At the time of this writing, the coronavirus relief plan is still a work in progress, with Americans eagerly waiting to hear what kind of financial support they can expect from the federal government.

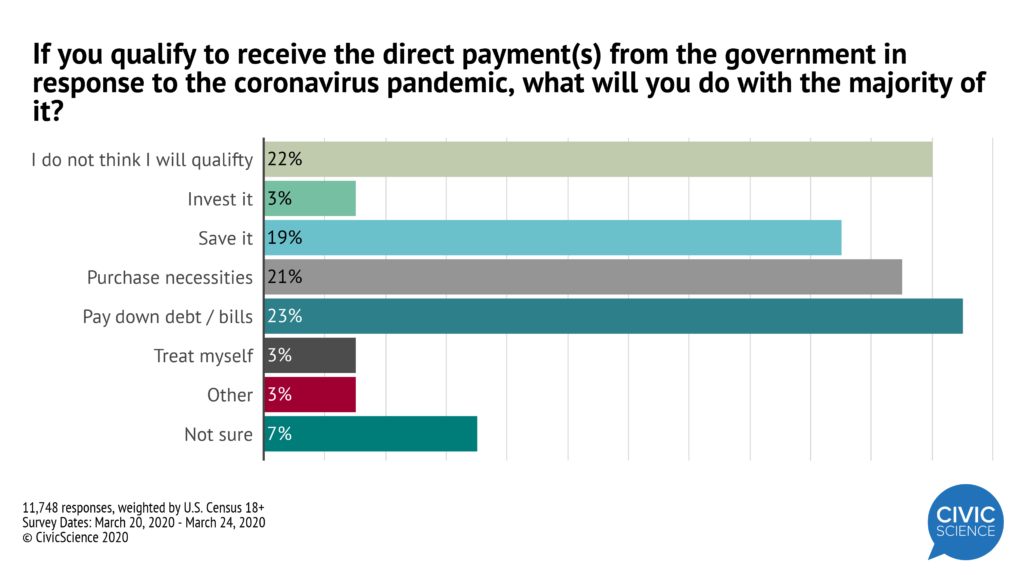

And this uncertainty played itself out when CivicScience asked over 11,000 adults what they plan to do with these direct payments, should they qualify to receive them. Right off the top, 22% of Americans 18 or older believed they wouldn’t qualify, and 7% weren’t sure what they were going to do with any money that comes their way.

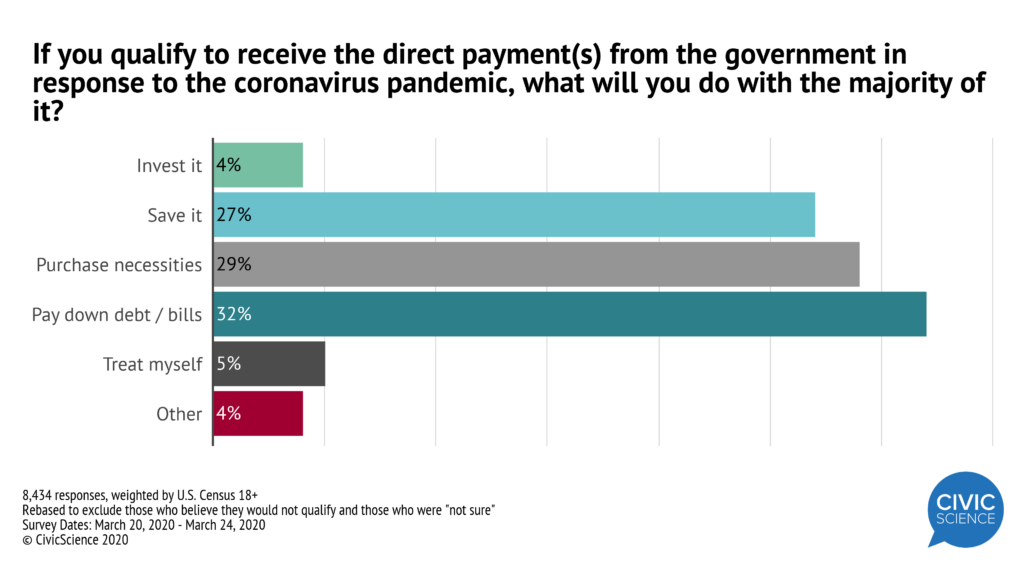

Eliminating both those groups from the sample cleared the waters a bit, with results split mostly among three categories: Purchase necessities (29%), pay down debt (32%), or save it (27%). Significantly smaller percentages of Americans said they would invest the money (4%) or treat themselves to things they want (5%).

