CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

CivicScience continuously tracks consumers’ intent to switch products or services, including insurance and banks, as well as cable and phone service providers. One category studied that continues to report higher switching intent – especially among younger consumers – is auto insurance.

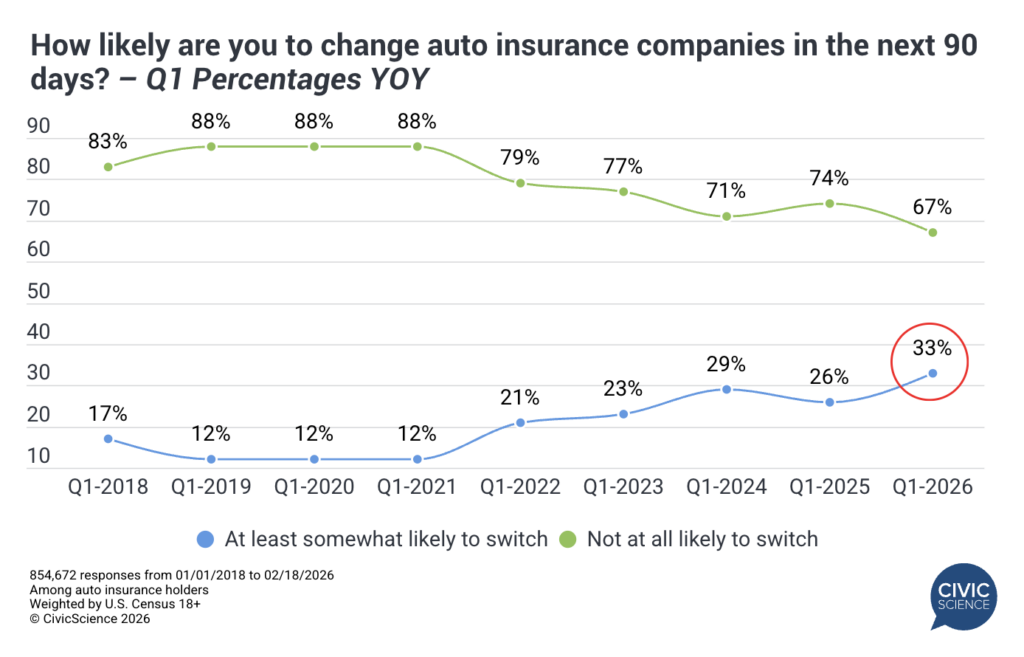

So far in 2026, one-third (33%) of auto insurance holders say they are likely to switch providers in the next 90 days. This includes 11% who are ‘very’ likely and 22% who are ‘somewhat’ likely to switch. It also marks a seven-point increase from Q1 2025 and represents the highest year-to-date switching intent since Q1 2018.

Notably, a majority (56%) of insurance holders aged 18-29 report they are at least ‘somewhat’ likely to change auto insurance providers in the next 90 days, with reported interest in switching decreasing with age.

Churn Isn’t Limited to Unhappy Customers

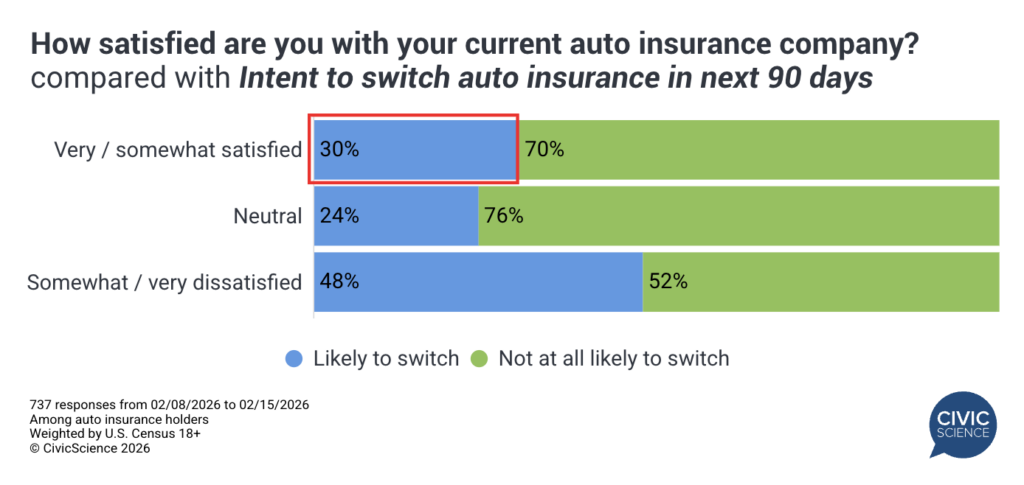

Dissatisfaction isn’t the only driver of churn. In fact, notable portions of the ‘safe’ segments are at risk: 30% of satisfied policyholders and 24% of neutral ones intend to switch within the next 90 days.

