The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

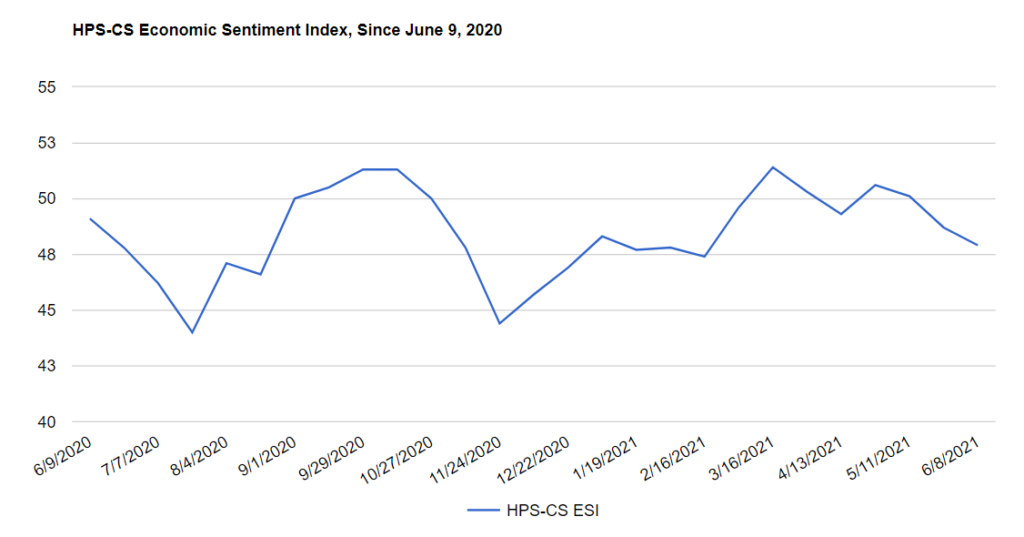

Economic sentiment fell for the third straight reading over the last two weeks, according to the HPS-CivicScience Economic Sentiment Index (ESI), dropping 0.8 points to 47.9. Job market confidence tempered its record-breaking surge while confidence in the housing market continued to sink, setting a new all-time low for the third straight reading with a decline of 3.3 points to 32.5. Confidence in the housing market has now fallen 18.7 points from its 2021 high.

Consumers continue to hold mixed feelings about the state of the U.S. economy and their personal financial positions. Despite the May jobs report showing the U.S. economy added 559,000 people to payrolls, wage growth data is still muddied and home prices continue to increase for a range of reasons. Confidence in the U.S. economy was the sole indicator to rise over the past two weeks, increasing 2.6 points to 52.0, far below its March high of 56.6. The rest of the indicators declined:

- Confidence in the housing market fell 3.3 points to 32.5, a record low.

- Consumer confidence in the job market fell 1.8 points to 58.7. It’s the first decline since April, but still 19.0 points higher than sentiment in January.

- Confidence in personal finances fell 0.8 points to 56.8.

- Confidence in making a major purchase sank 0.7 points to 39.3, its lowest level since May 2020.