This is just a tiny glimpse of the data available to CivicScience clients. Discover more data.

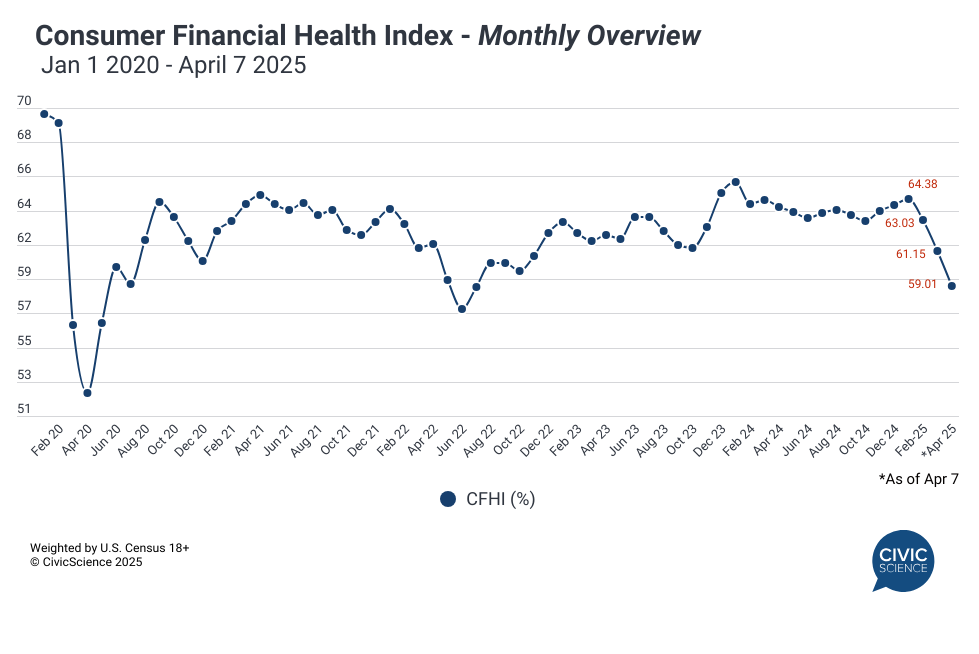

With new tariffs hitting the global trade market and shocking the U.S. economy into a deep dive, measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI) has a pulse on how U.S. consumers expect their personal financial situations to change in the next six months. Here’s what the latest data show:

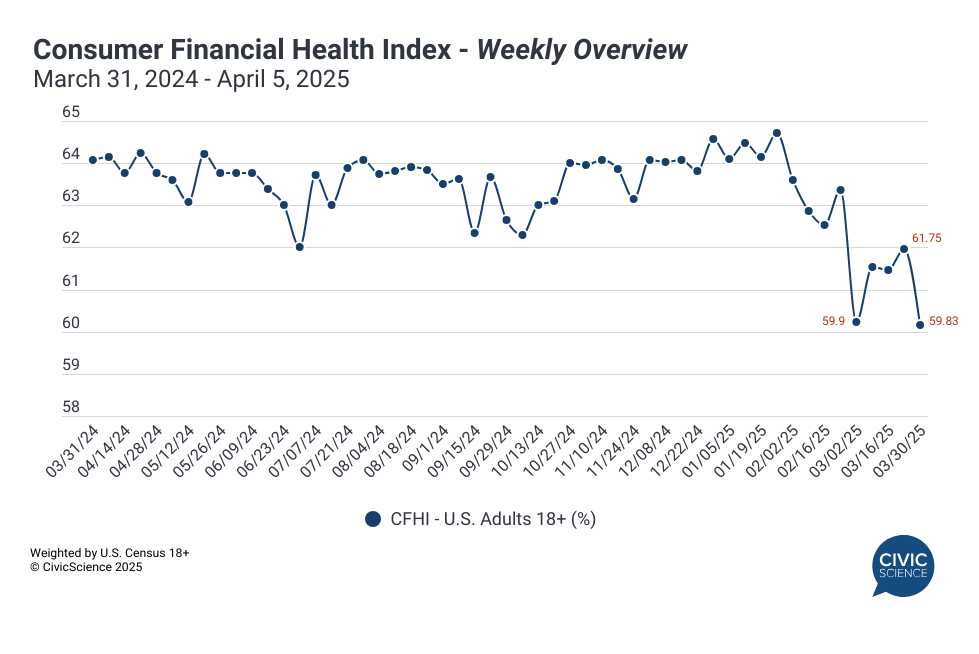

The personal outlook of Americans’ consumer financial health has seen significant fluctuations in recent months, with particularly dramatic swings in the last month alone. After a significant drop of 3.35 points into the first week of March, sentiments briefly recovered through mid-March before retreating to 59.83 in the final week of March and the first days of April with a fall of 1.92 points.

Take Our Poll: How’s your financial health?

A month-by-month look at the data reveals April begins with a continuation of the decline that’s been ongoing throughout 2025 – the CFHI has now fallen by more than five percentage points (5.37) since reaching a year-high in January. The monthly index now sits at its lowest level (59.01) since June 2022 when it sat at 57.57.

Let us Know: How confident are you in the current state of your finances?

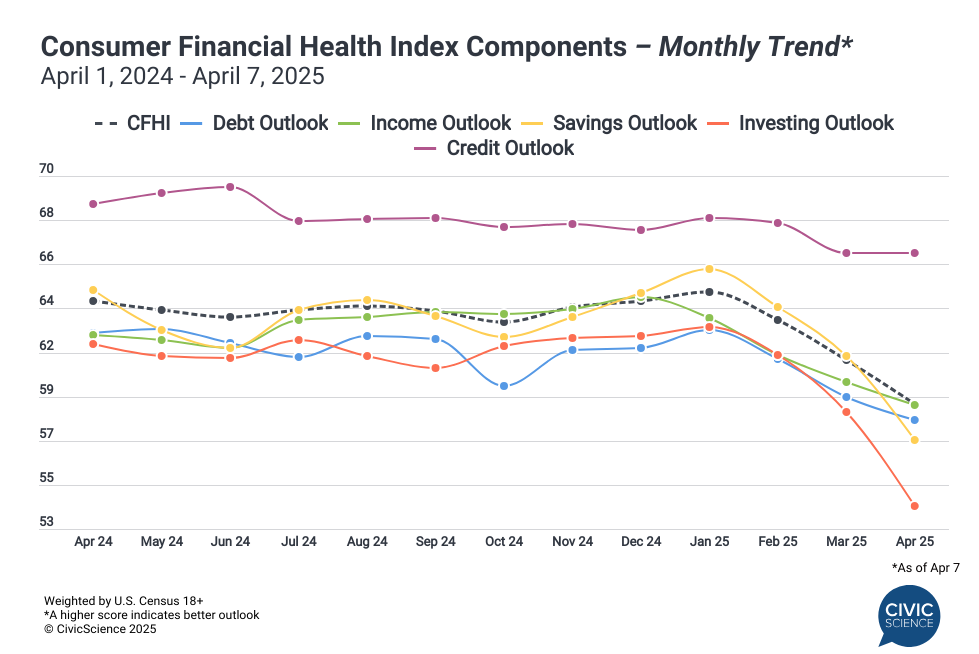

An examination of the index’s individual components finds consumer outlook on investments and savings in the next six months are the biggest factors in driving the CFHI’s decline through April 7. Since January, data show that consumer investment outlook has fallen by 8.58 percentage points, while savings outlook fell 8.23 points over the same time period. The one outlook consumers are feeling notably less bleak about is their credit outlook, which has only dropped 1.67 points from January, preserving its place as the primary component propping up the overall index.

Use this Data: CivicScience clients leverage real-time insights like these to predict consumer behavior changes, stay ahead of market disruptions, and identify opportunities for growth and retention, even as economic conditions shift rapidly.

With tariffs rattling the economy, consumer confidence is quickly eroding—especially around investing and saving. This tariff-driven environment of uncertainty is already shaping consumer behavior, and if expenses continue to rise, many may have to adopt even more cautious spending habits and dip into their savings. With credit outlooks holding steadier, consumers may consider leaning on credit as a short-term cushion amid tightening budgets.