Scared Money

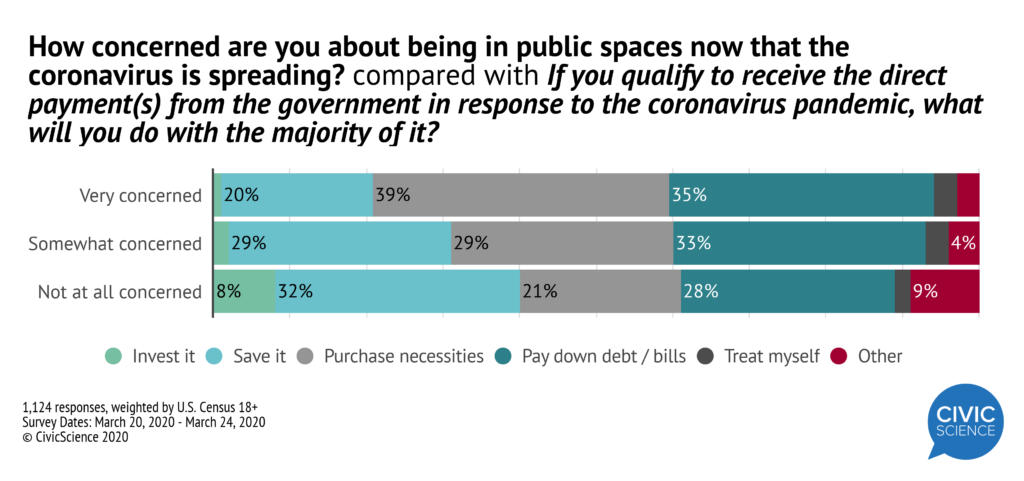

Americans who are “very concerned” with being in public spaces right now due to the coronavirus are twice as likely to use any direct payment from the government to stock up on necessities than people who aren’t concerned about being out in public. Sports Fans

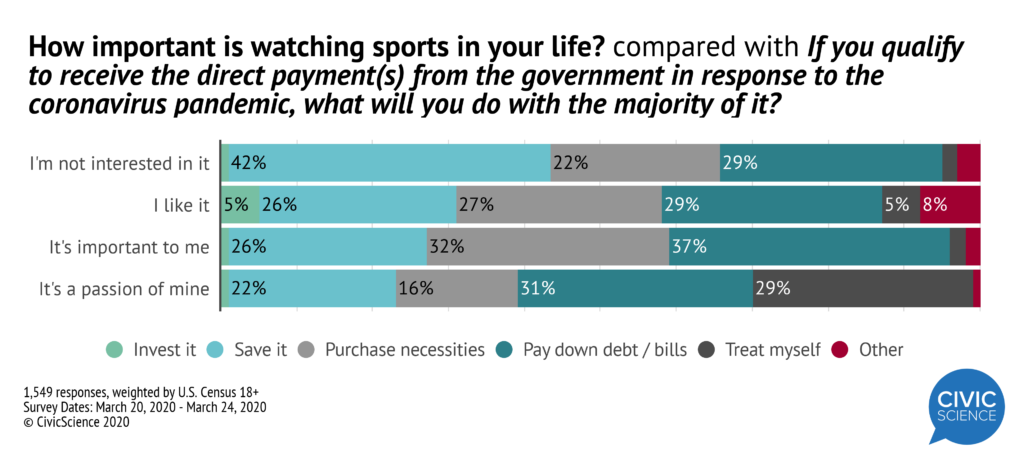

Sports Fans

There might be a little bit of noise in this sample, but the number is jarring: A third of Americans who say they are passionate about watching sports say they’re going to treat themselves. This is a 163% difference when compared to the national average, and perhaps not all that surprising. After all, if watching sports is someone’s “passion,” not having it around to help pass the time in the age of quarantine must be maddening. It’s difficult to fathom another pastime that’s been more affected by the coronavirus.

As an equally interesting aside, people who say watching sports is something they’re totally not interested in are overwhelmingly apt to save any money received as a result of the COVID-19 outbreak.

