It’s estimated that online holiday spending grew to a record high of $221 billion for the 2023 season. Adobe Analytics notes that buy now, pay later (BNPL) played a significant role in that total, contributing $16.6 billion in online spending during November and December – up 14% from the previous holiday season. Yet now that the flurry of spending has subsided, concerns are growing as to whether or not these users will be able to make their BNPL payments.

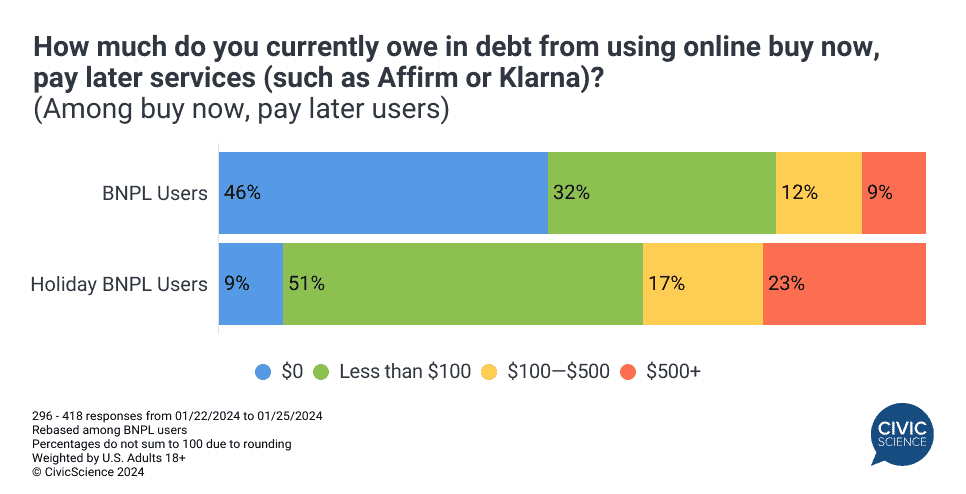

CivicScience data find that 9% of all U.S. adults who made holiday purchases say they used BNPL as one method to finance their holiday purchases this past season (50% used credit cards). January findings show that the majority of these holiday BNPL users currently owe payments on their BNPL purchases (whether made previously, during, or after the holidays). A look at their debt load shows:

- More than 1-in-2 owe less than $100, but 40% owe more than $100;

- A notable 23% have more than $500 in BNPL debt;

- The majority of all BNPL users have BNPL debt (53%), but those who used BNPL to make holiday purchases are significantly more likely than the average user to be carrying a balance.

Join the Conversation: How likely are you to use a “buy now, pay later” service?

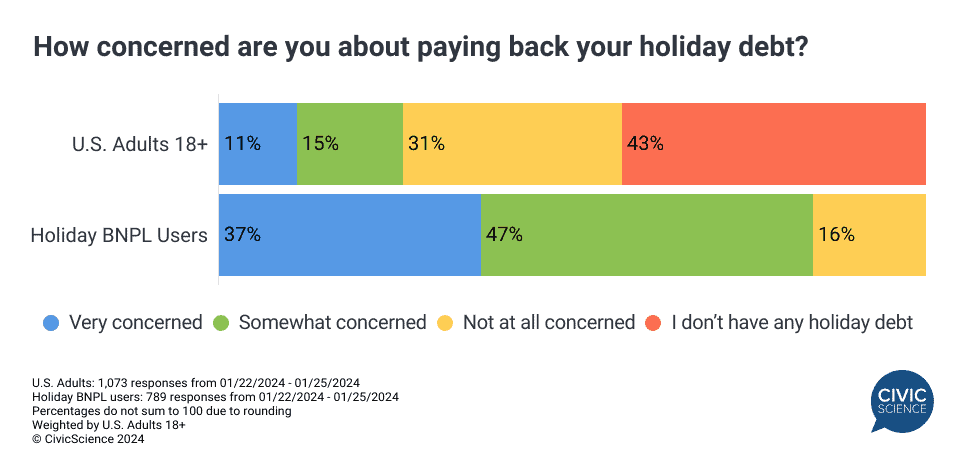

Many Are Worried About Paying Down Their Holiday Debt

How is debt impacting those who made BNPL holiday purchases in 2023? First off, these users express high levels of concern about their holiday-related debt in particular. Not only do holiday BNPL users say they have some form of holiday debt, a total of 84% are at least ‘somewhat concerned’ about being able to pay it back, compared to 26% of the total U.S. adult population. More than 1-in-3 say they are ‘very concerned.’

A Vicious Cycle

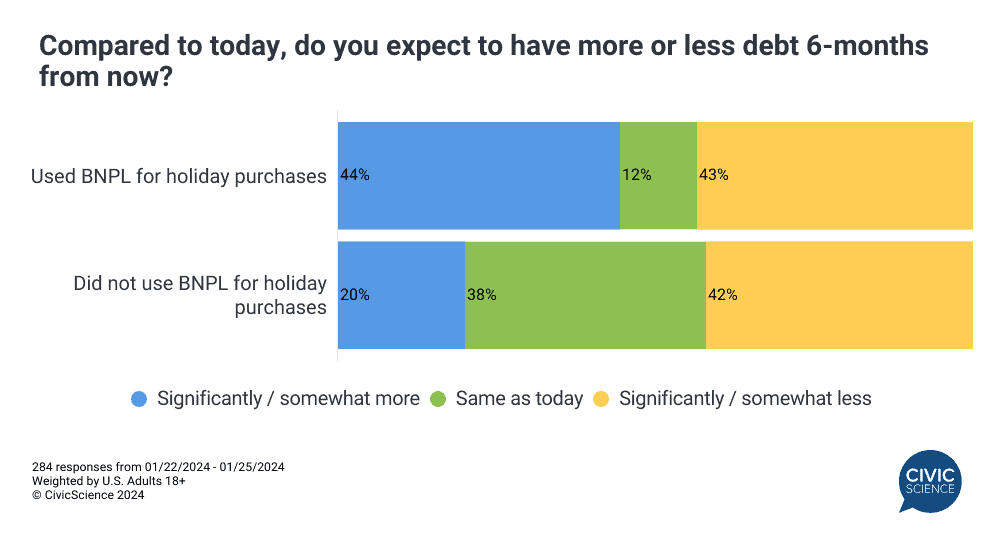

Additionally, consumers who used BNPL to make holiday purchases in 2023 are far more likely than non-users to expect to be in even greater debt in the next six months – 44% foresee acquiring at least ‘somewhat’ more debt, compared to just 20% of those who did not use BNPL services to finance their purchases. In fact, ongoing CivicScience consumer financial health tracking shows that just about 20% of all U.S. adults expect more debt in the months ahead, highlighting the extreme difference between these BNPL users and the general population.

Expectations for increased debt don’t necessarily paint a rosy picture for this segment of BNPL users, bringing into question how likely BNPL users are to default on their payments. Default rates among BNPL users are not widely known – contributing to what’s termed the “phantom debt phenomenon” – but a study from the Consumer Financial Protection Bureau indicates that BNPL users are more likely to default on other credit products, such as mortgages and car loans.

CivicScience has a close pulse on buy now, pay later trends and their impact on consumers and the economy. Get in touch to learn more about how to leverage more than 600K questions available in the CivicScience InsightStore™.

Take Our Poll: Do you think “buy now, pay later” services are generally positive or negative?