Take-out delivery — it’s no longer just for pizza and Chinese food. Apps such as Grubhub and Uber Eats are standing by, waiting to satiate pretty much any nearby take-out you’re craving.

As they become more available throughout not just the U.S., but the world, billions are being invested in on-demand food delivery services. A handful of companies have emerged at the forefront of the market, with Uber, DoorDash and Grubhub ranking among the top competitors right now.

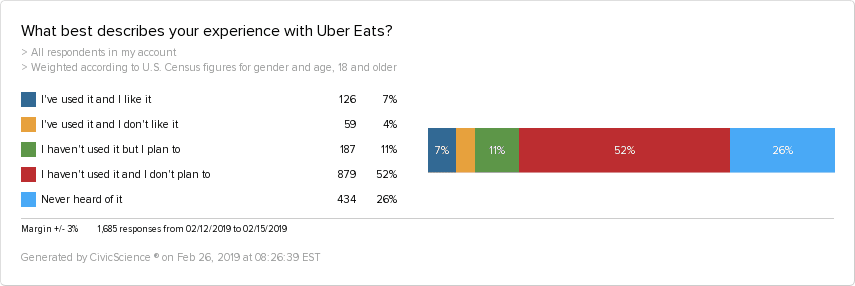

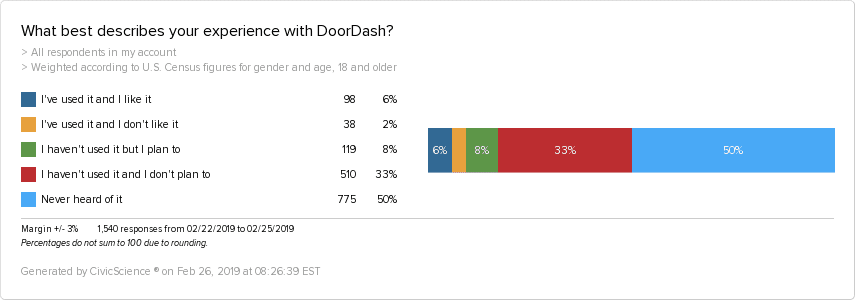

A recent online study by CivicScience of between 1,500 and 1,900 U.S. adults found that Grubhub leads in popularity, future potential, and overall awareness among the three, with 13% of respondents saying they use the app and like it and just 17% unaware of its existence.

That’s twice as many users as Uber Eats and DoorDash.

But despite DoorDash significantly trailing behind Uber Eats in terms of awareness, the two still rank about the same in terms of respondents who use and like the apps. That could be good news for DoorDash, who some liken to a sort of underdog in the market.

Certainly, there is a crossover among app users. A majority of both Uber Eats and DoorDash users also have used and like Grubhub, while about one-quarter of Grubhub users are favorable to the other two apps.

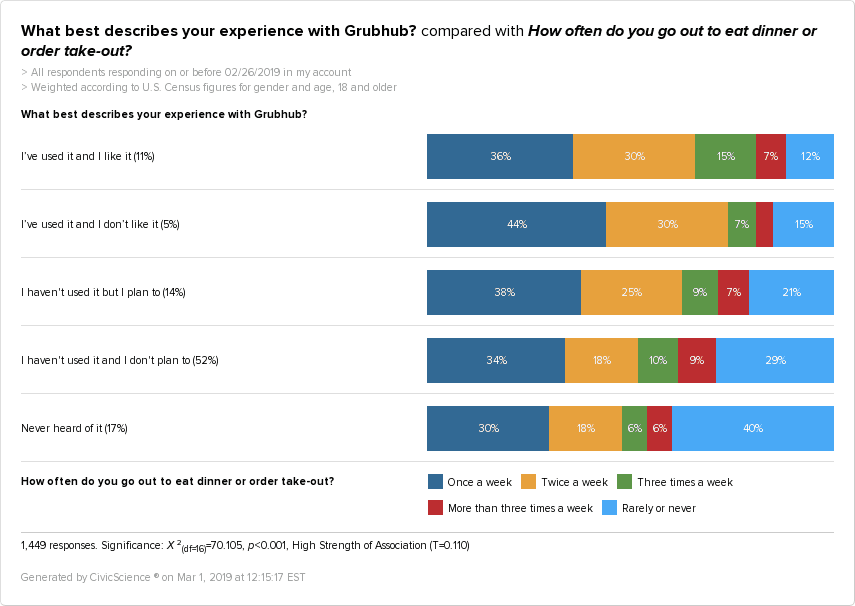

Consider that going out to eat and ordering take-out appears to be on the rise since 2018. More people are choosing to eat out or order take-out once (34%) or twice a week (21%). Today, 24% of people say they rarely or never go out to eat or order take-out.

