CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As the landscape of streaming continues to become more fragmented, understanding one of its core audiences, Gen Z, and their viewing habits has never been more critical. Gen Z streamers – defined as those aged 18-29 in this study – aren’t just a key part of the industry’s future; they’re actively reshaping its present through their approach to subscriptions, content consumption, and platform loyalty as fragmentation and live sports become the norm.

Here’s what those under 30 are telling us about streaming in 2026:

1. Gen Z Cord-Cutting Stalls, Multiple Subscriptions Reign

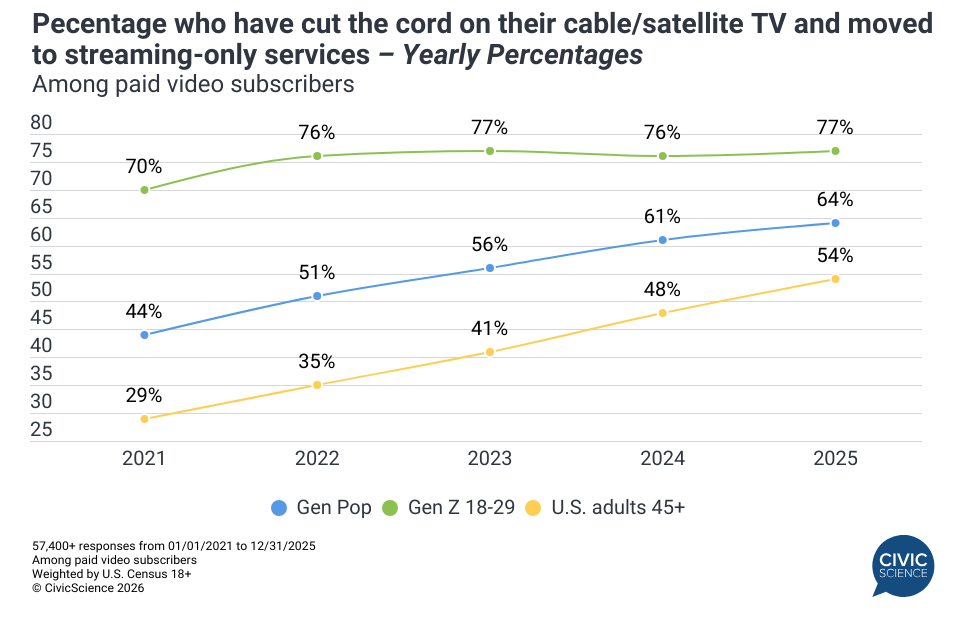

Once the trend-setters in cord-cutting, growth among Gen Z paid video subscribers switching away from cable has stalled, holding between 76% and 77% since 2022. While Gen Z still leads in cord-cutting, data show that recent growth is driven by the 45+ demographic.

Despite stagnant cord-cutting rates, many Gen Z streaming subscribers at the end of Q4 2025 reported having multiple subscriptions. In fact, the majority (56%) said they had three or more video-on-demand streaming subscriptions as of the end of 2025, with another 28% carrying two subscriptions.

2. Subscription Fatigue Drives Stream Churning

Carrying multiple streaming subscriptions does not reflect long-term loyalty, however, as subscription fatigue and churn are the story for the Gen Z streamer in 2026. Since December, 37% of young subscribers say they’ve canceled one or more streaming subscriptions explicitly due to feelings of subscription fatigue, and another 29% haven’t canceled one yet but plan to soon. Just 13% haven’t felt any feelings of subscription fatigue at all.

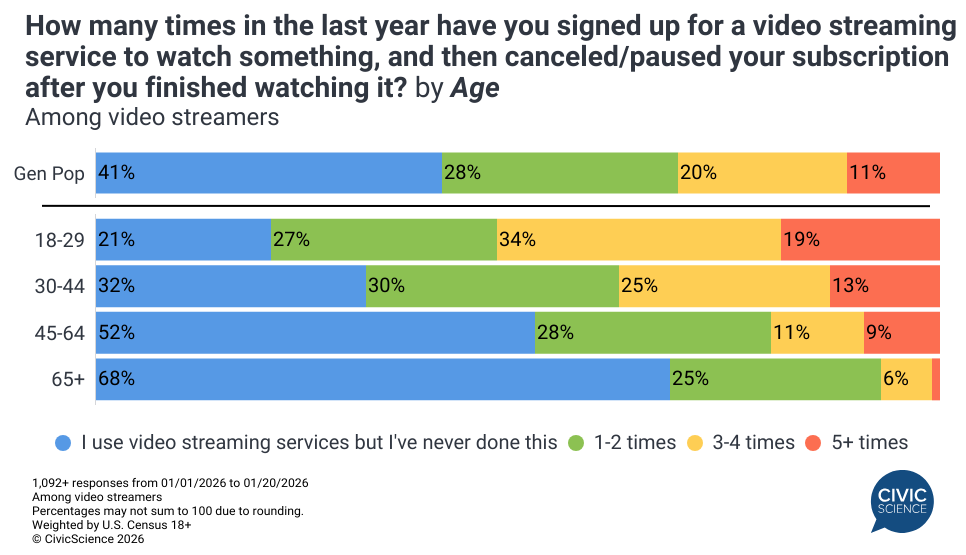

Given the prevalence of subscription fatigue among Gen Z subscribers, churning through subscriptions is unsurprisingly common, too. Roughly 8 in 10 Gen Z streamers say they signed up for a subscription specifically to watch a show, then canceled or paused it at least once in the past year, a rate far higher than Gen Pop and their older counterparts.

