This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

In July, CivicScience data showed that 43% of U.S. adults planned to cut back on travel spending.1 That was up from 40% the previous July. With budget top of mind, what are Americans doing to reduce travel costs, particularly air travel costs? CivicScience data detail three macrotrends shaping the travel industry.

Price-Conscious Travelers Seek Third-Party Booking Sites

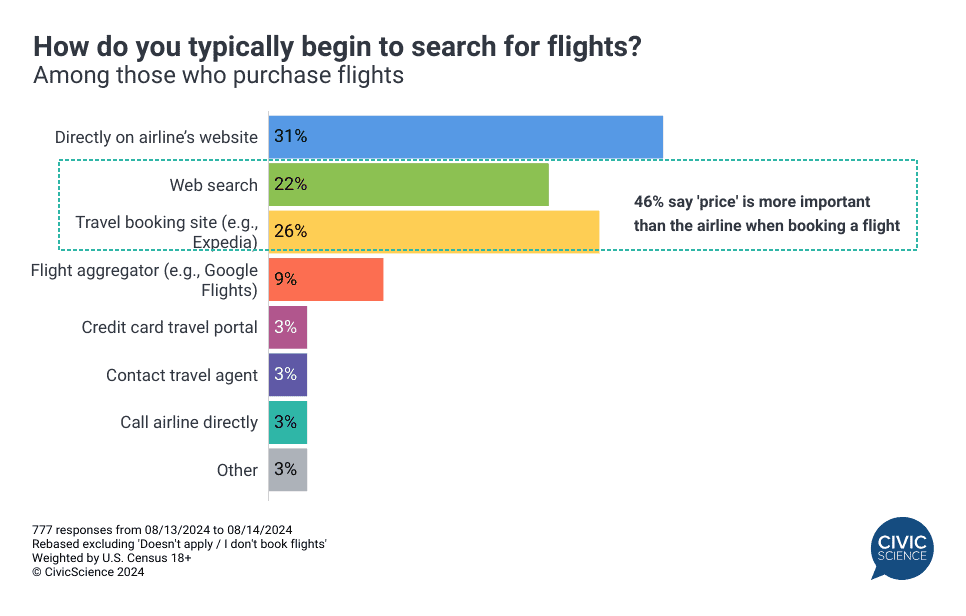

When it comes to purchasing airfare, price is of utmost importance. When asked what is more important when booking a flight – the airline or price – just 12% of respondents who purchase flights reported ‘the airline’ compared to 37% who said ‘price.’ For a slim majority (51%), both the airline and the price of the flight were equally important.2

So, it’s not surprising that the majority of flight-purchasing consumers start their search for a flight either by doing a general web search (22%), using a travel booking site such as Expedia or Booking.com (26%), or comparing prices on a flight aggregator site such as Google Flights or Skyscanner (9%). Less than a third go directly to an airline’s website – and believe it or not, a small percentage (3%) still call the airline to make reservations.

People who start with a web search or a travel booking site are the most price-minded flyers, as nearly half say that price alone is the deciding factor when purchasing a flight.

Join the Conversation: When planning a vacation do you use discount websites when booking airfare, hotel rooms, or car rentals?

Top Sites for Flights – Expedia Leads

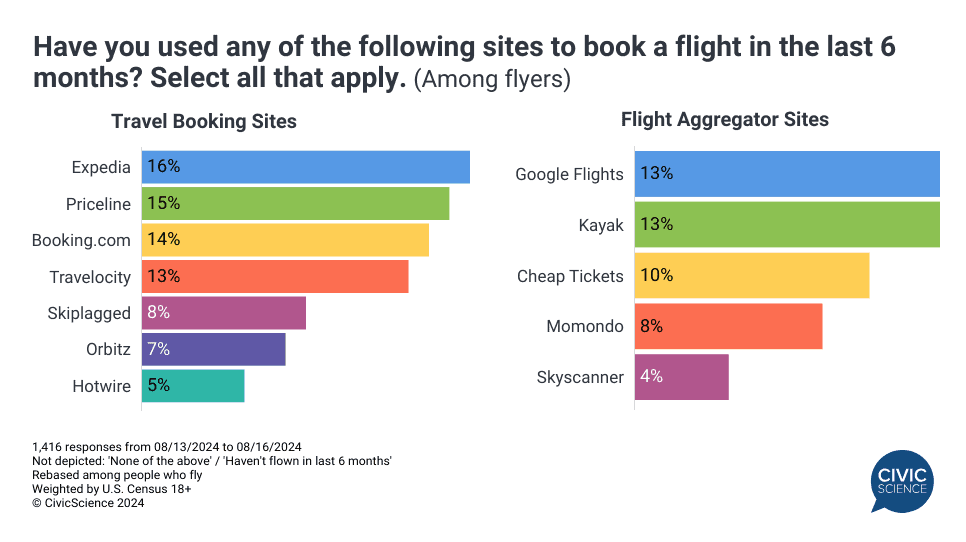

Consumers have a wide and ever-growing array of options when it comes to searching for the best fare. Travel booking sites are one, where users book directly through the site and can include add-ons such as hotels and rental cars.

In a poll of seven high-profile – and some less popular – online travel booking companies, Expedia emerged as the top site among recent flyers. Priceline, Booking.com, and Travelocity are also among the top picks. The lesser-known site Skiplagged, which offers workarounds to help customers get the cheapest flight (much to the dismay of some major airlines), pools 8% of recent flyers, but that increases to 17% of flyers under age 35.

Travel booking sites have been around for years – William Shatner started doing ads for Priceline in 1998. So have flight aggregator sites, such as Kayak, which find the cheapest flights and pass users through to airlines’ websites. Today, Google Flights and Kayak are the leaders in that category among recent flyers, while Skyscanner is the least used.

Take Our Poll: How likely, if at all, is it that you will use a third-party travel website to book a flight in the future?

Discount Airlines Gain Airspace

Discount airlines are making their mark on the industry. In a look at some of the top players in the “discount” category, Southwest is the unsurprising leader – 71% of flyers have used the airline at some point, and 54% will likely use it again. Frontier and Spirit have each attracted around two out of five flyers, but these airlines also have the highest percentages of dissatisfied customers. Newcomer Breeze Airways, although the least used, seems to have performed reasonably well among customers who have tried it.

Today’s competition for travelers is fierce – and complicated – with airlines, booking sites, and other industry players all vying to get ahead. While the data show consumers’ habits are extremely diverse when it comes to purchasing flights, it’s clear that they lead with price, and many rely on internet searches and third-party providers, as well as discount airlines, to get to where they want to go. Expect these trends to be at play in the upcoming 2024 holiday travel season.