CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

The flip of the calendar to January brings a focus on resolutions and goals for the year ahead. For the past several years, it has also marked the beginning of Dry January, during which people refrain from drinking any alcohol throughout the entire month of January.

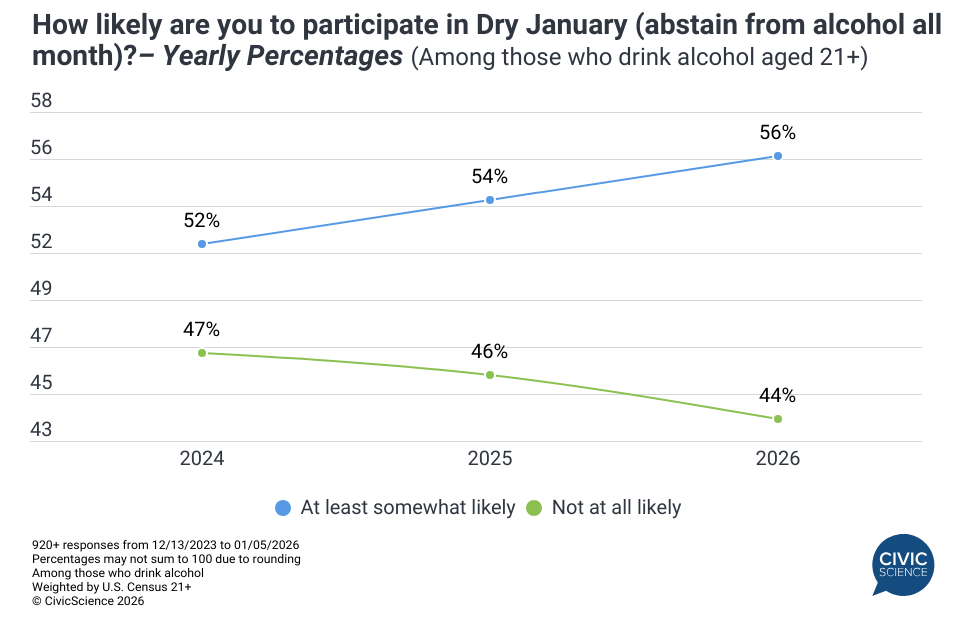

New consumer-declared data among U.S. drinkers aged 21+ show that intent to participate in Dry January (unofficially, not associated with the official UK Dry January) is continuing to increase, with a modest two-point jump since Dry January 2025 and a four-point increase from 2024. Millennials aged 30-44, women, and parents are the most likely segments to partake this year. This rising intent also aligns with an increasing emphasis on prioritizing health and reducing smoking and drinking as part of 2026 New Year’s resolutions.

Motivations and Alcohol Alternatives

Health considerations, as they were last year, are the most common drivers of Dry January participation, with 65% of participants citing either physical (41%) or mental health (24%) as their primary reason this year. This marks a two-point increase in those seeking to improve their mental health from Dry January 2025. Reasons such as saving money (17%), detoxing from the holidays (11%), and a desire to take a break from alcohol are less common and have each held relatively steady YoY.

