This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Summer vacation is already halfway over for millions of American students, and retailers are beginning to roll out their back-to-school sales. Ongoing CivicScience tracking shows a majority (57%) of back-to-school shoppers have already started shopping for school supplies, up from 47% in May.1 Compared with previous years, this represents an eight percentage point increase over July 2022 and is similar to the numbers reported in July 2023.

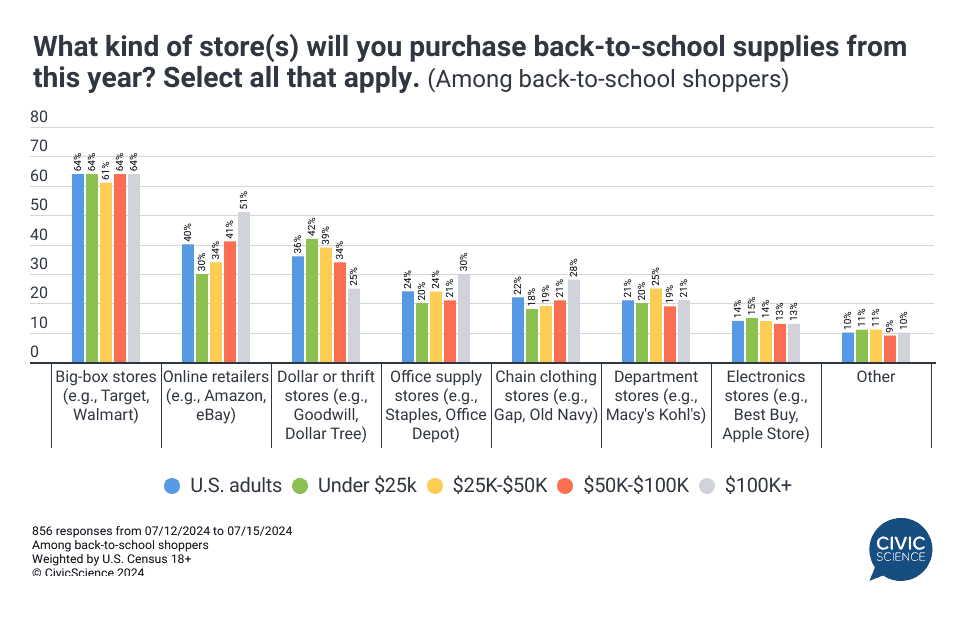

Big-box retailers dominate the back-to-school shopping landscape in 2024.

Big-box stores like Walmart and Target are, by far, the most popular places to shop for back-to-school supplies – and this holds true for consumers in all income groups. Nearly 2-in-3 shoppers say they plan to do at least some of their back-to-school shopping at big-box stores this year, including 64% of consumers in lower-income (less than $25K) households and 64% of consumers in higher-income (more than $100K) households.

More than 40% of consumers in lower-income households also plan to purchase supplies at dollar stores or thrift stores, while more than 50% of consumers in higher-income households plan to do some of their back-to-school shopping with online retailers like Amazon.

Join the Conversation: Have you already begun purchasing your children’s school supplies for this year?

