This is just a preview of the insights available from CivicScience. Want to see how your brand stacks up against the competition? Get started.

It has been a scorching summer for much of the country already. Cracking open a cold alcoholic beverage is just one of the many ways available for (drinking age) Americans to keep cool. An even deeper subset of them turn to hard seltzer.

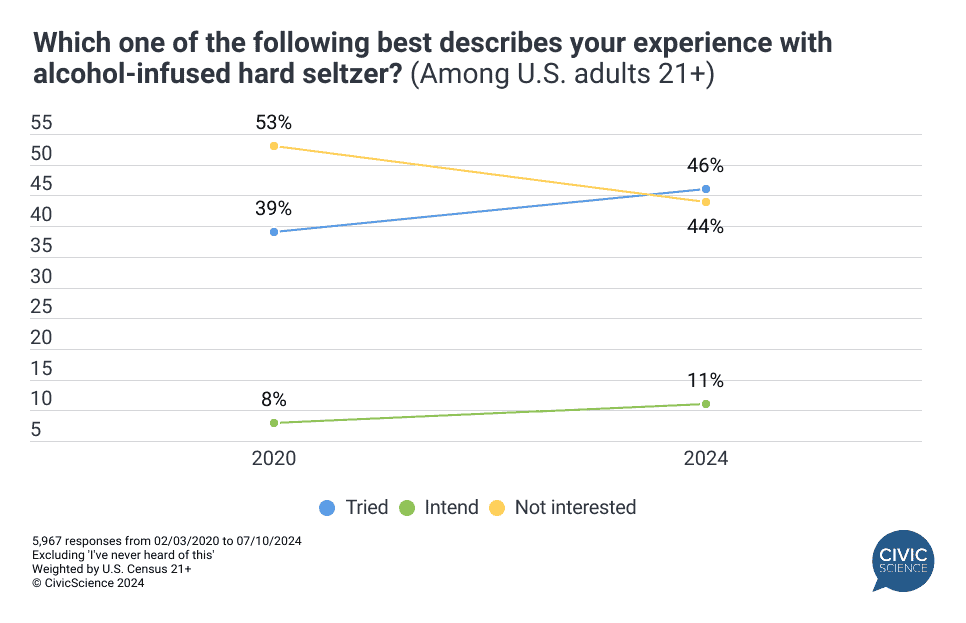

Hard seltzer rose to prominence before the pandemic and has seen increased interest since. The latest CivicScience data show that 46% of U.S. adults 21+ have tried it, a seven-point increase since 2020, with another 11% planning to. Among Gen Z adults aged 21-24, 55% report they’ve tried hard seltzer, and 23% intend to.

Take Our Poll: Are you a fan of hard (alcoholic) seltzer drinks?

Hard seltzer faces an uphill battle, but White Claw is well-positioned to stand out.

Additional CivicScience polling shows hard seltzer brands face an uphill battle to hold a spot in consumer alcoholic arsenals. While 61% of adults 21+ plan to buy the same amount of alcohol as last summer, more people plan to buy less (26%) than more (15%) this year.1 This aligns with earlier findings that Americans are drinking less overall, a trend extending into summer vacations and notable among Fourth of July celebrators.

