While most technology upgrades bi-annually, if not more, some items have been lagging behind.

Many of us have experienced credit card fraud. With recent hacks, customers and stores have been more cautious with transactions. When the EMV, or chip card, technology came to the US after years of use in Europe, you’d think we’d all embrace the safety features.

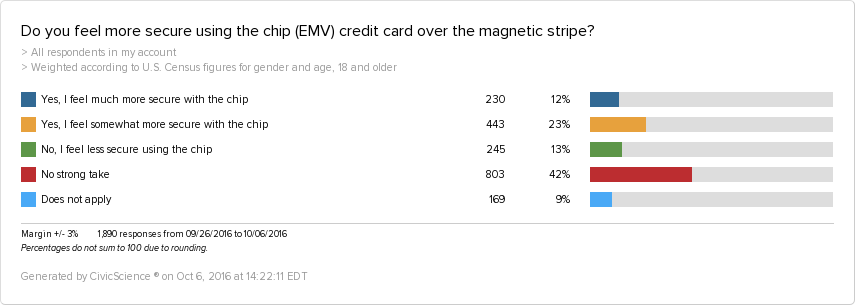

Let’s see how credit card users feel about the security of the EMV chip card:

42% of those asked responded “No strong take.” I find that disconcerting, considering debit card and credit card use make up 43% and 35% of all transactions, respectively. People who selected this response are more likely to be Twitter users but less likely to manage their money well.

I wonder if the “No strong take” mentality comes from the constant security breaches we experience. If groups are hacking into government files, what will keep them from getting credit cards, chip or no chip?

The most interesting insight comes from those who answered: “Yes, I feel much more secure using the chip.” This group is more likely to be 55+ and less likely to be 18-34.

I don’t think 18-34-year-olds would want a magnetic stripe back, but I believe they’re more skeptical about security when using their cards. But, it’s not hard to understand their cautious attitude. They are at a time in their lives when building credit is essential. Getting your card information stolen won’t help that process.

I’m surprised many have no feelings on this issue. I’m not surprised that a younger subset is more skeptical of this “secure” tech.