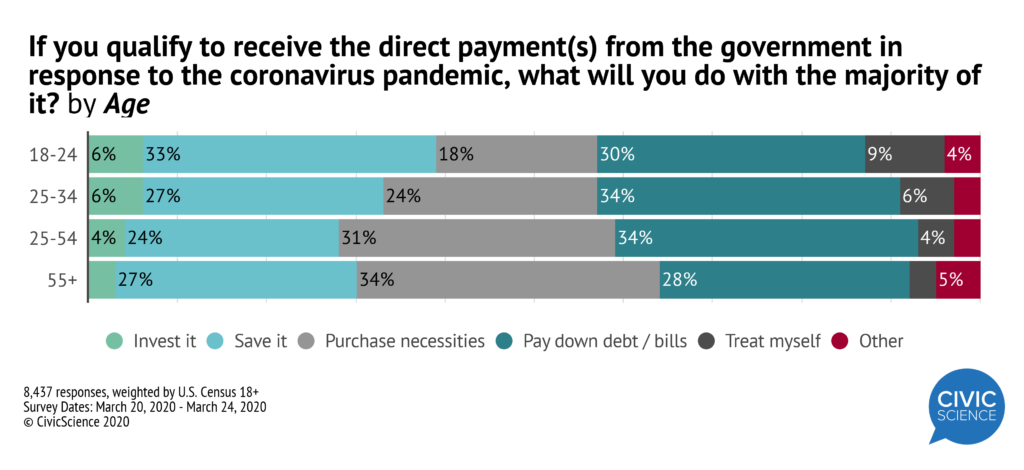

Age

Gen Z is more apt to either invest or save any money they get from the government as well as the most likely to splurge on themselves. Millennials are more apt to pay down debt, and Gen X and those 55+ are most likely to use the money to buy necessities. Income & Debt

Income & Debt

Here’s a bit of a surprise: Households making under $50,000 and over $100,000 are shockingly similar in what they would do with the money, whereas those in between are much more likely to pay down debt.

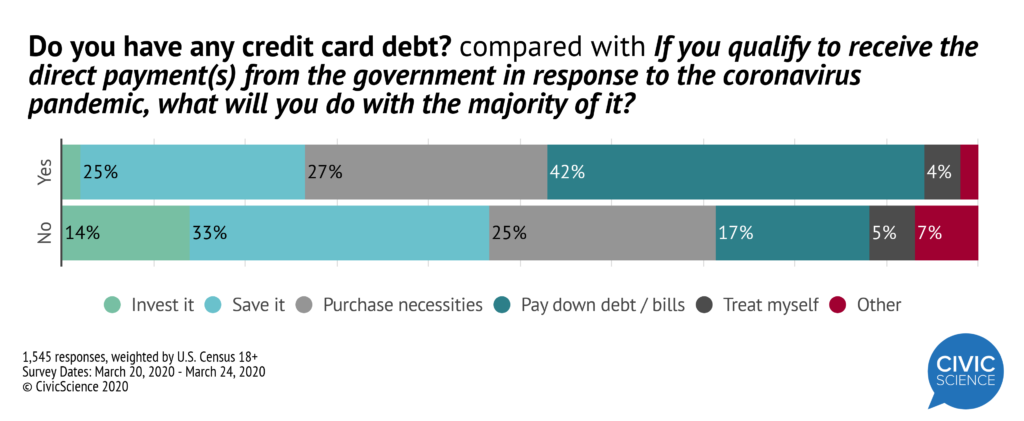

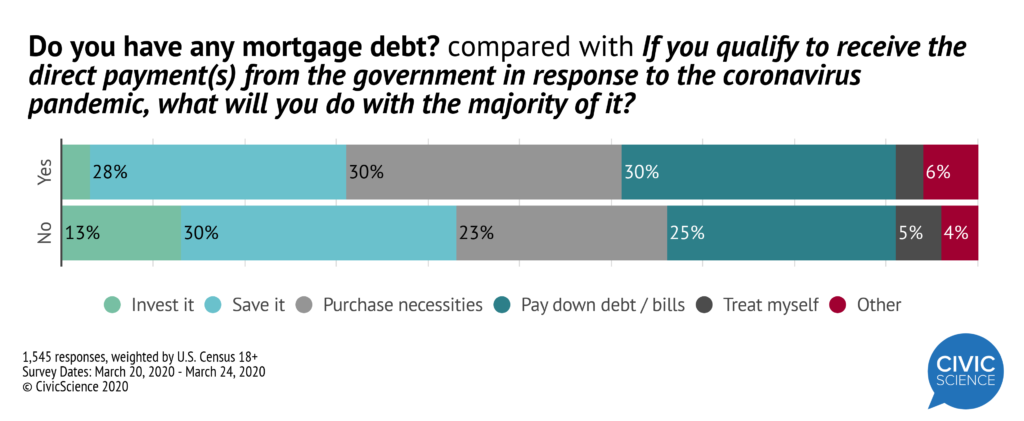

On the subject of debt, Americans holding mortgage debt are 18% more likely to use any coronavirus relief money to pay down debt, whereas those without mortgage debt are more than three times as likely to invest. A similar picture emerges with Americans who are carrying credit card debt: They’re overwhelmingly likely to use a government check to chip away at what they owe.

