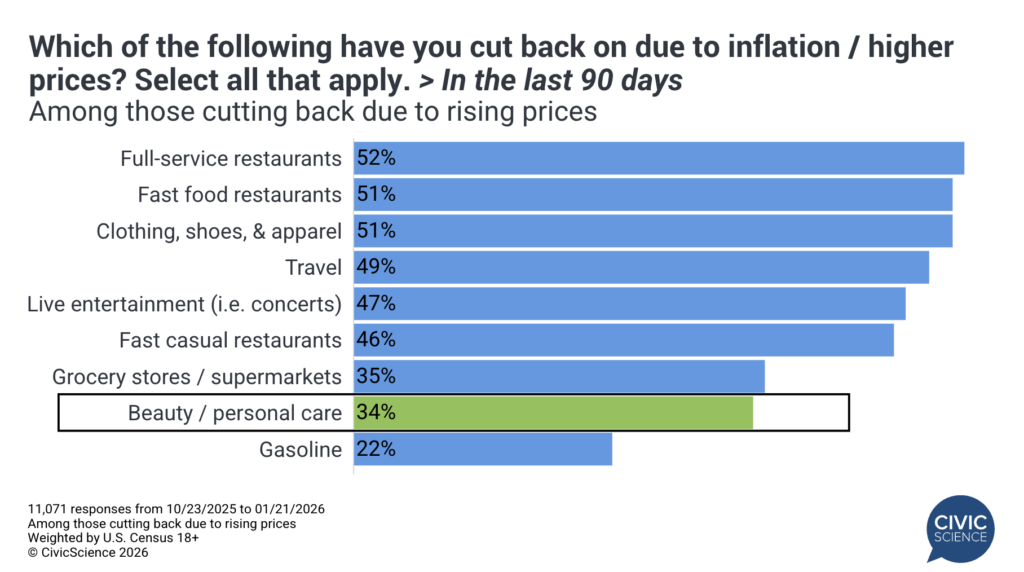

Looking ahead, CivicScience data show that while consumers remain cautious about spending amid inflation, beauty and personal care remain relatively resilient. Just 34% of consumers say they’ve cut back on beauty and personal care in the past 90 days, making it the second-lowest category for cutbacks among other expenses. This relative stability underscores the growing importance of broader health and wellness priorities for 2026.

These patterns offer an early signal of how evolving mindsets, routines, and purchase behaviors are reshaping the beauty category. Here are 10 beauty trends for 2026 that CivicScience is keeping a pulse on using self-declared consumer data:

1. Daily makeup use continues to decline 💄

Among Americans who wear makeup, daily use has continued to fall through the end of 2025, representing a 20-point decline since 2019. At the same time, there has been a slight increase in those who wear makeup weekly or monthly, suggesting a shift toward more selective use.

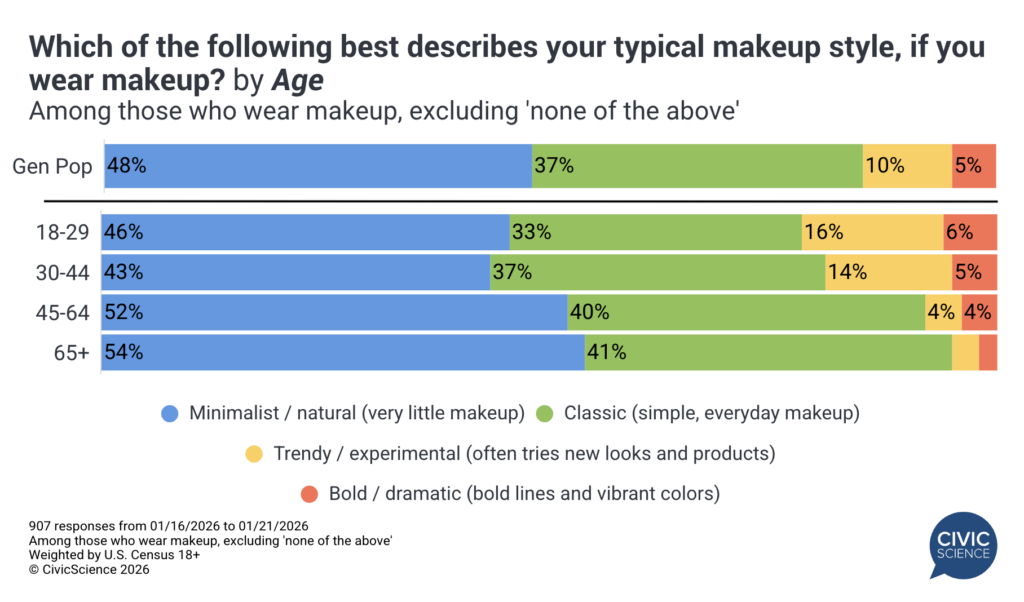

2. Minimalist makeup dominates personal style 🪞

Minimalist makeup is the clear preference among makeup wearers. Nearly half (49%) favor a minimal, light-makeup look, followed by a classic, simple everyday style. Trendy or experimental and bold styles account for 15% overall, rising to 22% among adults ages 18–29, reflecting a greater appetite for exploration among younger consumers.

