It took me about 2.5 weeks before breaking something in my new house – a record I would say. That disposal didn’t even know what hit it. After the initial shock from the apocalyptic sound of grinding marbles faded, the realization hit me that I would now have to pay for this unexpected cost – Yikes.

As anyone who has ever moved knows, you basically bleed money in a moving period. To make up for this lack of cash flow, I thought it might be best to finally get a credit card, but which one to choose?

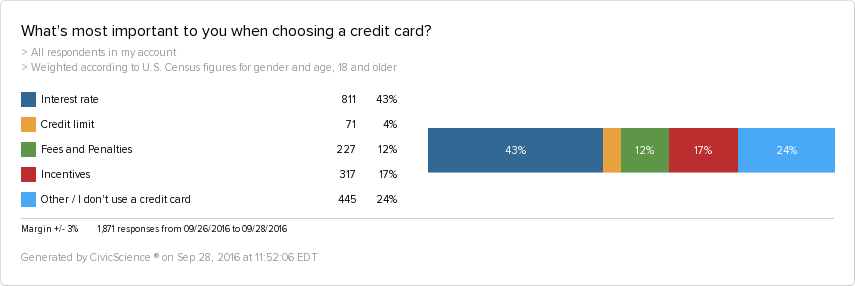

There are plenty of resources out there regarding which credit card is right for you, but that seems a little abstract. I wanted to figure out what people really look for, and along the way, maybe help me with my own credit card decision. So, I asked:

Interest Rate

As you can see, the majority of people care most about interest rate when choosing a credit card. As a quick refresher for those like myself who are less financially literate, a credit card’s interest rate is the amount you pay for borrowing money. It’s usually calculated on a yearly basis.

Those who care most about interest rate are more likely to be married, homeowners, and/or between the ages of 35 and 54 years old. In addition, 25% of this group consists of Millennials.

They are more likely to eat most often at casual restaurants, and follow food and cooking trends. In addition, they are more likely to favor restaurants with diverse menu options.

They are the most likely out of all the other groups to follow the NFL very closely, and they are also more likely to donate to religious charities. Lastly, they are less likely to be price-conscious.

For those who are looking for low-interest credit cards, CreditKarma is a great resource.

Incentives

This was the second most popular option (besides for the folks who don’t have a credit card). Incentives can take the form of cash back bonuses, dining points, travel points and more.

This group has the second highest percentage of Millennials, 30%, and consequentially, they are the most likely group to actively use Snapchat. This may not be surprising. Given that Millennials are spending more on experiences than things, travel incentives may be a high selling point for this group.

They are more likely to own their homes, manage their money very well, and closely monitor their retirement savings. They also are most likely to eat most often at upscale restaurants or local independent restaurants. They are more likely to live in the US Northeast.

Lastly, they care about costs (and possibly the environment as well), given that they are more likely to use reusable shopping bags, and showroom across multiple websites – presumably to find the best prices.

Fees & Penalties

This category is one that I personally have considered the most when thinking about credit cards. The average credit card, according to a 2015 survey, carries six fees. For those who make a lot of money, a few dollars in fees here and there may not be a big deal, but for the average entry-level college grad, they add up fast.

Therefore, I was somewhat surprised by what we found.

Only 24% of Millennials account for this group, and generally, this group is more likely to be over 55 years old. They are also more likely to be men, home renters, and are more likely do their shopping online.

I have to wonder, are incentives blinding other Millennials from the prominence and danger of fees and penalties? Then again, perhaps they’re just more responsible with their money, and therefore don’t have to worry about them.

Credit Limit

Credit limit, for those who are unaware, refers to the maximum spending a person can use on a credit card. If you have a $5,000 credit limit and have already spent $4,500, you can say goodbye to that Gucci suit you wanted until it’s paid off.

Though credit limits are widely discussed, and affect those both rich and poor, a feeble 4% care most about it when choosing a credit card.

This group is almost evenly split between men and women, with 24% between the ages of 35 and 44, followed by those over 65, who make up 22%. This is also the second largest group of Millennials, at 27%. This makes sense as entry-level Millennials typically make less money than those with more experience, and are in the process of building credit. Therefore, they need to be more intentional about their credit limit.

Lastly, 53% of this group is Republican, which is the largest of all of the other groups.

Other

24% of people responded that they either care about something other than the 4 choices above, or do not have a credit card. From the data, it seems more likely that the majority of these people do not have a credit card.

This group has the highest percentage of Millennials (44%) out of all the other groups. They are more likely to favor restaurants with lower prices, and they’re also price-conscious when shopping in general. Lastly, they are also more likely to be Democrats.

It turns out that there may be a great deal of truth to the notion that Millennials are spooked by credit cards.

Write Me a Check and Let’s Call it a Day

Though credit cards may seem mundane, they’re a big deal. What you do with your money affects so many different dimensions of your life, so choosing which credit card will best suit you is not an easy decision. As we can see, there is no unanimous say on what is most important when choosing a credit card.

Credit card companies and financial institutions need to take this polarity into account, and understand the profiles of their potential and current costumers.

For those credit cards that rely on incentives, they may want to highlight their travel points to capitalize on the large Millennial group. For those that highlight their low interest rates, they may want to appeal to customers through NFL advertising.

There is no one-size-fits-all profile of a credit card consumer. Seeing them – rather, us – in different ways may help credit card companies and consumers build more sustainable, effective, and trusting relationships with each other.