The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

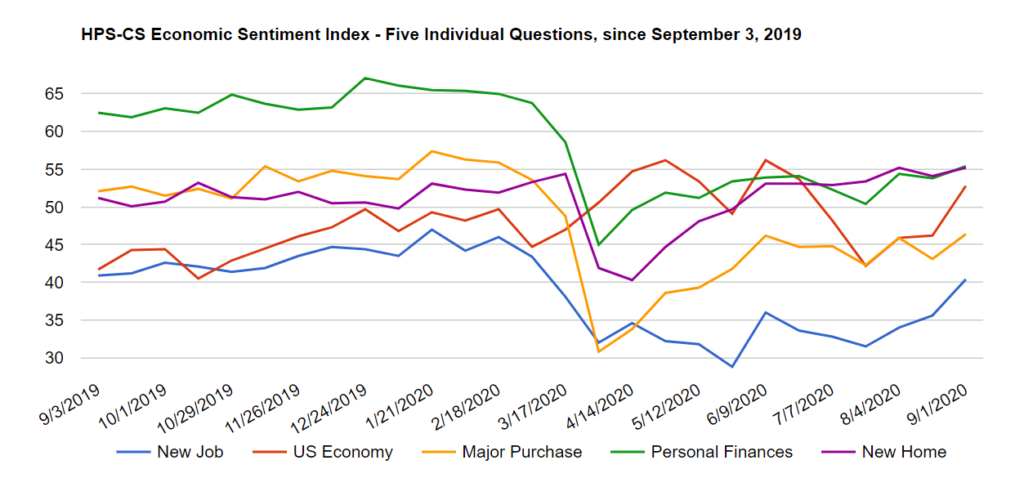

After several months of fluctuations, economic sentiment saw a significant improvement over the past two weeks, climbing back to early March levels when the economy began to shut down due to the COVID-19 pandemic. The HPS-CivicScience Economic Sentiment Index (ESI) jumped by 3.4 points to reach 50.0, driven by an even larger increase in confidence in the broader U.S. economy and labor market.

All five of the ESI’s indicators improved over the past two weeks. Confidence in the broader U.S. economy led the way with a 6.6-point jump to 52.8. Consumer sentiment towards the labor market followed closely behind, with an increase of 4.8 points to 40.4. Confidence in making a major purchase neared its late-March 2020 level, climbing 3.3 points to hit 46.4. With smaller improvements, confidence in personal finances and the housing market rose by 1.6 and 1.1. points, respectively. Unlike the other indicators, however, confidence in personal finances and the labor market have yet to reach their pre-pandemic levels.

The upturn in sentiment comes after a busy month and some shifts in economic indicators. While Americans are seeing an overall decline in new COVID-19 cases nationwide and businesses begin to reopen, many Midwestern states are seeing a large spike in cases. August also brought an incredibly strong stock market, with the S&P 500 scoring its best August since 1986. Despite many Americans’ attention shifting this month toward the future due to presidential conventions and the upcoming election, experts remain worried about the uneven economic recovery occurring in the U.S. due to varied state responses and setbacks with the pandemic.