The proliferation of Ozempic and other GLP-1 weight loss drugs is poised to create significant ripple effects throughout the economy and consumer markets. Industries such as healthcare, retail, food service, fitness, travel, and apparel are all at risk of major disruptions as the increasing awareness, utilization, and associated behavioral shifts driven by these medications gain momentum.

CivicScience’s extensive tracking and forecasting report provides ongoing insights into the surge of Ozempic and other GLP-1 drugs among U.S. consumers and their consequential impact on consumption patterns, healthcare practices, and lifestyle behaviors. Here’s a preview of the most recent insights available in the latest edition of the Ozempic and GLP-1 Consumer Tracker – learn how to access the full report here.

1. Updated Usage and Awareness

Recent CivicScience tracking through mid-December found that 16% of U.S. adults are either currently using (7%) or considering taking a GLP-1 drug for weight loss purposes (9%). Usage for reasons other than weight loss (5%) is lower than usage for weight loss among the general population.

When asked what they’ve heard regarding the uses for Ozempic and other GLP-1 medications, U.S. adults were 10 percentage points more likely to have heard of GLP-1 medications for weight loss than for type 2 diabetes. Research suggests the possible effectiveness of these drugs in managing addictions, as well as potential usage in cases of dementia and diseases such as Alzheimer’s. However, awareness of these use cases remains relatively low among the Gen Pop at 7% and 3%, respectively.

Take Our Poll: Do you know anyone who takes the drug Ozempic?

2. Shifting Trends in Snacking

Unwrapping recent snacking trends reveals that 55.1% of current GLP-1 users reported eating salty snacks daily, along with 54.4% who ate sweet snacks daily – percentages have changed very little since October. Additionally, 69.4% of Ozempic/GLP-1 users say they ate healthy snacks daily, marking a 10-point bump since October and 26.4 points higher than average U.S. adults.

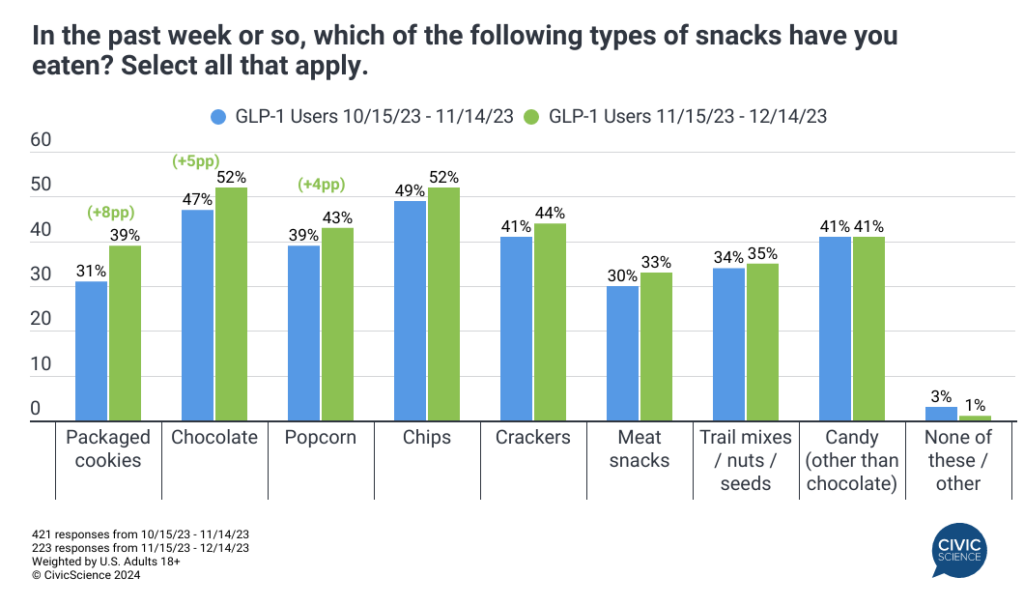

With Thanksgiving and other holidays likely playing a role, GLP-1 users grew more likely to say they increased their consumption of a wide variety of snack foods weekly through mid-December. In particular, packaged cookies (39%) and chocolate (52%) each increased by eight and five percentage points compared to the period before the holidays. Popcorn (43%) was also not far behind in increasing demand.

3. Spending Habits

Now a week into the new year, spending plans come into focus. What areas are GLP-1 users more likely to prioritize for increased spending? CivicScience data show users grew more likely to anticipate increased spending on bars, restaurants, and personal care items over the next month. Conversely, they’re six percentage points less likely to expect increased spending on groceries.

See the full spending data, as well as other financial data about GLP-1 users in the report.

Join the Discussion: Would you ever consider traveling to Mexico in order to purchase the weight loss drug Ozempic at a lower cost?

Want more in-depth insights into Ozempic/GLP-1 users and intenders, such as health and wellness, retail, lifestyle trends, and how the adoption of these medications is impacting numerous industries? Sign up now for a free preview of this syndicated report.