CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

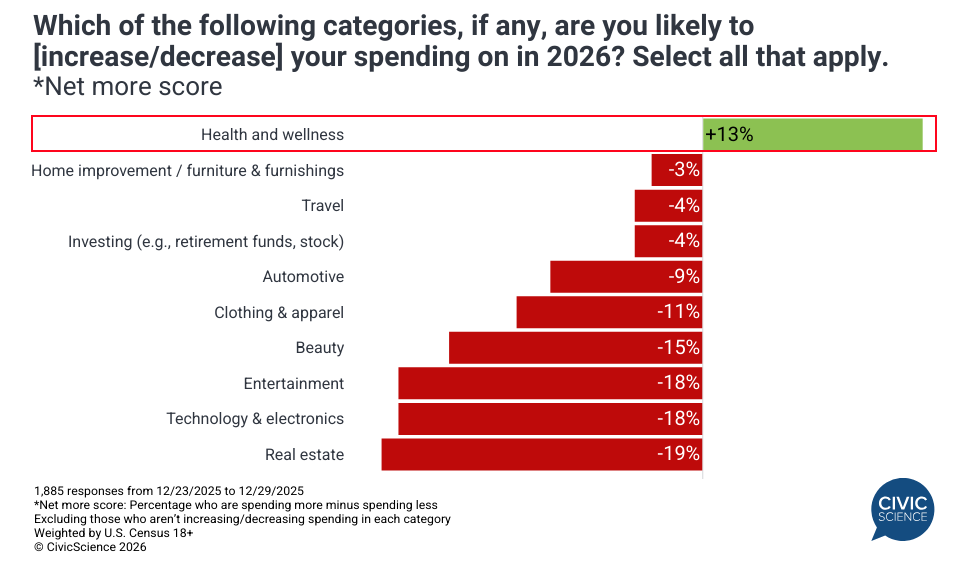

1. Health and wellness stand out as a key spending area as consumers cut back amid a stagnant income outlook for 2026.

As Americans look ahead to 2026, a plurality (42%) expect their disposable income to remain unchanged from 2025. Still, more consumers anticipate having less disposable income (35%, up from 30% last year) than more (23%, down from 27% YoY). Category-level spending expectations reinforce this cautious outlook. Health and wellness stands out as the only area where the intent to increase spending outpaces the desire to decrease spending, while in every other category studied, those planning to cut back outnumber those planning to spend more. In particular, consumers are most likely to plan on reducing spending on entertainment, technology, electronics, and real estate. This data also aligns with increasing intent for health-focused New Year’s resolutions this year.

Let Us Know: Are you making it a point to get your personal finances in order in the year 2026?

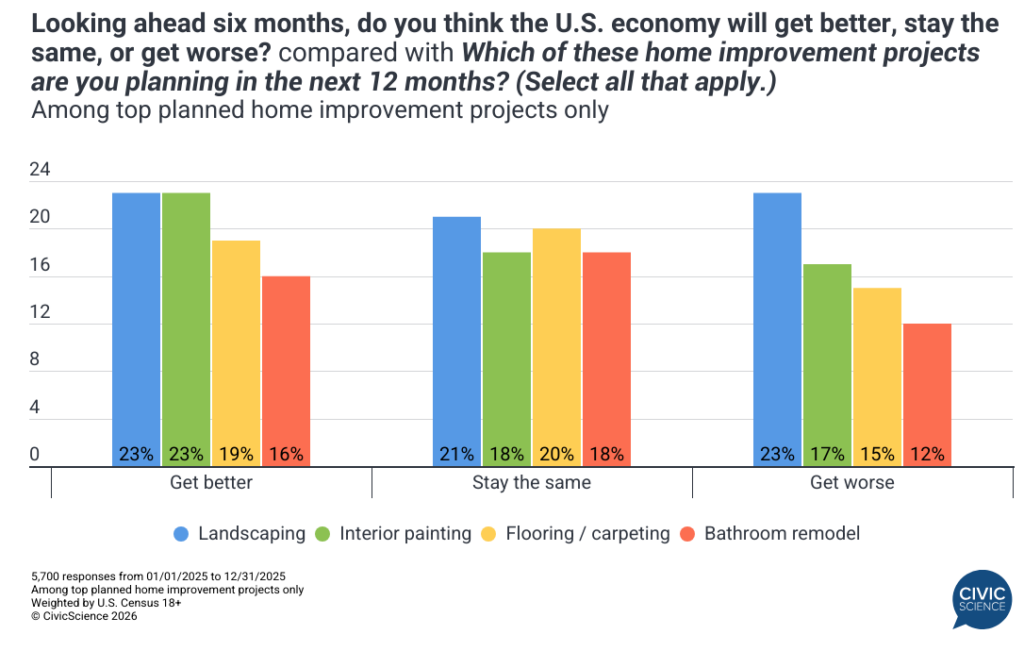

2. Landscaping, interior painting, and flooring upgrades lead as planned home improvement projects this year, but one’s economic outlook plays a key role in remodeling decisions.

Stagnant housing market conditions and high material costs are driving some homeowners to invest in their current properties rather than relocating. According to recent CivicScience data, landscaping is the most popular project for the coming year (cited by 22% of respondents), followed closely by interior painting (19%), flooring or carpeting updates (17%), and bathroom renovations (16%). These figures suggest a preference for manageable, high-impact aesthetic upgrades over more intensive structural overhauls during a period of financial uncertainty.