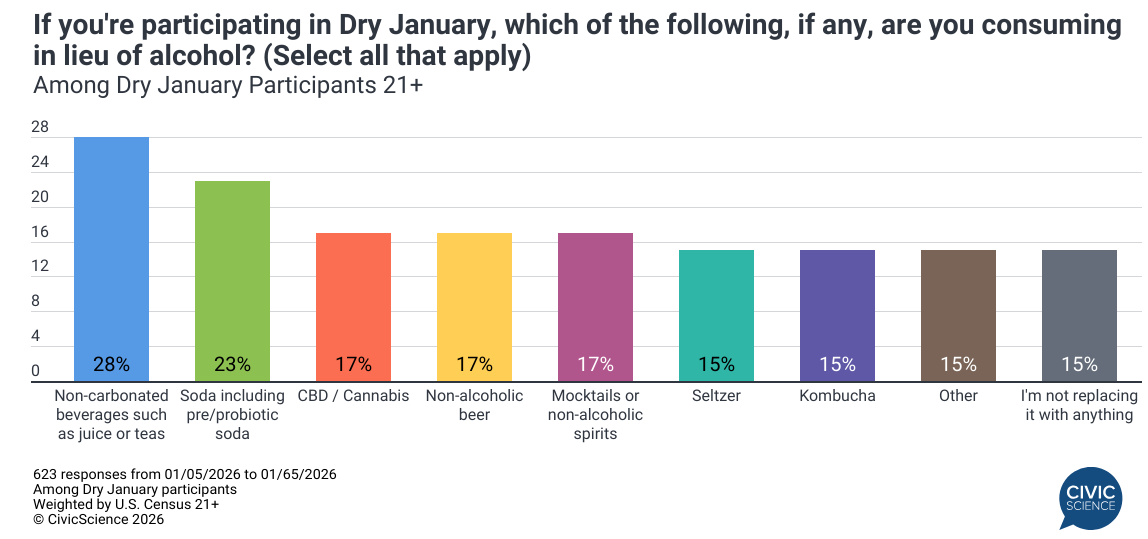

As for what participants turn to in place of alcohol, non-carbonated beverages (e.g., juice or tea) are the most common substitutes, followed by soda. Beyond them, the field is fairly evenly distributed among all other alternatives studied, with an equal percentage turning to either cannabis or non-alcoholic beverages (e.g., NA beer, mocktails, or spirits). Notably, 15% say they’re not replacing alcohol with anything.

Dry January also arrives at a time when the percentage of Gen Pop (21+) who say they’re interested in trying non-alcoholic (NA) beverages, such as NA beer or mocktails, finished off 2025 at 41%. This marks a 35% increase since 2022 and is a six-point increase from 2024 alone.

Coinciding with rising interest in Dry January is an increasing curiosity about a completely alcohol-free lifestyle—50% of drinkers 21+ tell CivicScience they are at least ‘somewhat’ curious about a sober lifestyle, up from 41% in 2024. Dry January may serve as the test for a sober lifestyle for participants, as 71% of those likely to participate in this year tell CivicScience that they hold at least some curiosity about going alcohol-free.

Why Dry January Should be on Brands’ Radar

Dry January participation isn’t just affecting the alcohol industry; it’s also influencing overall consumer spending intentions for 2026. A new CivicScience survey among drinkers reveals that those who are likely to participate in Dry January this year are nearly twice as likely as non-participants to say their spending over the past week is ‘higher’ than usual (43% to 22%, respectively).

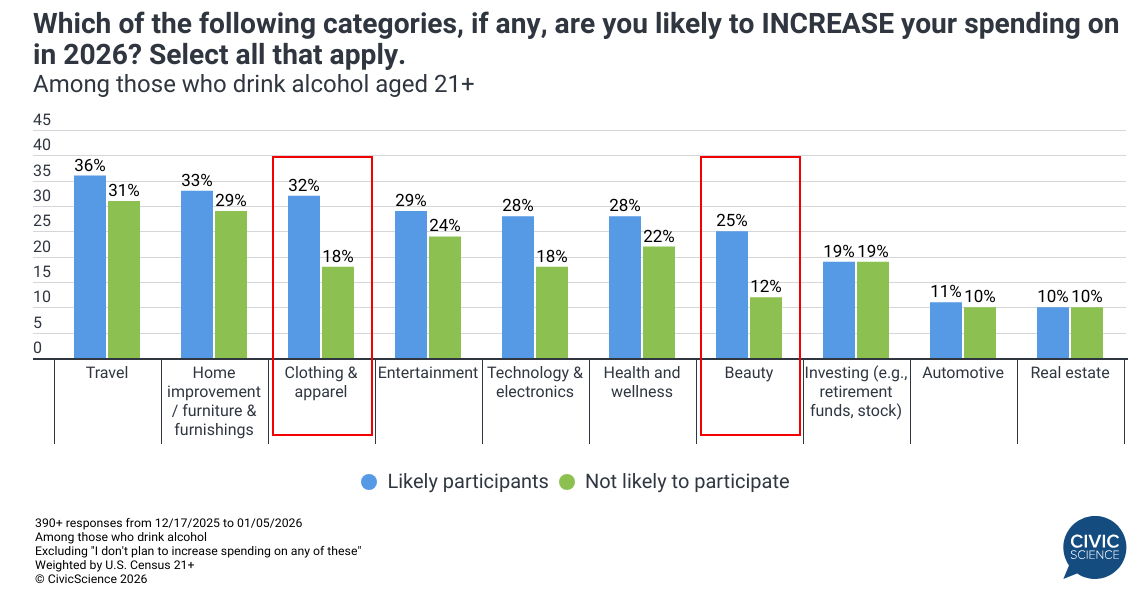

This trend is likely to carry into the new year, as additional data show that likely participants are significantly more likely than non-participants to report increased spending this year in nearly all categories studied below. Brands and advertisers in the clothing and beauty sectors, in particular, should be paying close attention to this year’s crop of consumers participating in Dry January.

More than just an abstinence challenge here in the U.S., Dry January offers the potential gateway to a permanent lifestyle shift for a significant portion of the alcohol-drinking public. This “reset” creates a unique retail opportunity where cutting back on alcohol may spark increased spending and engagement across the wider retail, beauty, and wellness sectors.