The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

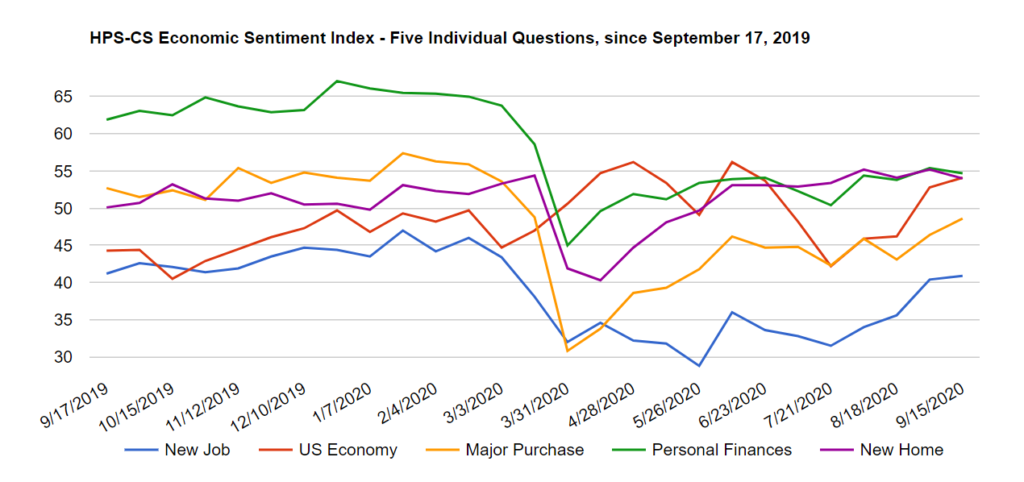

Economic sentiment posted a modest increase over the past two weeks, following a significant spike in late August. The HPS-CivicScience Economic Sentiment Index (ESI) inched upwards by 0.5 points to 50.5, driven largely by a boost in confidence in making a major purchase.

The ESI’s five indicators posted somewhat differing results over the past two weeks. The biggest gain was in confidence in making a major purchase, which rose 2.2 points to 48.6. Also rising were confidence in the overall US economy (up 1.3 points to 54.1) and confidence in finding a new job (up 0.5 points to 40.9). Weighing the index down were slight declines in the ESI’s two other indicators: confidence in the housing market decreased by 1.2 points to 54.0, while confidence in personal finances declined 0.7 points to 54.7.

The slight uptick in sentiment comes on the heels of mixed economic news. August’s strong jobs data, released on September 4, showed the addition of 1.4 million jobs and a decline in the US unemployment rate to 8.4% from 10.2% in July. Overall US COVID-19 infection rates continue to drop from their summer peak. Stocks, however, were erratic over the two-week period. After the best August since 1986, stocks posted declines in the first weeks of September; the Nasdaq, for example, fell 4.1 percent between September 4 and September 11, its worst week since March. The housing market, meanwhile, faces pressures from record-high lumber prices, which are adding $16,000 on average to the price of a new home, according to the National Association of Home Builders.