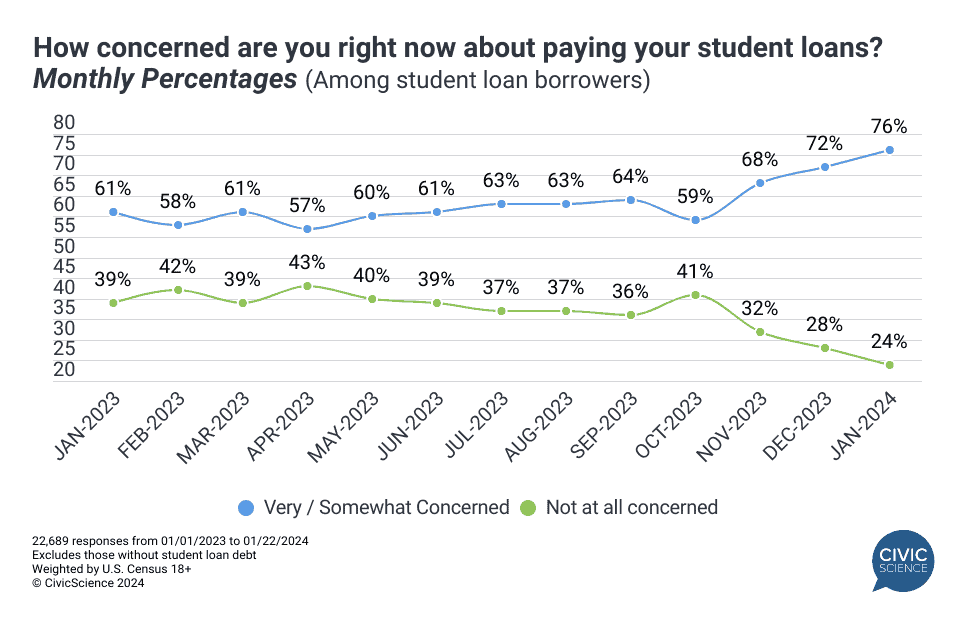

Now that student loan repayments have resumed after years of pause during the COVID-19 pandemic, so too has concern over being able to pay back the loans. Ongoing CivicScience data tracking show that the percentage of borrowers who feel ‘somewhat’ to ‘very’ concerned about paying student loans has risen rapidly since October (when repayment was reinstated), climbing month-over-month.

As of January, more than three-fourths of borrowers have expressed concern over loan repayment, while those who are ‘not at all’ concerned fell to an all-time low of 24%.

Join the Conversation: What type of debt hinders you the most?

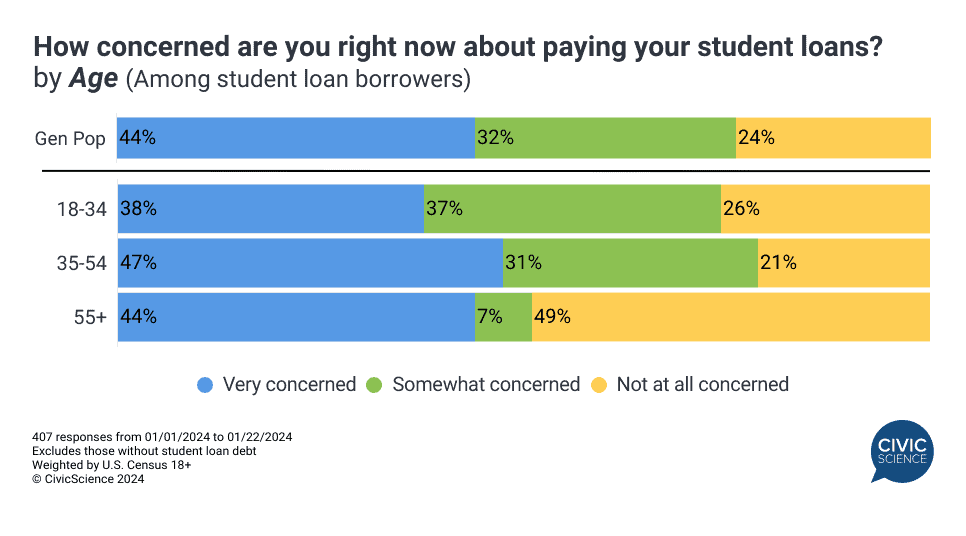

Concern over paying student loans varies across borrowers. Women, homeowners, and people who live in cities all show higher levels of concern than their counterparts.

