This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Federal interest rate cuts may be coming very soon. Recent inflation data from July kept in line with expectations, while Federal Reserve Chairman Jerome Powell recently hinted that rate cuts may be on the way.

How might consumers respond if/when interest rates are cut and what sort of impact might it have on the housing market? Here are three key insights to monitor:

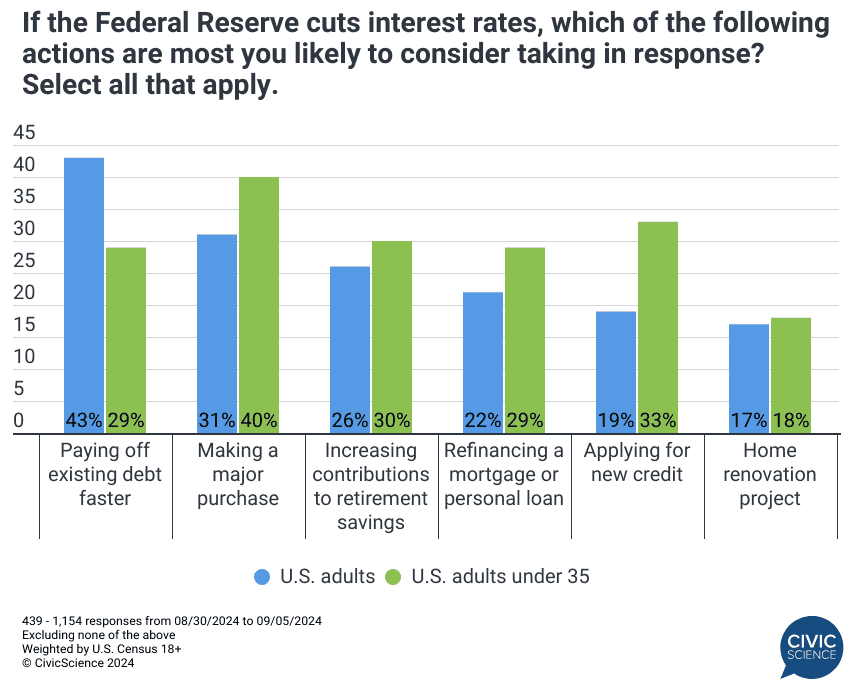

1. Major purchases look to spike, but Americans under 35 have other priorities in mind.

New CivicScience data show the Gen Pop would most likely target paying off debt first and foremost, followed by making a major purchase or bumping up their retirement contributions following an interest rate cut.

Priorities shift noticeably for consumers under the age of 35 – they are less focused on paying off debt and more inclined toward spending on major purchases such as a home, as well as opening new lines of credit.

Join the Conversation: To what extent do you approve or disapprove of the job the Federal Reserve is doing?

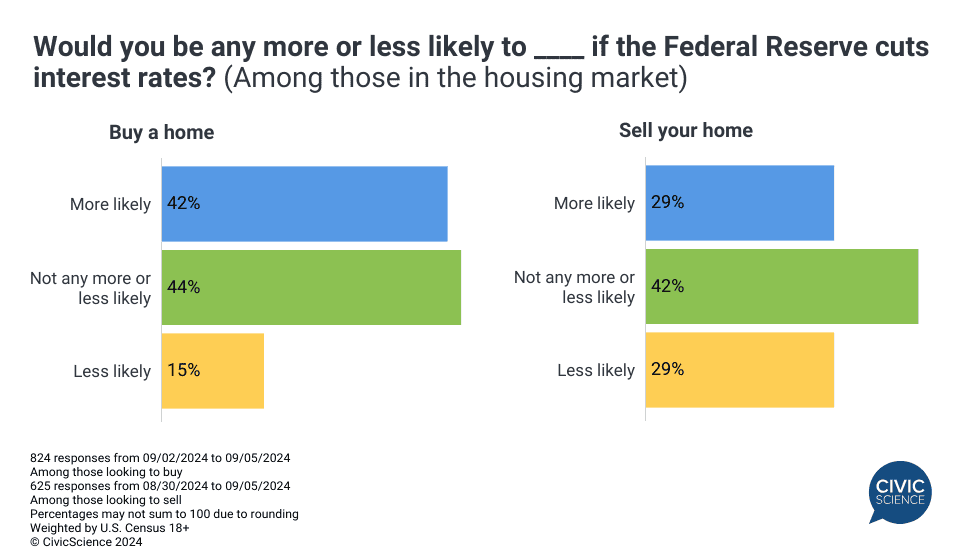

2. Those in the housing market are mixed on the impact of interest rate cuts.

Among those in the market to buy a home, 42% would be ‘more’ likely to buy should interest rate cuts indeed come to fruition. Notably, this percentage jumps significantly to 68% among first-time homebuyers. Still, a plurality (44%) of those looking to buy say they would not be any more or less likely to purchase a home following cuts.

On the flip side, homeowners looking to sell their homes are equally split on whether they would be more or less likely to sell, while 42% expect no impact on their plans.

Weigh In: Will lower interest rates boost home buying?

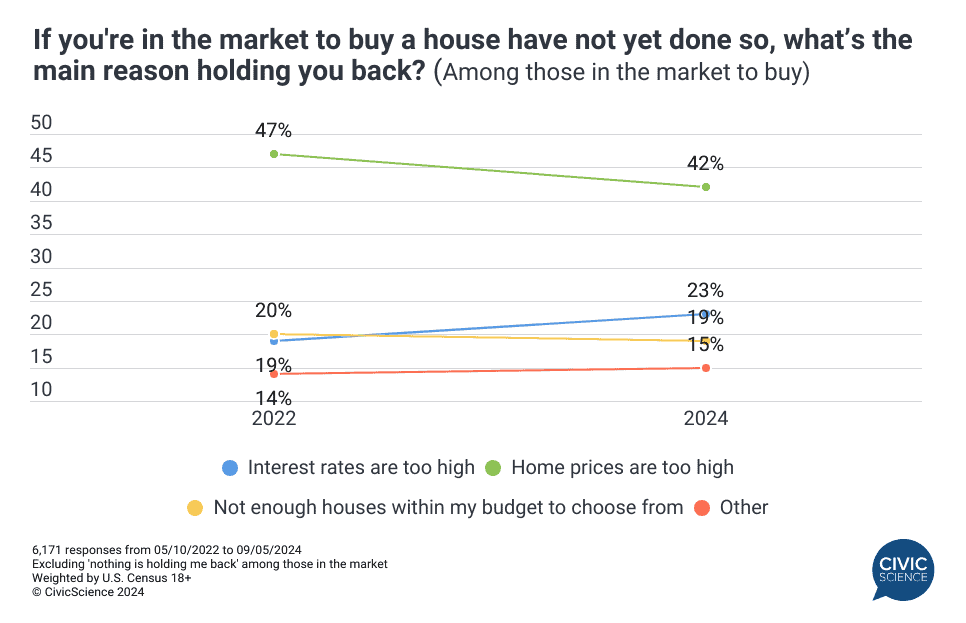

3. What’s keeping prospective buyers from buying today?

The prevailing roadblock for homebuyers is housing prices, though the percentage of buyers who said this has declined by five percentage points since 2022. Unsurprisingly, ‘interest rates are too high’ is the second most common reason after having overtaken ‘not enough homes within my budget to choose from’ since 2022.

Although interest rate cuts could boost consumer spending and borrowing, their effect on the housing market is likely to be tempered by persistent affordability and inventory concerns. First-time buyers may respond more positively, but high home prices and limited inventory will continue to present challenges for many prospective homeowners.