CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

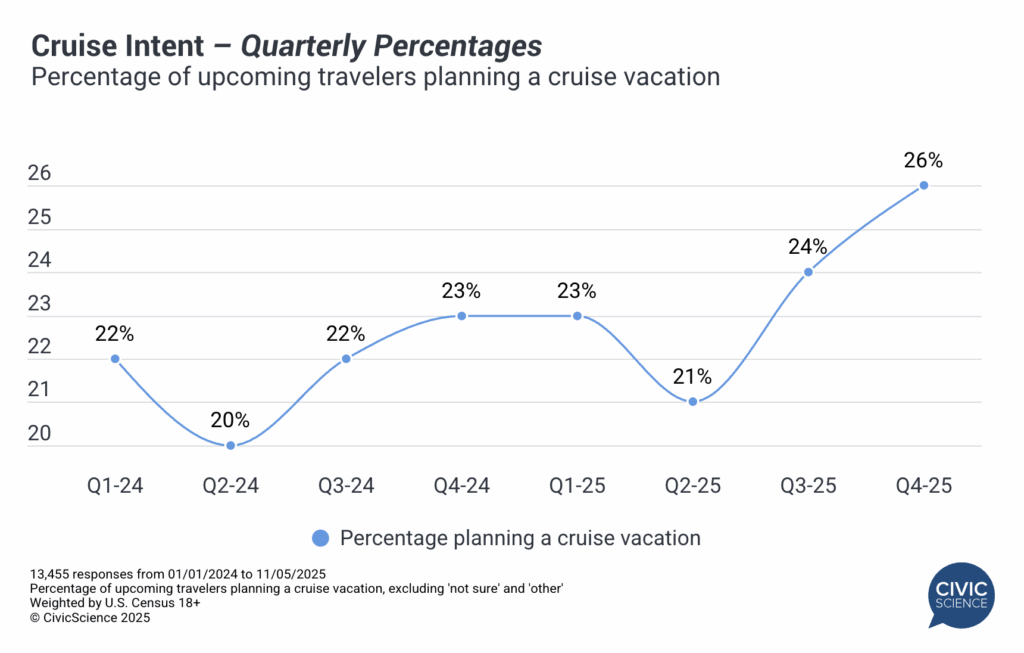

As Thanksgiving and the winter holidays approach, CivicScience data show that cruise vacations are gaining stronger consideration among U.S. travelers. Shifting emotional well-being remains a significant driver of travel planning and may be contributing to the rise in cruise intent. Recent findings indicate that 26% of upcoming travelers plan to take a cruise, marking the highest level of intent YTD. While beach, lake, and outdoor vacations remain the most popular overall, intent for these trip types has either declined or returned to previous levels compared to prior quarters.

As cruise intent rises, these shifts offer valuable insight into evolving traveler plans – and key opportunities for brands, advertisers, and media publishers to engage with this audience.

Answer our Poll: Would you consider going on a cruise in the near future?

Real-Time Insights Highlight What’s Driving Purchasing Decisions

Unlike data drawn from past bookings or purchases, CivicScience captures what consumers are thinking and planning right now. Through millions of daily, real-time responses directly from consumers, CivicScience reveals who these travelers are, what motivates their decisions, and how to reach them before they finalize their plans – turning evolving travel intent into actionable opportunities.

Here is a glimpse of the insights available, comparing intended cruise travelers to those not planning this type of trip:

Brand Affinity & Shopping Preferences: When it comes to purchasing decisions, cruise travelers tend to be driven by brand considerations. Compared to those not planning to go on a cruise, these travelers are 15 points more likely to prioritize brand and six points less likely to prioritize price. They’re also 20 points more likely to say they usually try new products before others do and nearly twice as likely to be ‘very’ open to trying newly launched brands. Additionally, 46% report using online review services, such as Yelp, at least once a week, highlighting their active engagement with brand research and discovery.

Finances: While price sensitivity varies among travelers, cruise intenders are 17 points more likely than non-cruisers to describe themselves as ‘less’ price sensitive over the past twelve months. However, that doesn’t mean they aren’t open to alternative payment methods – they’re 14 points more likely than non-cruise travelers to have experience using Buy Now, Pay Later services, and 7 points more likely to say they haven’t used them yet but plan to.

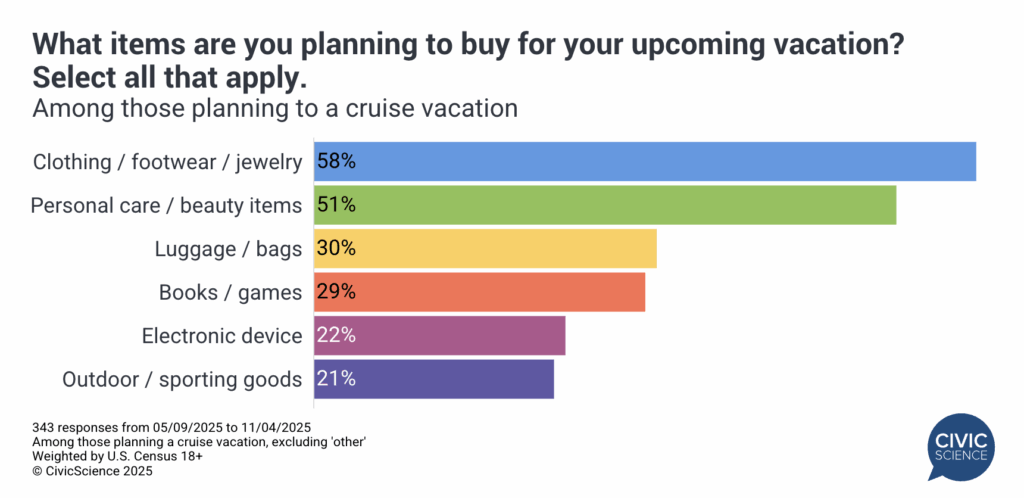

Travel-Related Shopping: Cruise intenders are also active retail consumers preparing for their trips. Nearly 60% plan to purchase clothing, footwear, or jewelry for upcoming travel, and just over half expect to buy personal care or beauty products. About 30% plan to purchase luggage or books, while roughly one in five anticipate outdoor gear or electronics (excluding ‘other’), highlighting strong spending intent among upcoming travelers.

Health & Wellness: Cruise intenders stand out for their engagement with health and weight management trends. They’re nearly twice as likely as those not going on a cruise to use GLP-1 medications for weight loss currently or to have used them in the past. They’re also nearly three times more likely to follow a paleo diet, seven points more likely to eat supplement bars daily, and 20 points more likely to drink juices, nutritional shakes, or smoothies daily. They are also more likely than non-cruise travelers to take vitamins daily.

Media & Entertainment: Cruise intenders demonstrate higher switching intent with media services. They’re roughly twice as likely to say they’re at least ‘somewhat’ likely to switch cable or satellite providers in the next 90 days (65% vs. 34%). They’re also more than twice as likely to go to the movies at least once a month.

Weigh In: What’s the best season to leave home and take a cruise on a cruise ship?

Targeting The Right Audience

Cruise travel intent is at its highest level year-to-date, marking a notable shift in how travelers plan their upcoming vacations. As this segment continues to grow, advertisers have a timely opportunity to better understand and connect with these consumers through their health and wellness habits, dining choices, shopping preferences, and other lifestyle factors. With CivicScience’s consumer-reported intent data, brands can find and engage the right consumers at the right time, on the right channels.