3. Simpler routines and fewer products remain the norm ✅

Interest in using makeup products for multiple purposes (such as using blush as eyeshadow) remains strong, driven by motivations like saving money and simplifying routines. This aligns with data showing that most makeup wearers use four or fewer products in their typical routine.

4. Gen Alpha continues to influence the beauty conversation 📱

Among parents of Gen Alpha children, beauty engagement has increased modestly since 2024. The share who say their children wear makeup has grown from 10% to 13%, while skincare use has increased from 15% to 17%.

5. Non-surgical cosmetic procedures see higher adoption, but flat intent 💉

Experience with non-surgical procedures such as Botox and dermal fillers has increased from 17% to 23% over the past two years. However, future intent has remained relatively unchanged over the same time period (10%). Additionally, use is shifting slightly away from preventive aging toward wrinkle-smoothing and self-image.

6. Nail salons rebound despite DIY momentum 💅

Despite DIY beauty gaining interest in 2025, more consumers could be returning to nail salons in 2026. Among those who wear nail polish, 34% report they go to a nail salon ‘several’ times a year, compared to 21% who said the same last year.

7. Online beauty shopping continues to gain momentum 🛒

Beauty shopping habits are highly polarized; consumers typically commit to entirely online or entirely in-store purchases instead of a mix of both online and in-store shopping. Over the past few years, online beauty purchasing has steadily increased, while in-store buying – though still the most common – has declined.

8. Where consumers shop depends on how they shop 🛍️

Online-only retailers like Amazon lead among consumers who buy beauty products online, while big-box retailers dominate in-store purchases. Beauty specialty stores such as Sephora and Ulta rank second for online shopping but fall to third place for in-person buying, behind drugstores.

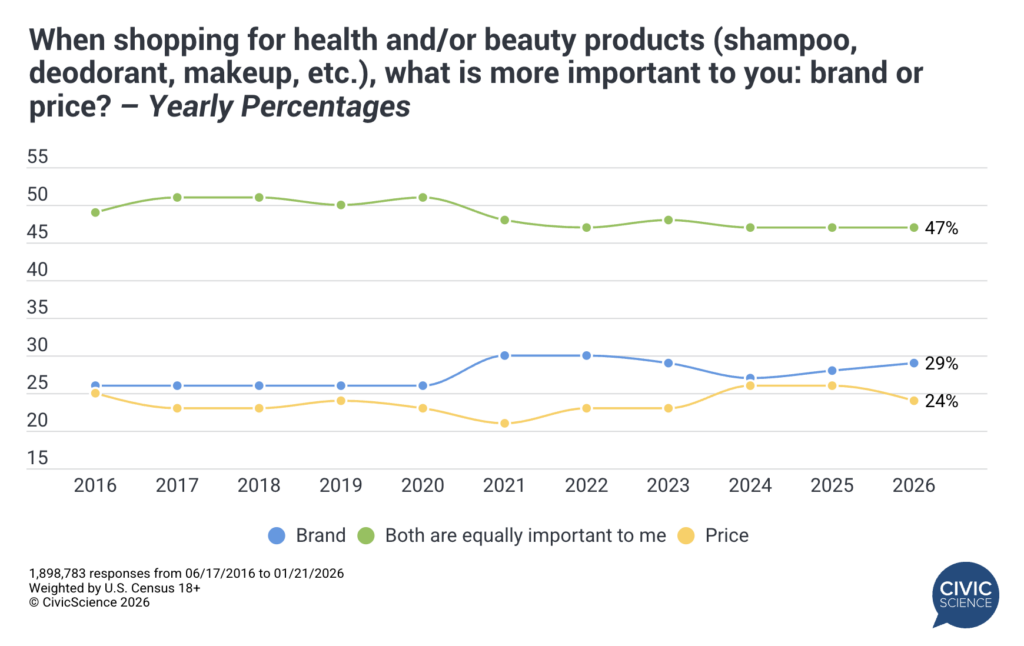

9. Brand is regaining importance relative to price ⚖️

After brand and price were nearly equally important to beauty buyers in 2024, the gap between the two is widening again. Brand importance (29%) is returning to levels seen between 2021 and 2023, while the share who say brand and price are equally important has remained relatively steady year over year.

10. Prestige beauty remains strong in certain categories 🪮

Among consumers who purchase prestige or premium beauty products, hair care, fragrance, and facial skincare rank as the top categories. In contrast, the share of prestige makeup purchases declined by four points, from 32% in 2024 to 28% at the end of 2025.

Overall, looking ahead to the rest of 2026, beauty remains important, but in more intentional ways. Rather than fully cutting back amid rising prices, consumers appear to be more selective, prioritizing beauty differently alongside broader wellness goals. Stay tuned for more of the latest beauty trends throughout the year.