This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI) has a pulse on how U.S. consumers expect their personal financial situation to change in the next six months. Here’s what the latest data show:

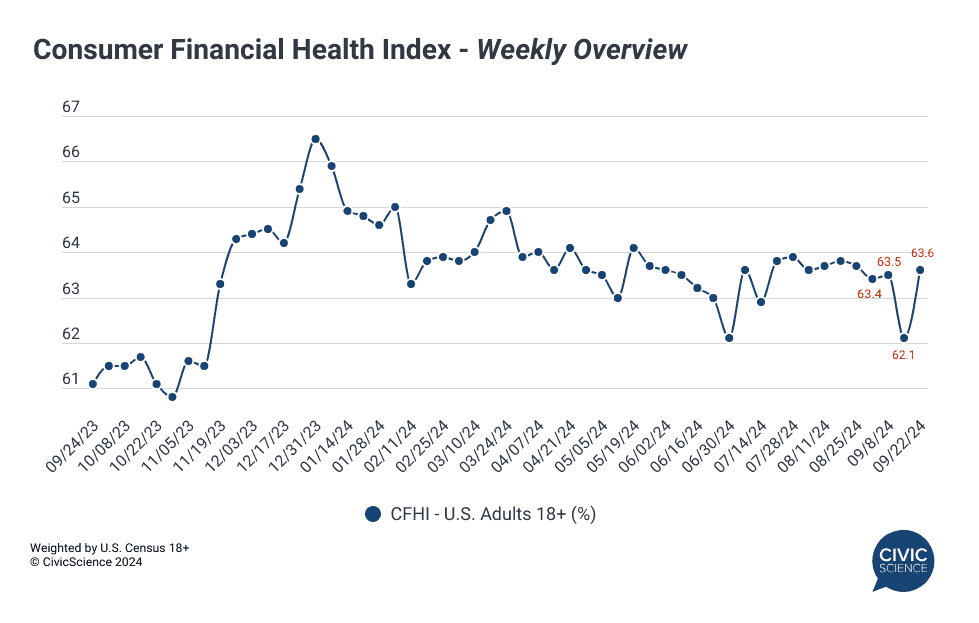

After a remarkably stable run in August, the CFHI experienced a major dip in consumer outlook mid-September. Consumers reported a decline of 1.4 points, a low not seen since the start of July, before rebounding the following week. The swing occurred the same week as the Federal Reserve’s interest rate cut (the week of September 15), suggesting consumers initially responded more negatively than positively to the cut. Additional CivicScience data collected following the announcement of the rate cut found that 21% of U.S. adults reported they felt ‘worse’ about their personal finances, compared to 16% who felt ‘better.’

Take Our Poll: To what extent do you agree or disagree that your current spending habits match your long-term financial goals?

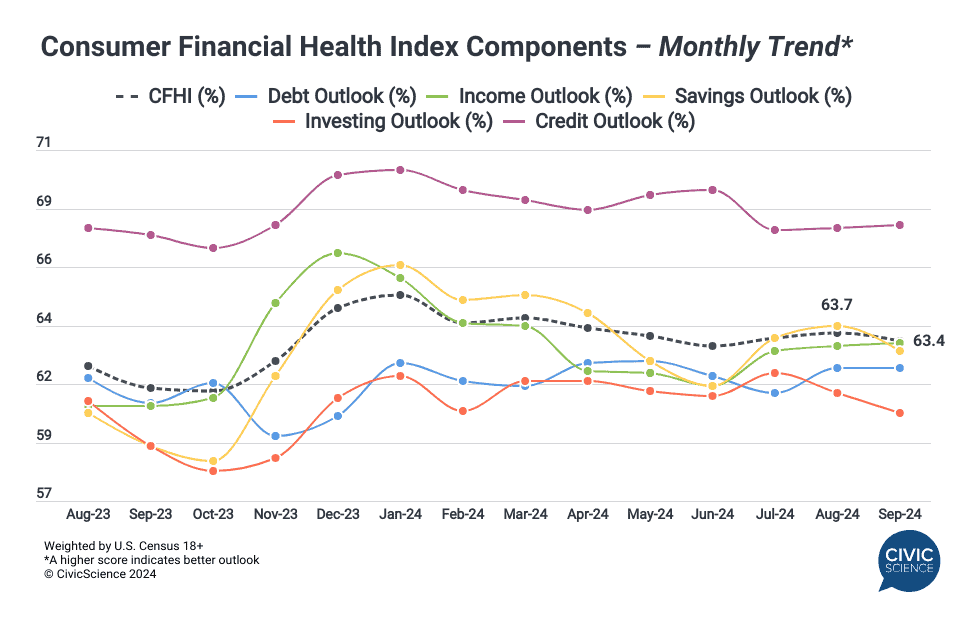

A look at the running monthly average shows that financial health decreased slightly from August to September, falling 0.3 points to 63.4%.

Consumers reported poorer short-term (6-month) outlook on their savings and investments, which could reflect concern over reduced interest rates. Monthly savings outlook declined close to one point while investment outlook fell 0.7 points.

On the other hand, debt and credit outlook remained stable month to month, while income outlook saw a 0.3-point increase.

Weigh In: How confident are you in the current state of your finances?

Year-over-year, financial health as measured by the index is up compared to a year ago, which has been largely fueled by increased optimism around savings and income. The data suggest this could change as consumers respond to economic and political conditions, including future interest rate cuts, a shifting labor market, and the 2024 presidential election.

Learn more about the CFHI here.