CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As the days grow longer and spring looms on the horizon, many will begin thinking about home improvement projects. However, amid ongoing economic uncertainty, the state of home improvements is more nuanced this year, and CivicScience has new data on what home improvement will look like in 2026:

Home Improvement Plans Down From Q1 2025, But a Growing Segment Plan to Outsource and Up Spending

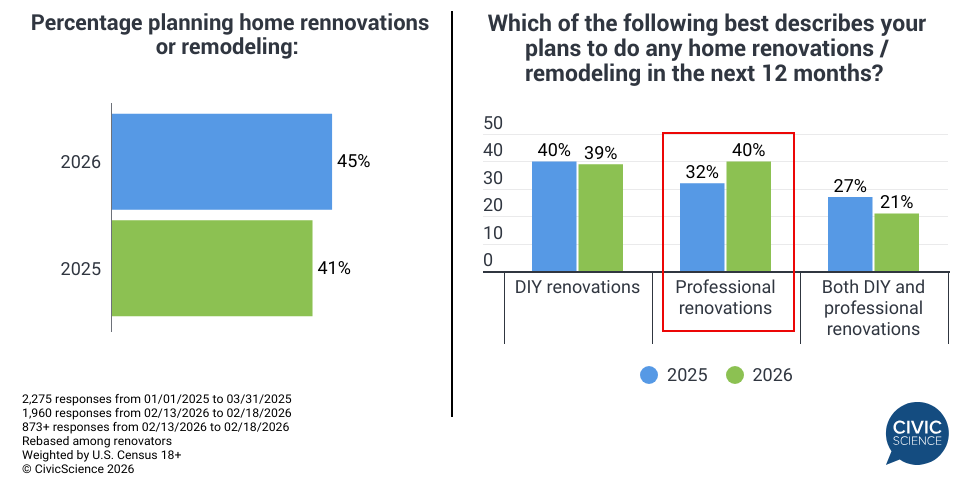

While 10% of Americans say they plan to spend their tax refund on home improvement projects, overall renovation intent has softened slightly. Just over 4 in 10 homeowners (45%) tell CivicScience they plan to spruce up their homes in the next year, a four-percentage-point decline from Q1 2025 — suggesting some pullback amid broader economic uncertainty.

However, renovators are increasingly likely to hire a professional, with 40% saying they plan to outsource the work entirely, up eight points from 32% in Q1 2025. Slightly fewer intend to take the DIY (39%) or hybrid approach (21%).

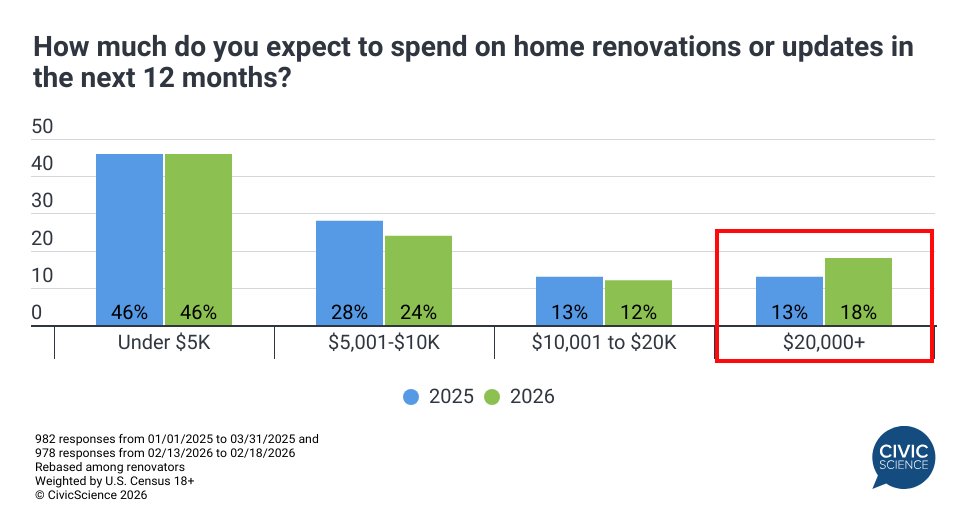

While nearly half of prospective renovators expect to spend under $5K, the share planning more substantial investments ($20K+) has risen by five points since this time last year. This suggests that although fewer Americans may be planning renovations overall, those who are moving forward are preparing for potentially more expensive or professionally driven projects.