A similar picture emerges with Americans who are carrying credit card debt: They’re overwhelmingly likely to use a government check to chip away at what they owe.

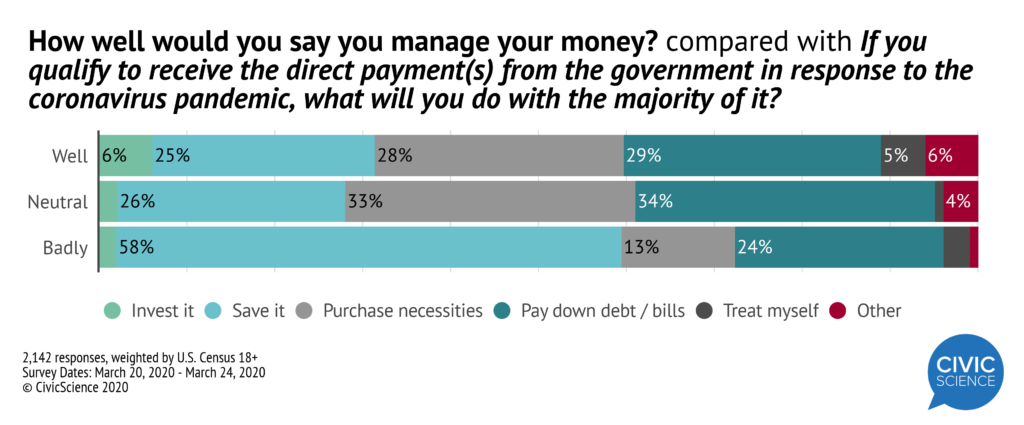

Additionally, Americans who self-identify as being poor managers of their personal finance are overwhelmingly likely to try and save any money that comes to them from the government.  Softening of the Tribes?

Softening of the Tribes?

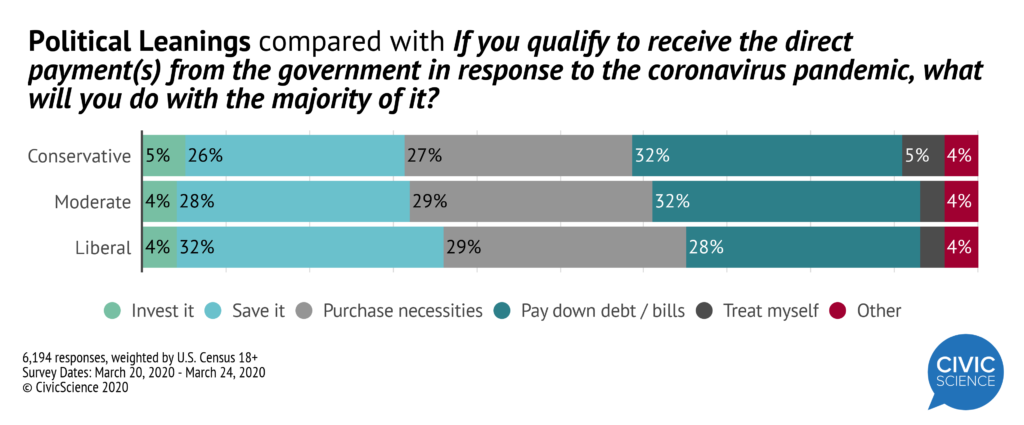

Some of CivicScience’s coverage of the coronavirus has shown how political leanings in America have been coloring opinions of the outbreak. But when it comes to the proposed bailout, the differences – while still there – aren’t as pronounced.

People who identify as liberal are 21% more likely than conservatives to save any direct payments from the government. Conservatives, however, are 13% more likely than liberals to pay down debt. While Americans are split in different ways as to what they would do with a coronavirus relief check, it’s fair to say not many will be turning their nose up at it.

While Americans are split in different ways as to what they would do with a coronavirus relief check, it’s fair to say not many will be turning their nose up at it.