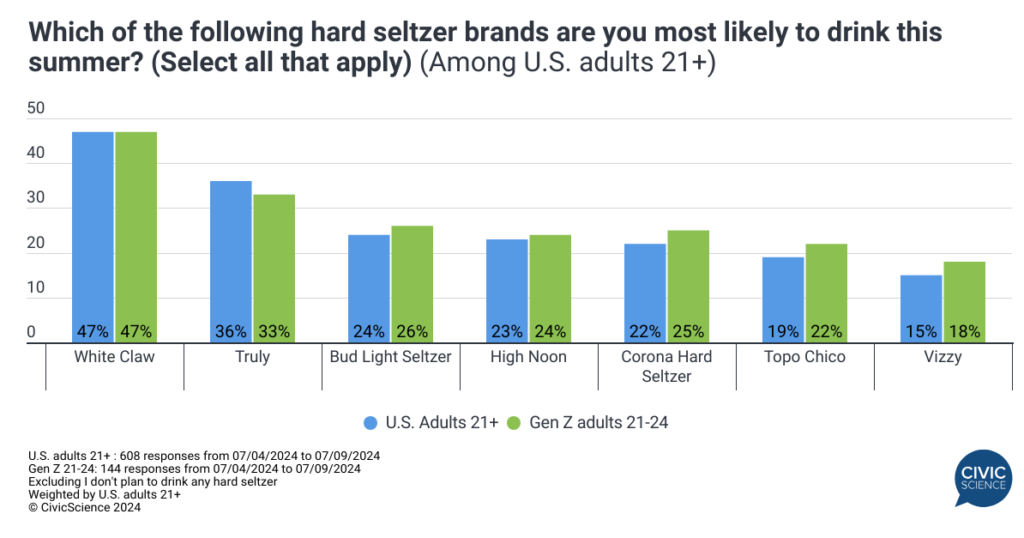

Despite shifting alcohol consumption trends, 28% of U.S. adults 21 or older say they’ll be drinking some hard seltzer this summer. As far as which brands they’ll be reaching for, there are two clear standouts – Truly and especially White Claw. Gen Z adults aged 21-24 are a key driver behind the summer White Claw interest.

Weigh in: How do you feel about White Claw Hard Seltzer?

How do Americans who enjoy the summer’s leading hard seltzer, White Claw, stand out?

Consumers who enjoy drinking White Claw (31%) are more than twice as likely as the Gen Pop (15%) to say they’re buying ‘more’ alcohol this summer compared to last year. Thirty-four percent of White Claw fans report drinking five or more alcoholic drinks per week.

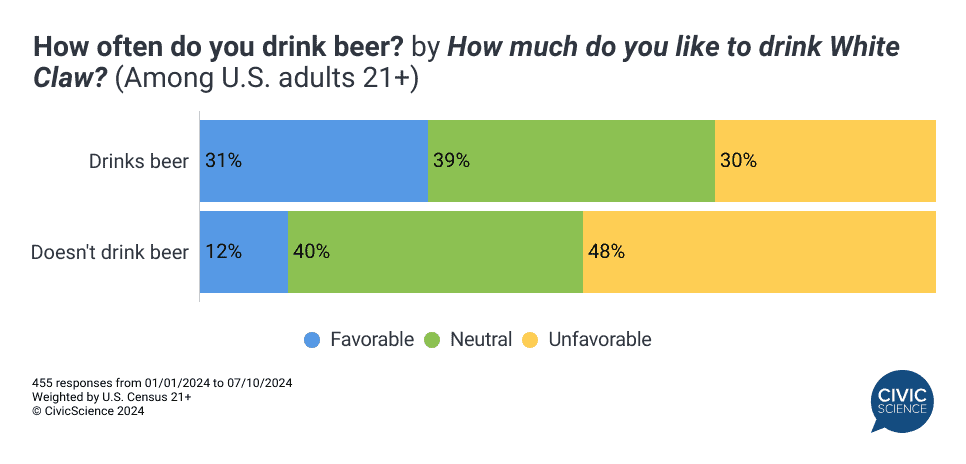

Data also find that White Claw holds a market share among a considerable segment of beer drinkers. Just over 3-in-10 drinking-age Americans who drink beer also enjoy drinking White Claw, although they’re more likely to be neutral toward the hard seltzer brand.

Here are three more key insights to know about Americans who like White Claw:

- Overlap among rivals – 72% of those who love to drink White Claw also say they also enjoy drinking Truly. That percentage jumps to 80% among drinking-age Gen Zers

- Seventy-six percent of White Claw fans visit the YouTube site or app at least weekly, with 47% checking in daily.

- They’re most likely to be influenced by the video ads they see on TV/ad-supported video streaming services (37%), compared to 34% on free video sites (like YouTube) or social media platforms (28%).

Hard seltzer faces a challenging market with declining alcohol consumption, but brands like White Claw are still making their mark, especially among Gen Z adults. By focusing on this demographic and perhaps not overlooking beer drinkers, hard seltzer can adapt to changing preferences and secure its place in American coolers this summer.

See beyond the data – With CivicScience, you can leverage insights like these to build highly targeted audience segments for successful advertising campaigns. Learn how with our free eBook.

- n=1,253 responses from 07/4/2024 to 07/09/2024, excluding those unsure and not planning to buy alcohol ↩︎