Plans to Take on Debt Increase

Planning to spend doesn’t necessarily mean paying out of pocket. Nearly one quarter (24%) of renovators say they plan to take on debt for home improvement projects in the next 12 months, up from 19% who said the same last February. Financing intent is particularly pronounced among those budgeting for larger projects, though debt isn’t limited to high-cost renovations – a meaningful share (30%) of lower-budget renovators also expect to borrow.

City Residents Lead in Larger Upgrades

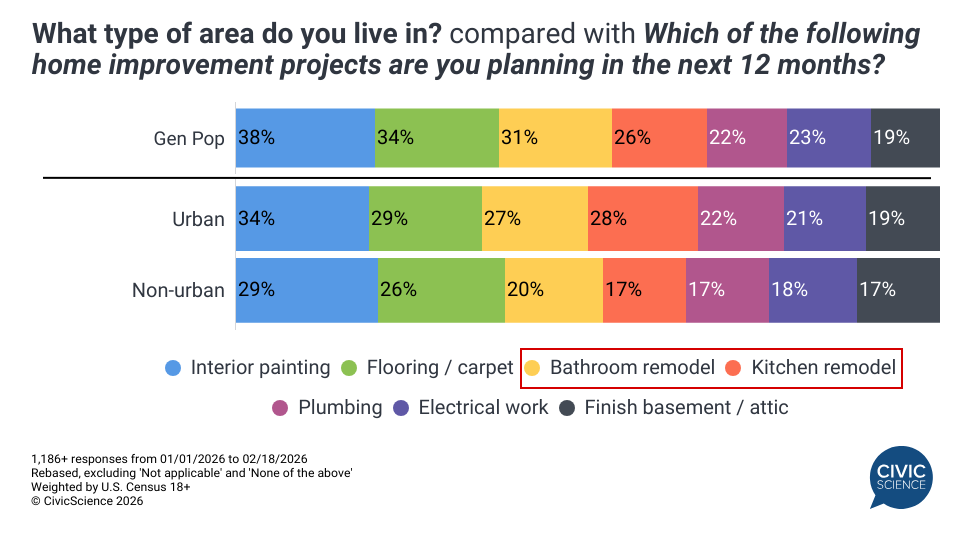

When it comes to the types of renovations homeowners are planning, priorities remain largely consistent year over year. Interior painting, flooring or carpet installation, and bathroom remodels rank as the top three intended projects. Most other renovation categories have held steady compared with last year, but finishing a basement or attic has increased four percentage points since Q1 of 2025.

CivicScience can further segment audiences based on reported demographic data, including the type of area in which they live. City residents are more likely than those in non-urban areas to plan every type of renovation in the next 12 months. While interior painting leads across both, urban residents notably over-index on larger, value-driven upgrades, particularly kitchen remodels (28% vs. 17% among non-urban residents) and bathroom remodels (27% vs. 20%). They are also more likely to plan plumbing and flooring projects.

Additionally, suburban residents are the most likely to hire a professional, leading urban residents by more than ten points. City dwellers, meanwhile, hold a slight edge in DIY-only projects but show a more notable lead in taking a hybrid approach that combines DIY and professional work.

While overall renovation intent has edged down slightly, the homeowners moving forward are planning larger, more professionally driven projects and showing greater openness to financing. Renovation plans may be shaped less by widespread participation and more by a concentrated group of homeowners willing to invest strategically in their current spaces.