It’s likely Grubhub has some influence on this growing trend. The polls show that Grubhub users are by far the least likely to say they rarely or never eat out or order take-out:

Who Uses On-Demand Food Delivery Apps?

The study looked at Grubhub and Uber Eats specifically and found several overall key trends among respondents who use and like both apps.

People who live in cities, rent, are between the ages of 18-34, have never been married and don’t have children are all the most likely to use and like the apps, with little to no variation between Grubhub and Uber Eats users.

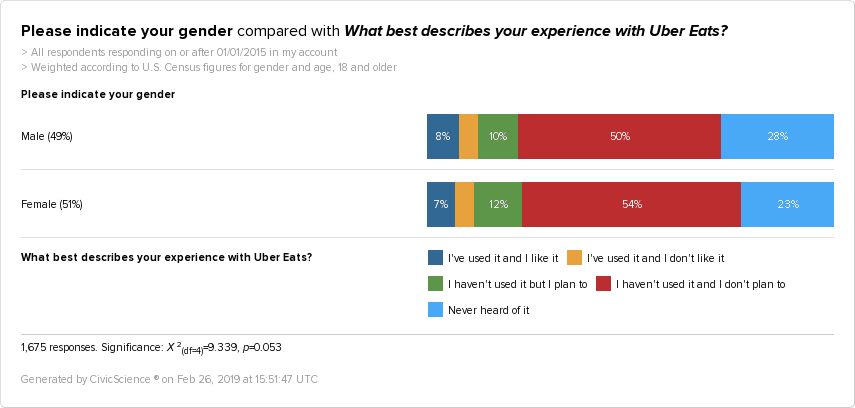

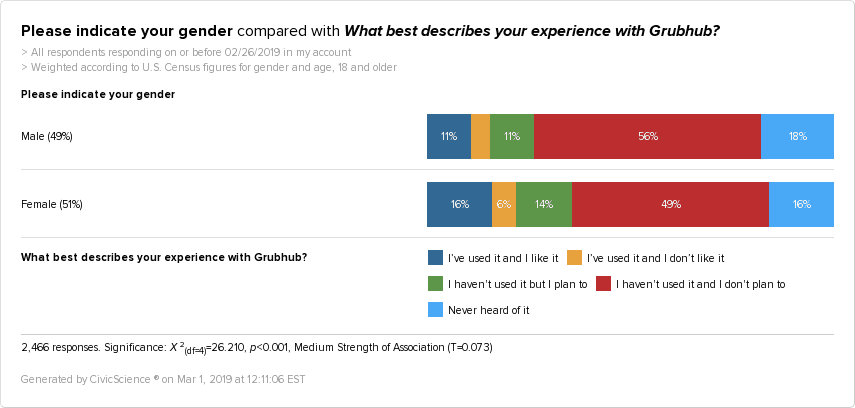

However, that’s not the case when it comes to gender. The study also shows that male and female users are close to even when it comes to Uber Eats, but interestingly, women are 45% more likely than men to use and like Grubhub. Overall, women tend to have a greater awareness of both apps than men.

What about income? Surprisingly, income doesn’t necessarily dictate favorability to Grubhub or Uber Eats. Even though people who make $50K or less per year are the least likely to know about the apps compared to higher earners, they are still nearly just as likely to use and like them, although at what rate is to be determined.

Related Trends in Emerging Tech

The study looked more closely at Grubhub specifically and uncovered additional trends, related to food-related apps, and interestingly, mobile banking.

