This is just a tiny glimpse of the data available to CivicScience clients. Discover more data.

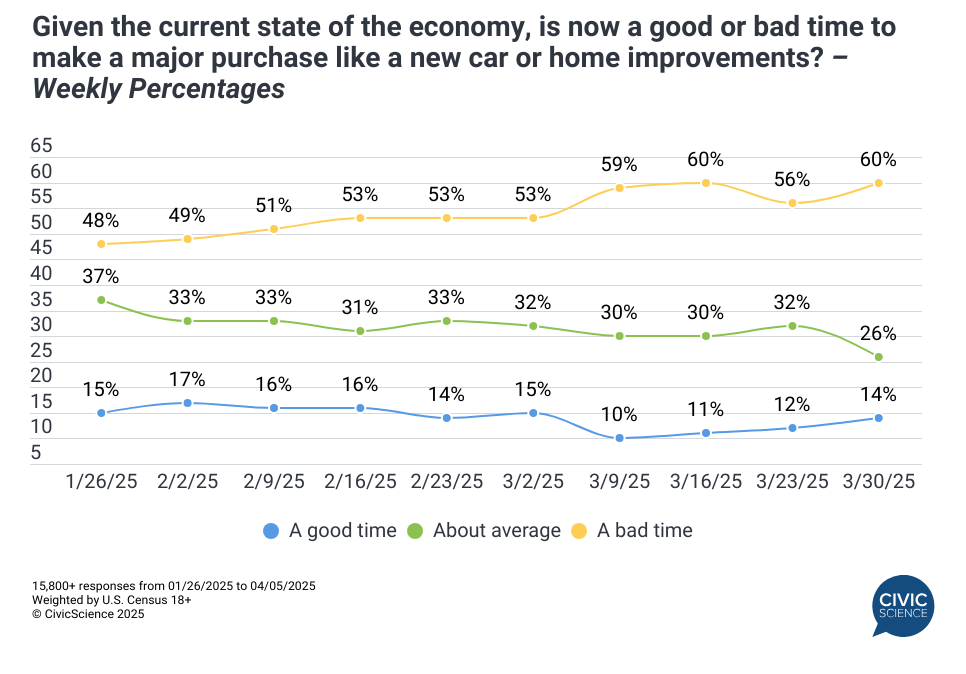

1. Six in ten consumers believe now is a ‘bad’ time to make a major purchase amid tariff uncertainty.

Last week’s announcement of sweeping tariffs rattled both the U.S. economy and global markets. The automotive tariffs, in particular, have led some consumers to postpone auto purchases. Zooming out from auto-buying finds consumer outlook on major purchases overall has fallen week-over-week – 60% of Americans now believe it is a ‘bad’ time for a major purchase, marking an increase from 56% last week and equaling its highest level seen so far this year. Despite this, 14% feel it’s a ‘good’ time to purchase, a slight increase from the end of March, as some consumers likely aim to act before any tariff effects hit their wallets.

Use this Data: CivicScience clients leverage real-time data like this to pinpoint consumer sentiment and predict shifting consumer behavior, enabling proactive strategies to maintain customer retention and drive growth.

