This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI) has a pulse on how U.S. consumers expect their personal financial situation to change in the next six months. Here’s what the latest data show:

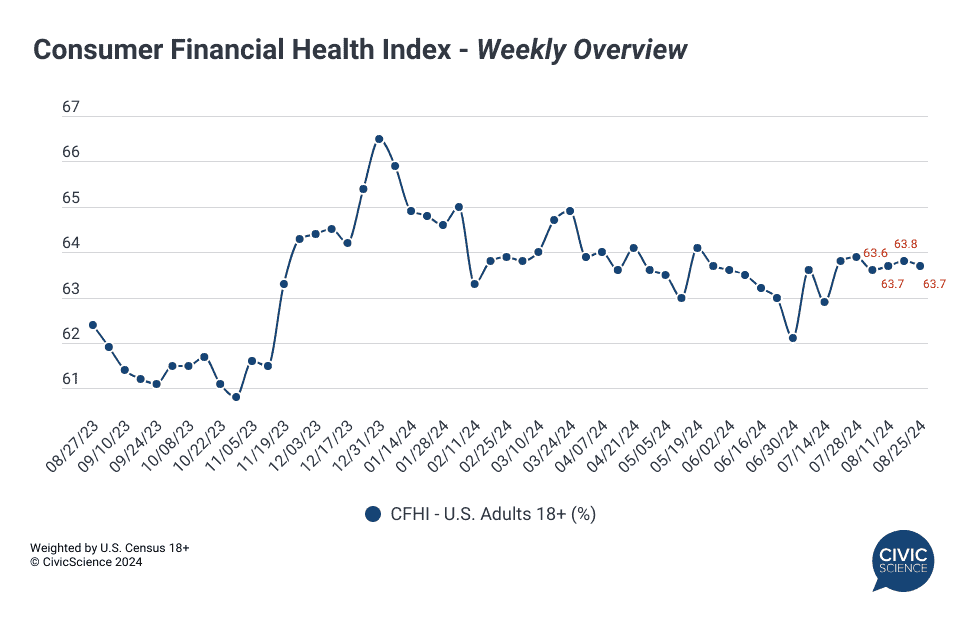

After months of weekly fluctuations, financial outlook slowed to a stable period in August. Consumers reported minimal changes in expectations for their financial situation from one week to the next. Overall, financial health as measured by the index is well above where it was this time last year, which should be a positive indicator heading into the holiday season.

Take Our Poll: How confident are you in the current state of your financial health?

A look at the running monthly average shows that financial health continued to improve from July to August, reaching 63.7% for the month and marking the highest score since April.

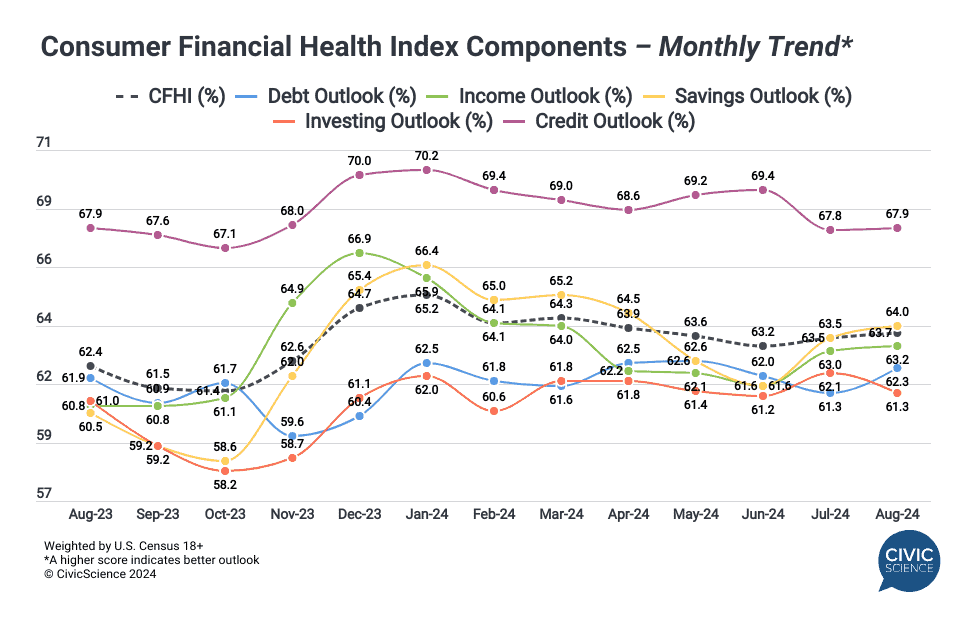

Consumers reported increased optimism about their short-term (6-month) outlook on savings, debt, credit score, and income. Debt outlook saw the strongest increase (up 1.0 points) from month to month, which could play out in how consumers plan to spend as the holiday shopping season nears. Perhaps the Federal Reserve’s plans to potentially lower interest rates has consumers feeling more confident.

Investing outlook was the one area that saw a decline in August.

Weigh In: Does thinking about personal finances make you anxious?

Additional data suggest that the political climate has a role to play as well. Democrats and Independents showed an increase in monthly financial health outlook, while Republicans showed a slight decline – trends that mirrored other CivicScience indexes in August, including the Well-Being Index which measures the collective emotional well-being of the nation.

Learn more about the CFHI here.