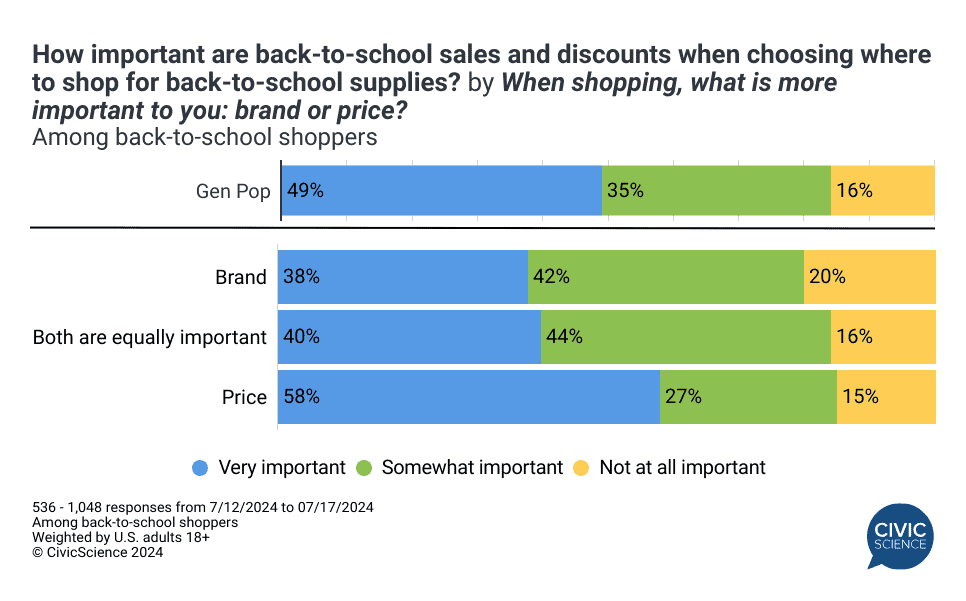

Back-to-school sales will play a big role in where shoppers go to buy school supplies.

New data show nearly one-half of back-to-school shoppers say that back-to-school sales and discounts, such as Amazon Prime Day, will be ‘very important’ factors when choosing where to shop for back-to-school supplies. In fact, roughly 25% of all back-to-school shoppers purchased school-related items from Amazon during Prime Day this month.

Consumers who place a lot of importance on back-to-school sales are more focused on getting good deals than they are on shopping for specific brands. U.S. adults who value price over brand when shopping are 20 percentage points more likely to prioritize sales and discounts when choosing where to do their back-to-school shopping, compared to those who value brand.

Answer our Polls: When do you start your back-to-school shopping?

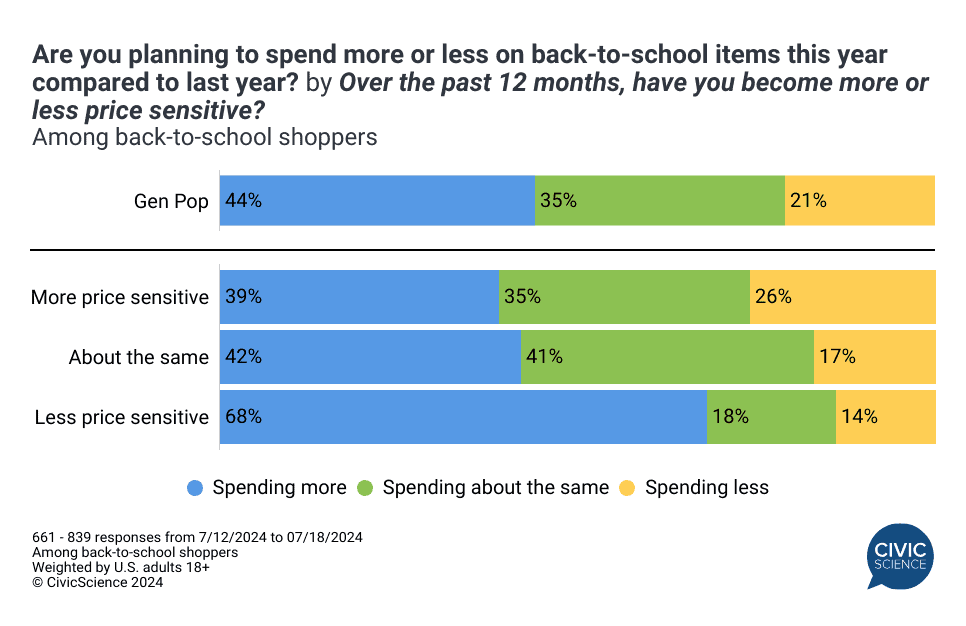

Despite the importance shoppers place on sales, many still believe their back-to-school supplies will cost them more than they did last year. July data indicate 44% of respondents expect they will spend more on back-to-school supplies than they did in 2023, compared with only 21% who expect they will spend less.2

Shoppers who are not as affected by price increases are even more likely to plan on increased back-to-school spending. Among consumers who have grown less price sensitive over the past 12 months, 68% plan to spend more on back-to-school shopping this year than they did last year.

As inflation and high prices persist through the summer, Americans are looking for ways to save money on necessary purchases, and school supplies are no different. Expect consumers to be on the lookout for the best back-to-school sales and discounts ahead of the 2024-2025 school year.