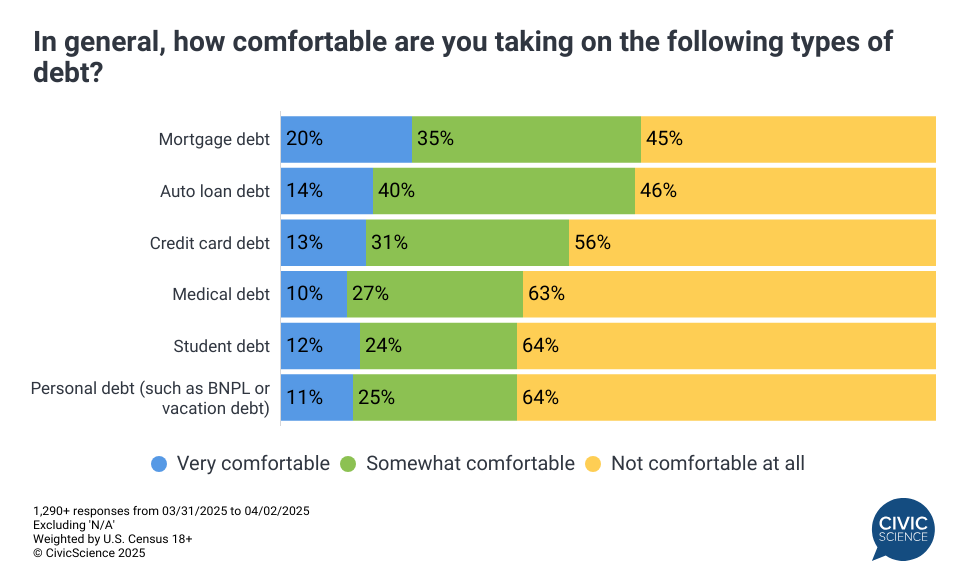

2. Comfort with debt varies by age, while consumers have a higher tolerance for mortgage or auto loan debt.

How comfortable are Americans with debt? According to new CivicScience data, it depends on how old you are and what kind of debt you’re talking about. Younger adults appear to be more accepting of debt: 14% of Gen Z adults say that debt is a necessary tool for financial growth, compared with only 4% of Baby Boomers (65+). Comfort levels also vary by type of debt. For instance, consumers are far less likely to feel comfortable with student loans, medical debt, or personal debt (such as Buy Now, Pay Later). Conversely, a majority are at least ‘somewhat’ comfortable taking on mortgage debt or auto loan debt.

Take our Poll: Do you consider debt to be a problem in your life?

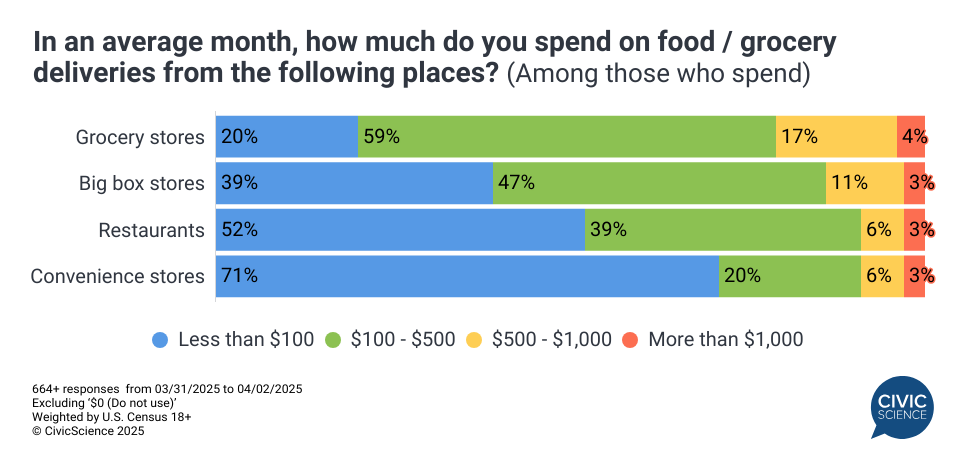

3. More than three-quarters of Americans are spending money on food and/or grocery delivery at least once per month.

Speaking of debt, CivicScience recently examined data on the new DoorDash/Klarna partnership. One of the noteworthy findings beyond the partnership was an openness to using Buy Now, Pay Later for groceries and food delivery. A deeper dive into food and grocery delivery spending trends shows that more than three in four U.S. adults (76%) spend money on food or grocery delivery on average at least once a month. The highest average spending is seen on deliveries from grocery stores and big-box retailers, where a majority of respondents exceed $100 per month. This is significantly higher than the 48% of restaurant delivery users and 29% of convenience store customers who spend the same.

Let us Know: Are you more likely to shop at a store with a grocery delivery service?