Cost is likely the primary driver behind this behavior. Two-thirds (66%) of auto insurance holders rank price or affordability as the most important factor when choosing a provider, outpacing every other consideration studied by at least 20 percentage points. Coverage options follow at 45%, with customer experience (38%), and company reputation and trust (37%) close behind. Member benefits (24%), recommendations from others (9%), and digital tools or mobile app experience (3%) rank lower.

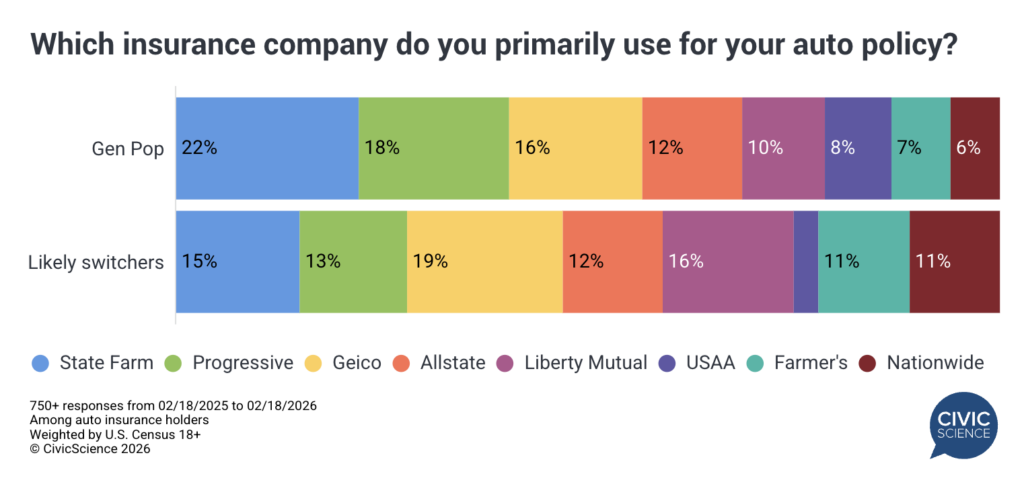

Market Share Is Up for Grabs

What Intended Auto Insurance Switchers Tell Us

CivicScience enables brands to precisely identify and reach consumers who are ready to switch or convert. Here’s an example of our capabilities through the lens of auto insurance switchers, compared to non-switchers (among those who currently hold insurance):

- They are serial switchers: More likely to switch in other areas of their lives, such as switching banks and health insurance companies. They also lead the way in cutting the cord on cable TV and moving to streaming-only.

- They are financially stressed but forward-looking: While managing household expenses and debt remain their top financial stressors, they are nearly 3X as likely to cite improving their credit score as their biggest financial concern. Even so, they are more optimistic than non-switchers about their financial outlook over the next six months.

- They are digitally influenced decision-makers: While recommendations and reviews remain the top purchase driver among the average consumer overall, auto insurance switchers are far less likely to rely on them. Instead, they over-index on online ads, social media advertising, and email promotions to drive their final decisions.

- They are active auto consumers: More likely to report interest in buying or leasing a vehicle within the last 365 days, and among car buyers, nearly 2X as likely to prioritize safety as the most important factor when buying a car (though quality/reliability and price remain the top overall drivers among all consumers).

Auto insurance switching intent has reached new levels so far in 2026, particularly among younger consumers, signaling a market where loyalty is increasingly fluid. With price driving decisions and even satisfied customers open to change, competitive pressure is unlikely to ease. For auto insurers, winning in this environment will require clear value and targeted digital engagement focused on what matters most to consumers considering switching auto insurance.

CivicScience tracks switching intent insights like these across a wide range of industries, helping brands understand where loyalty is strengthening and how to reach ready-to-convert audiences.