CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

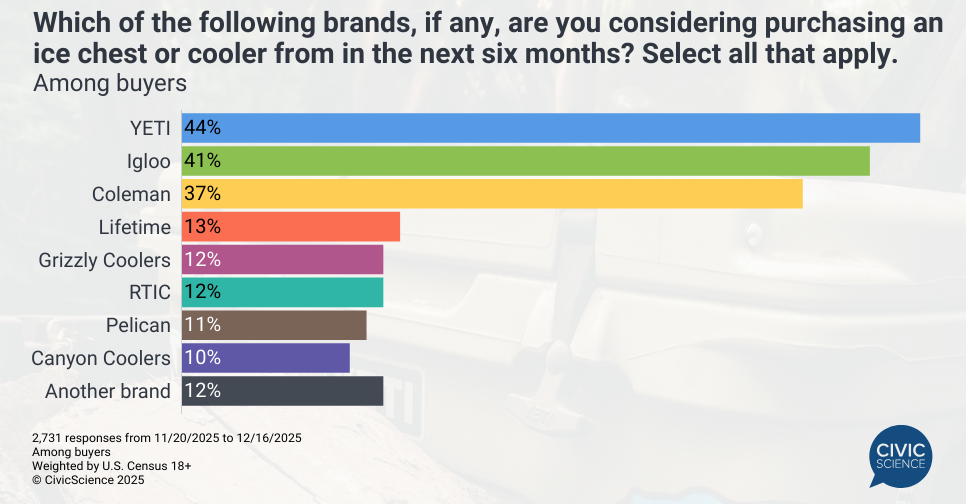

Despite colder temperatures and turbulent weather settling in throughout the country, new consumer-reported data reveals a significant segment of U.S. consumers is thinking about and planning for future outdoor activities and gatherings with a cooler as a sidekick. CivicScience data find strong purchasing intent for coolers: More than 4 in 10 (42%) U.S. adults say they plan to purchase a cooler or ice chest within the next six months. At the forefront of this market stand YETI and Igloo, with each capturing over 40% declared purchase interest, led by YETI.

While both brands are key players in the outdoor gear and cooler industry, the consumer profiles they attract are subtly, yet notably, different. A deep dive into CivicScience’s more than one million daily survey responses provides a few of the key ways these two segments distinguish themselves from each other:

Cooler Usage Trends

Usage Spotlight: Consumers planning to purchase an Igloo brand cooler are more likely to use a cooler at least weekly, whereas YETI brand buyers tend to use a cooler monthly. Social gatherings (e.g., parties, picnics, or barbecues), road trips, camping, hiking, and casual at-home use are the most common ways both audiences typically use their coolers. While differences are minimal, Igloo buyers are slightly more likely to use their coolers for fishing and boating, whereas YETI has a slight lead on picnics and casual at-home use.

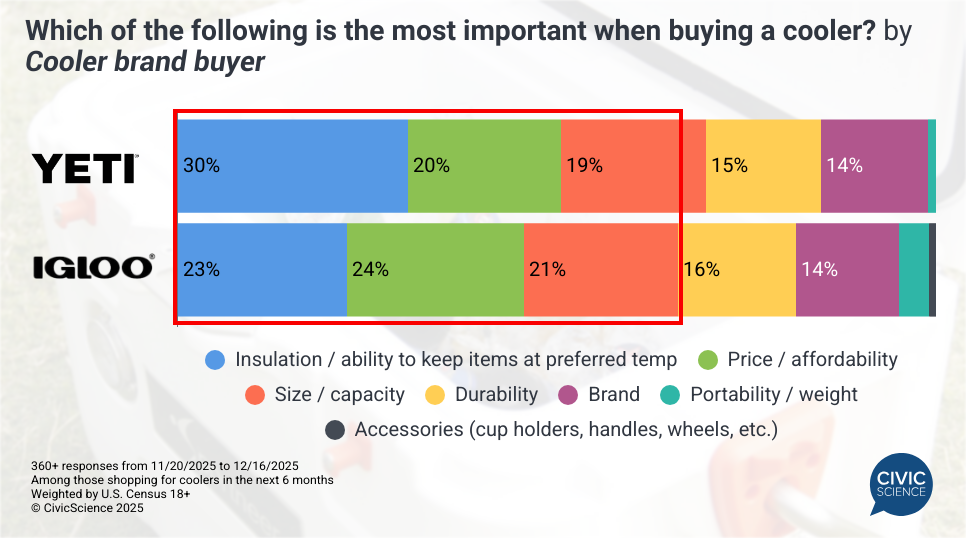

Outdoor Purchasing and Cooler Priorities: YETI buyers slightly over-index in buying sports and outdoor gear from sporting goods stores and directly from a specific brand, while Igloo purchasers lead in buying outdoor gear from big-box stores and online-only retailers. Significant differences emerge in what matters most when deciding on a cooler, specifically. YETI buyers care most about temperature management, while Igloo buyers prioritize affordability and maximizing capacity for that value.

What to Know About Igloo and YETI Cooler Buyers

YETI Buyers: More optimistic about the future in general and are more likely to expect to have more disposable income in 2026 than they did in 2025. They’re also hosting social gatherings more often than they did last year (among those who host).

Igloo Buyers: More likely to say they try new products before others do. They’re less likely to have used Buy Now, Pay Later services in the past and more likely to say they have no interest in using them in the future. Igloo shoppers are also five points more likely to say their next vacation will be at a beach or lake and slightly more likely to say it will be a camping trip.

Reaching Cooler Buyers

Sports Streaming Subscribers: Just under one in four buyers of each brand report having at least three video subscriptions specifically for watching sports. Additionally, a majority of both Igloo and YETI buyers report paying for ad-supported video streaming services.

The Importance of Video: At least 7 in 10 of both cooler brand buyers say they use video (online, social streaming, or TV) to learn about products and make purchase decisions. Video research is notably more common among YETI buyers, with 23% saying they ‘always’ do this, compared to 17% of Igloo buyers.

The Online Ads That Win: Honing in on online ad types that are most influential, YETI buyers are notably more likely to say they’re influenced by ads on search engines and pre-roll ads. Conversely, Igloo buyers are more likely to report being influenced by banner ads.

These insights preview how cooler buyers will diverge in their purchasing journeys through the new year and beyond. While YETI buyers express greater optimism about their financial futures, Igloo buyers focus on maximizing value; both segments remain highly engaged with video content and sports streaming. As consumer priorities shift, CivicScience’s daily survey data empowers brands to stay ahead of these changes in real-time, ensuring they can be reached in the right place at the right time.