This is only a glimpse of the data available to CivicScience clients. Discover more data.

As we enter the second half of 2025, macroeconomic uncertainty and ongoing political developments continue to shape the consumer landscape, particularly within the food and beverage space. CivicScience’s latest Uncertainty to Action webinar examined key behavioral shifts that provide a window into consumer sentiment, values, and purchasing priorities. From spontaneous Prime Day shopping to generational divergence in food indulgence and long-term declines in alcohol consumption, these trends offer timely signals for where attitudes and behaviors may be headed — and how brands can prepare for what’s next.

1. Prime Day shoppers embraced impulse buys.

This year’s extended July Prime Day drew in about 40% of U.S. adults, including 17% who were either first-time shoppers or returning after not shopping a Prime Day sale for a while. Another 17% said they typically participate but opted out this year, while 43% expressed no interest in the event.

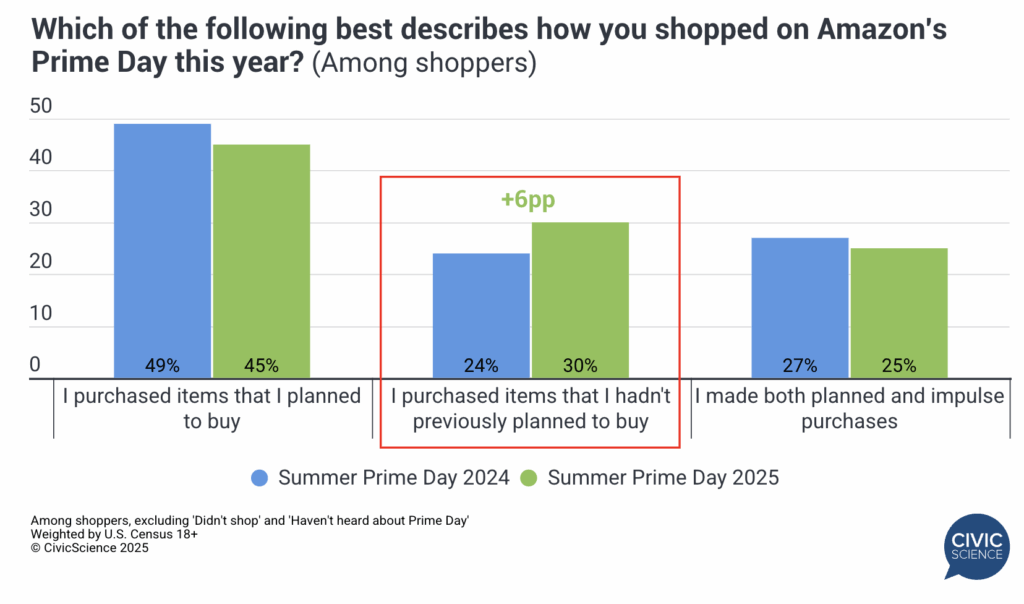

The webinar explored motivations for shopping the sale, top product categories, overall spending, and intent to shop competitor events – and how these behaviors have evolved year over year. One particularly notable finding was a six-point increase in the share of Prime Day shoppers who made impulse purchases compared to 2024. Whereas, the percentage of consumers who stuck exclusively to planned purchases declined from 49% to 45%. This shift reflects a growing openness to discretionary spending when the moment feels right, suggesting that even amid economic uncertainty, consumers are finding space to treat themselves.

Weigh-In: Do you typically shop Amazon’s major sales?

