CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

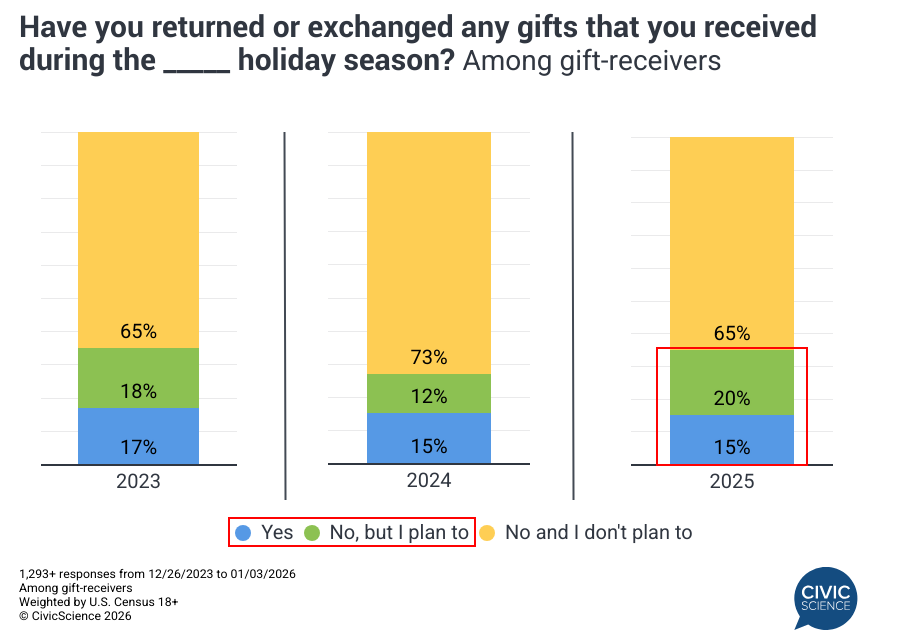

The turning of the new year brings about the end of holiday shopping and gift-giving, but it also means the clock is now ticking to return the gifts that missed the mark. The window to make returns for holiday gifts largely closes by the end of the month, and new survey data show an increasing percentage of gift recipients may exchange or return their gifts this year. Thirty-five percent of those who received a holiday gift tell CivicScience they’ve made a return or exchange, or plan to do so soon, equalling the percentage who did the same after the 2023 holiday, but marking an eight percentage point jump from those who did returns/exchanges following the 2024 holiday season.

Return intent is particularly strong among Gen Z aged 18-29, with 53% of gift recipients saying they either already have or plan to make a gift return. By income, it’s low-income earners (those earning under $50K) who lead the way in intent, likely a proxy for age. Still, 23% of high-income earners ($100K+) also report gift return/exchange plans.

Holiday Gift Return Insights to Know

Consumer-declared data from CivicScience allows the ability to go beyond demographics and take a deeper look into holiday gift return plans this year:

- Return Motivations: Incorrect size/fit is the leading driver of gift returns (19%). This is followed by a ‘lack of usefulness for the item’ (14%), receiving something they already own, a mismatch with personal taste, and damage or defect to the item (13%, respectively). A preference for cash or store credit is the least common driver for making a return (11%).

- Multi-Returns: Sixty percent of those returning a holiday gift plan to return two or more gifts this year.

- Leading Return Categories: Fifty-one percent say they will return gifts related to clothing and accessories, far ahead of 34% who will return toys/games or household items (37%).

- Holiday Debt Concerns: Holiday debt is a key theme for early 2026. Among consumers with holiday debt, those at least ‘somewhat’ concerned about repayment are nearly twice as likely to return gifts compared to those who are not concerned.

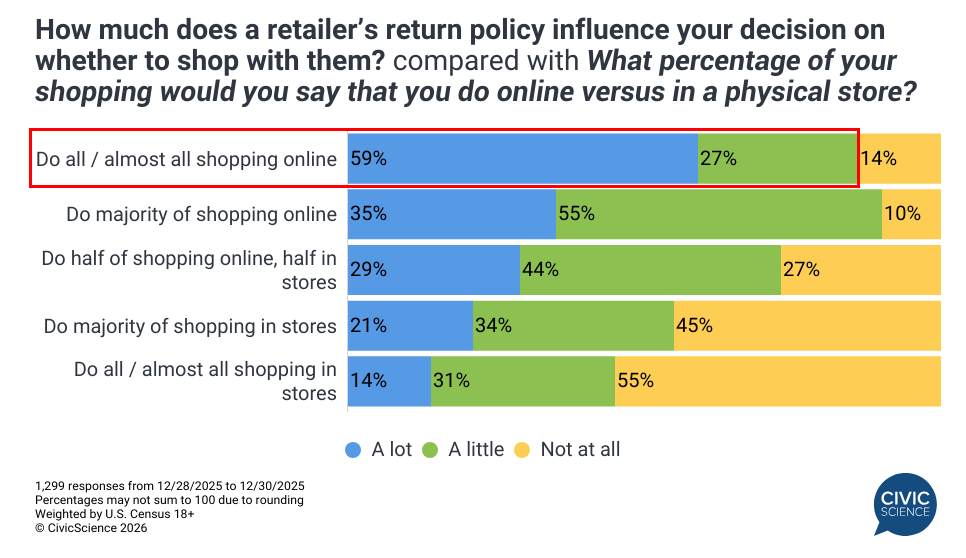

Retailer Return Policies are Key in Shaping Consumer Purchasing Decisions

Beyond holiday gifts, a retailer’s return policy is a critical factor in shaping consumers’ overall initial purchasing decisions. Recent CivicScience data indicate that more than 7 in 10 U.S. adult respondents cite return policies as a factor in shaping their shopping decisions, with 29% considering them a very important consideration. This sentiment is unsurprisingly strong among online shoppers. While only 14% of in-store shoppers are heavily influenced by return policies, that number spikes to 59% for those who shop exclusively online, highlighting that a flexible return process could be key for e-commerce businesses trying to attract new customers. This is particularly notable given that more than half (53%) of holiday gift-returners and intenders this year say they do the majority of their retail shopping online.

Return intent looks to be up from last holiday season, and while retailers can’t control a gift’s “usefulness” to the recipient, their policies are shaping where consumers spend their dollars. Because today’s gift-returners are more likely to report being ‘very’ loyal to their favorite brands, compared to non-returners, the return process acts as a pivotal touchpoint for possible retention. A positive experience may hurt the bottom line in the short term, but it is a necessary investment to secure the loyalty of a segment of consumers who will soon engage with them, if they haven’t already, as they make their returns.