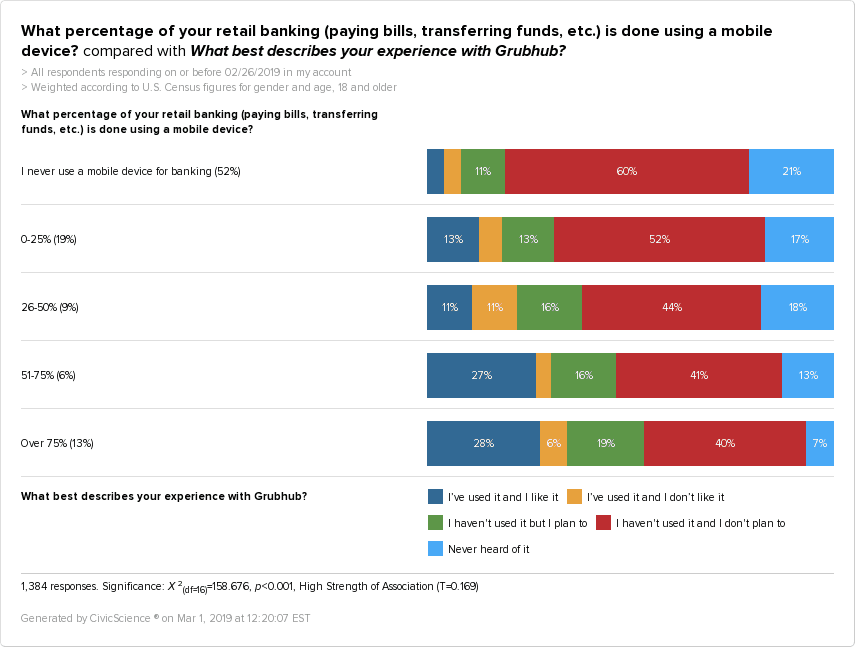

Mobile Banking Apps

Survey results show a significant correlation between people who rely heavily on a mobile device to do their banking (including paying bills and transferring funds) and using Grubhub to order food. The most frequent mobile banking users (those who indicate over 51% of their retail banking is done online) are nearly seven times as likely to use and like Grubhub, compared to those who never use a mobile device for banking.

Connection to Grocery Delivery and Meal Subscription Apps/ Services

In the wide world of other disruptive apps, grocery delivery services such as AmazonFresh and Instacart are gaining traction. The survey findings indicate that people who have used grocery delivery are significantly more likely to have used Grubhub.

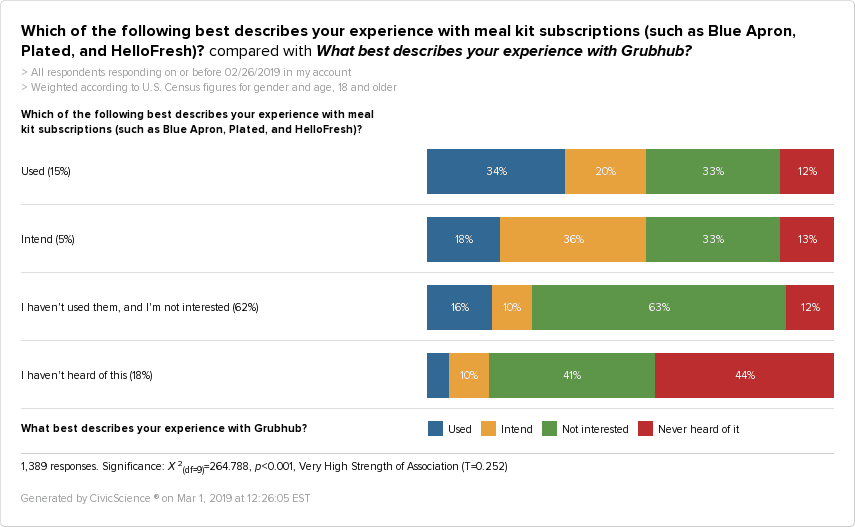

At the same time, those who have used meal subscription services, such as Blue Apron and HelloFresh are significantly more likely to use Grubhub:

Of course, it’s important to bear in mind that only about one-quarter of Grubhub users are also patrons of grocery delivery and meal subscription services.

Furthermore, all of these apps and services — whether that’s Grubhub or UberEats, grocery delivery, or meal subscriptions — still have plenty of room to grow.

However, even with only 13% of the population who use and like them, Grubhub has the highest level of engagement, in comparison to grocery delivery (9%) and meal subscription services (5%).

That’s expected — take-out and delivery have been a part of the American lifestyle for decades, but grocery delivery and meal subscription are new concepts for many. That leaves us to wonder what the future holds.

Grubhub and other similar apps are expected to pick up speed; it’s estimated that on-demand food delivery is expected to grow steadily in the next six years. The picture of a growing culture of convenience related to all things food is quickly emerging.