When it comes to age, Gen Z adults aged 18-24 and young Millennials aged 25-34 express very similar levels of concern. However, older Millennials aged 35-44 and Gen Xers aged 44-54 harbor the most concern out of any age group about paying back loans.

The ‘Cost’ of Student Loan Debt

Concern over paying back student loans correlates strongly with other financial concerns and personal financial outlook. For example, CivicScience data show that 48% of borrowers who are ‘very’ concerned about paying back loans expect to have ‘significantly more’ debt six months from now, versus just 9% of average U.S. adults (based on data from December/January).

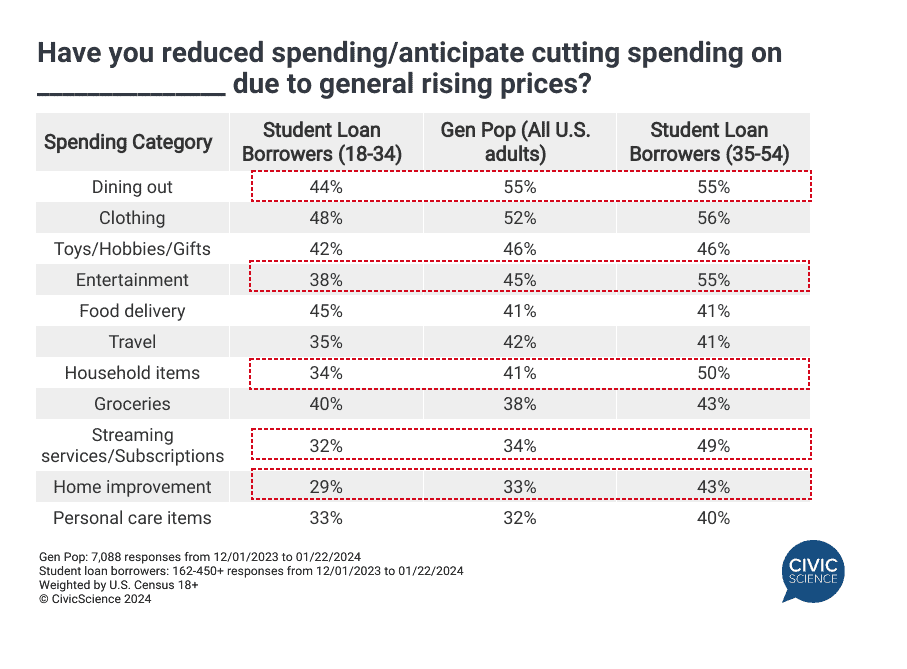

Student loan debt compounded with other financial concerns is bound to have an economic impact, as borrowers pull back on spending and make trade-offs to meet payment expectations. Which areas are the most likely to be affected?

CivicScience tracking compared how borrowers across different age categories are cutting costs on goods and services, or intend to do so. In general, borrowers in the 18-34 age range are less likely than borrowers aged 35-54 to reduce spending. Dining out, entertainment, home improvement, household items, and streaming services/subscriptions are categories where older borrowers are significantly more likely than younger borrowers to cut spending. Food delivery is the one area where younger borrowers are more likely than older borrowers to cut back.

These are only some ways that student loan debt is impacting spending. Previous data has shown how student loans are also stalling major life decisions, such as purchasing a home and starting a family.

Take Our Poll: Do you closely track your spending habits?

Looking for more insights about how student loan debt is impacting your industry, including access to more than 600K questions available in the CivicScience InsightStore™? Get in touch.