2. Post-pandemic trends in dessert-eating are going in opposite directions between young and old.

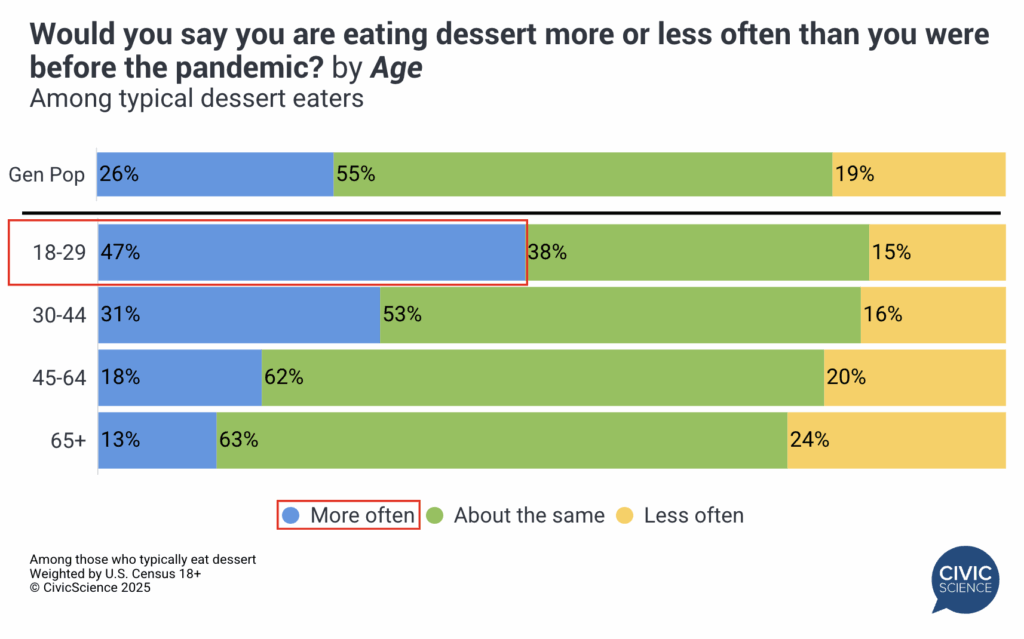

When asked how their dessert consumption has changed since before the pandemic, U.S. adults revealed a pronounced generational divide. Nearly half (47%) of those aged 18 to 29 reported eating dessert ‘more often’ today than five years ago. That’s in sharp contrast to just 13% of adults aged 65 and older who said the same. Older adults were far more likely to say they’re eating less dessert now than they were before the pandemic began.

This reflects broader emotional and lifestyle factors. For younger adults, dessert may serve as an affordable indulgence — a way to add moments of joy amid ongoing stress or economic pressure. For older consumers, the trend may align more closely with long-term wellness goals.

Use our Data: CivicScience clients have access to real-time insights like these, allowing them to keep a pulse on the latest trends and how they could impact their bottom line.

3. Beer consumption continues its decline.

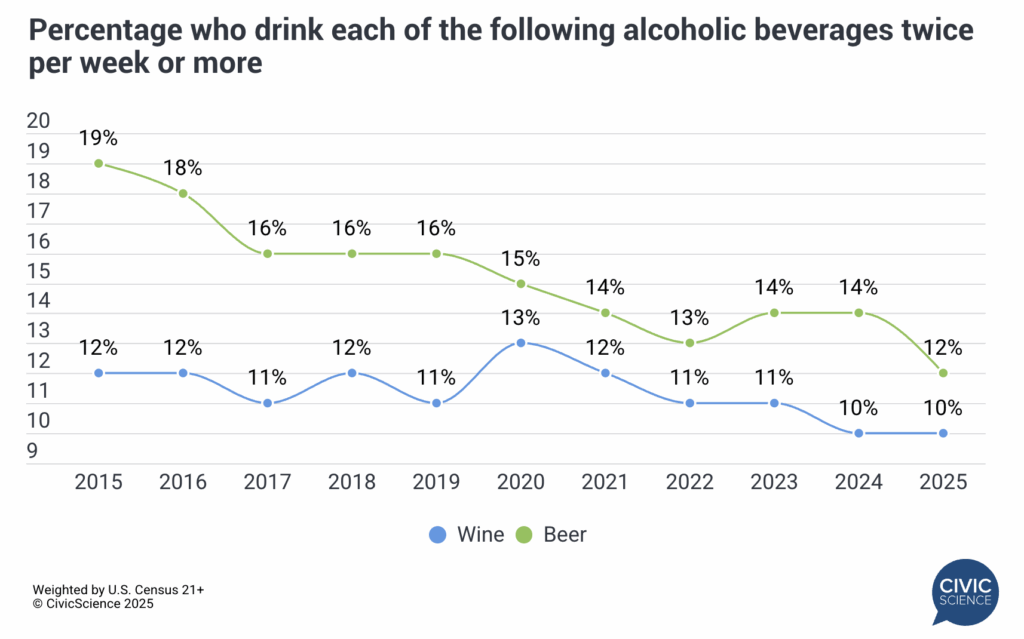

Over the past decade, the share of U.S. adults 21+ who report drinking beer at least twice a week has steadily declined, falling from 19% in 2015 to just 12% today. In contrast, weekly wine consumption has remained relatively flat, holding in the 10% to 12% range during the same period. The data points to a broader shift in adult beverage preferences, where beer is losing its place as the default choice for drinkers.

This shift may be partly attributed to growing interest in health and wellness, generational moderation trends, or the increasing popularity of non-alcoholic alternatives. As younger adults 21+ embrace more intentional drinking habits – or opt out of alcohol altogether – these changes are expected to persist.

Answer our Poll: What’s your favorite type of alcoholic beverage?

These evolving behaviors – from impulse-driven shopping to shifting food and beverage habits – offer a nuanced view of how consumers plan to navigate the remainder of 2025. While some choices reflect a desire for indulgence and spontaneity, others signal long-term lifestyle shifts rooted in wellness and restraint. For brands, staying attuned to these micro-trends will be key to connecting with consumers in an emotionally and economically complex environment.