3. Advertising Opportunities as Gen Z Looks to Save on Subscriptions

Not only is the majority of Gen Z carrying multiple subscriptions, but CivicScience data show they are by far the most likely age group to report spending $100+ per month on subscriptions. Ad-supported subscription tiers are one way to help manage that monthly spend, and 52% of Gen Z streamers say they’re using them as of mid-January.

Consumer-reported CivicScience data highlights why advertisers hoping to reach Gen Z should be paying attention to this trend – 43% of Gen Z ad-supported viewers say their spending over the past week is ‘higher’ than usual, far higher than the percentage who say it’s lower than normal (19%). This audience is particularly high-value to advertisers in the travel and financial sectors, as 50% say they travel 3+ times per year (excluding work/business travel) and 42% say they plan to start investing this year.

Streaming bundles are another cost-management avenue to help balance multiple subscriptions. Thirty-seven percent of Gen Z streamers say they currently utilize a streaming bundle and enjoy it (among those who are aware that streaming bundles are an option). This is poised to climb this year as 32% of them say they don’t currently use a streaming bundle, but are interested in signing up for one.

4. Gen Z Are Power Users for Streaming Sports

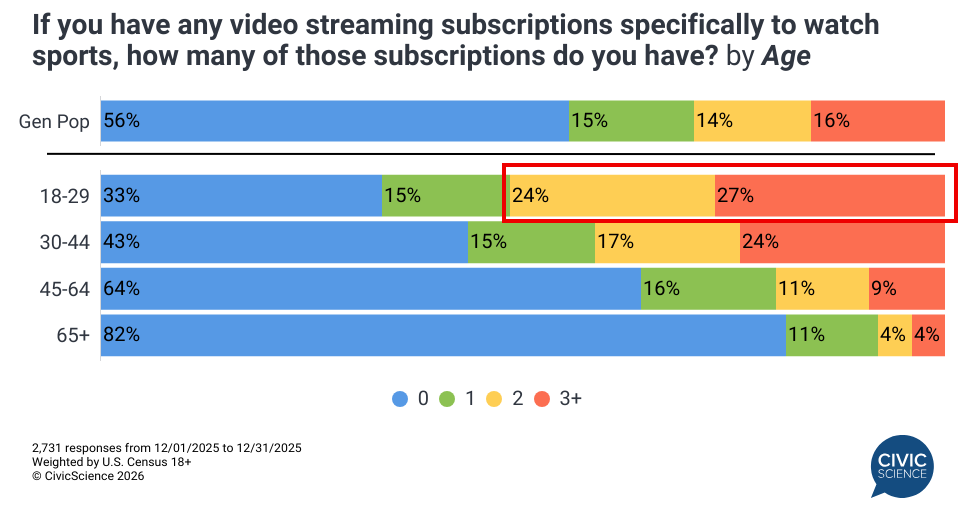

Watching sports is a particular passion for Gen Z, with only 25% saying they’re not interested, the lowest percentage among any adult generation tracked by CivicScience by at least seven percentage points. As a result, Gen Zers are by far the most likely to have multiple streaming subscriptions specifically to watch sports – 51% say they have two or more subscriptions, 10 points higher than Millennials who say the same. And this is all before major upcoming events like the Winter Olympics, Super Bowl, and World Cup.

While the majority of Gen Z sports streamers say they cancel once their preferred season ends, a still significant share (45%) report they typically hold onto their sports-specific subscription even when the season concludes.

5. Social Integration Sparks Gen Z Curiosity

In a streaming landscape dominated by fragmentation, how can platforms stand out? One way could be to incorporate social features, such as live chat or virtual watch parties. Sixty-three percent of Gen Z who subscribe to streaming services say they would be at least ‘somewhat’ likely to subscribe if a streaming platform began offering social integrations directly within its platform.

6. Turning to Social Media for Movie and TV Content

One trend to watch, with significant disruption potential for the streaming industry, is the use of social media to watch clips from TV and movies. New CivicScience data among Gen Z aged 18-29 reveals that 61% report watching short clips from movies or TV on social media at least once per week, while just 15% say they rarely or never do so.

Gen Z’s 2026 streaming patterns reveal a generation that embraces multiple subscriptions but strategically churns through services and splits viewing time with social media. Despite the high churn rate, advertisers hoping to win with Gen Z have an opportunity to break through via ad-supported tiers and sports, with those in the financial and travel sectors particularly well positioned in early 2026.