While landscaping and painting plans remain resilient, major interior projects like flooring and bathroom remodeling are highly sensitive to the economic outlook. Homeowners who anticipate a downturn or view the current market unfavorably are significantly less likely to commit to these higher-cost improvements. This suggests that while the “improve instead of move” trend persists, it is tempered by caution regarding discretionary spending on complex renovations.

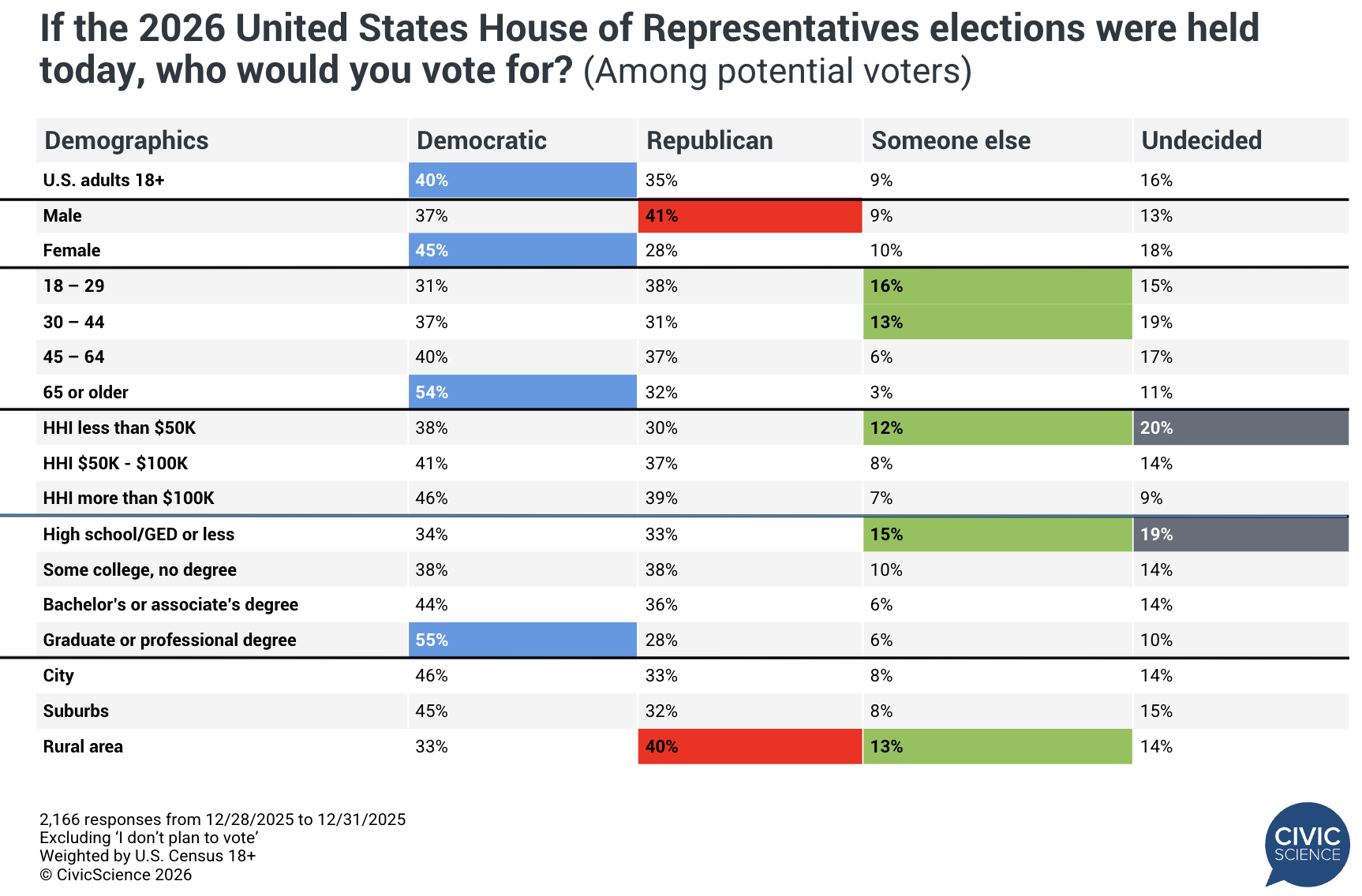

3. Likely midterm election voters tend to favor Democratic candidates, while younger voters show a greater interest in alternative candidates.

The start of 2026 means midterm elections will soon take center stage. CivicScience asked Americans whom they would vote for in House and Senate elections if they were held right now, with Democrats holding the advantage in both houses of Congress (excluding those who say they don’t plan to vote). In Senate races, Democrats currently hold a seven-point advantage over Republicans among likely voters 18+ (40% to 33%, respectively), while their lead in House races is slightly narrower at five points (40% to 35%). This Democratic momentum is largely driven by strong support from women, respondents aged 65 and older, and those with post-graduate education. Conversely, Republican candidates maintain their core appeal among men, high-income households, and residents of rural areas, highlighting a continued geographic and socioeconomic divide among likely voters.

Interest in alternative movements among Gen Z, Millennials, and lower-income voters presents a possible “wild card” for this cycle, especially in House contests. These segments are notably more likely than the general public to consider third-party candidates, signaling dissatisfaction with the two-party system. This shift in younger and lower-income demographics could prove decisive in party control, which currently is held by the slimmest of margins.

Weigh In: How likely is it that Democrats will take a House majority in 2026?