The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

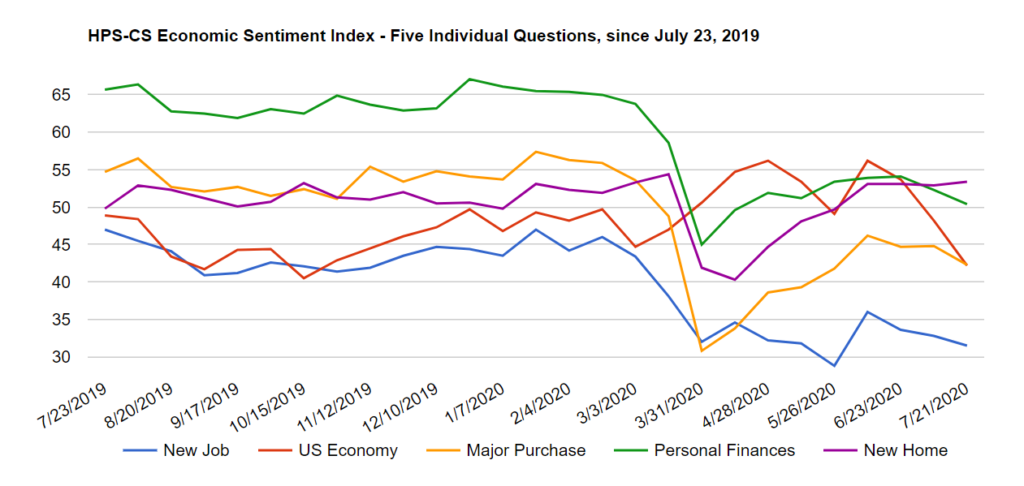

Economic sentiment continues to drop as U.S. COVID-19 cases keep rising and states reimpose restrictions. The HPS-CivicScience Economic Sentiment Index (ESI) declined for the third consecutive reading, dropping 2.2 points to 44.0. The index now stands at its lowest level since mid-April, when the country faced the initial spike in U.S. COVID-19 infections and accompanying lockdowns.

Four of the ESI’s five indicators declined over the past two weeks. Confidence in the broader U.S. economy fell 6.0 points to 42.2, its lowest reading during 2020, and has now dropped a total of 14.0 points since early June. Also falling were confidence in making a major purchase (down 2.5 points to 42.3), confidence in personal finances (down 1.9 points to 50.4), and confidence in the job market (down 1.3 points to 31.5). Confidence in the job market is currently at its second-lowest reading in ESI history, following its all-time low in May 2020. The sole indicator to rise was confidence in the housing market, which posted a slight bump of 0.5 points and closed out the two-week period at 53.4.

The continued decline in confidence comes on the heels of an uncertain economic recovery. Retail sales jumped 7.5% in June after states lifted COVID-19-related restrictions, but plateaued late in the month as cases increased and some states reimposed restrictive measures. Texas, for example, ordered bars closed at the end of last month, while California added new restrictions to indoor dining. The rise in infections across the country has been coupled with a slowing of economic activity across the board. Average rates on long-term mortgages, meanwhile, have fallen to record lows. Freddie Mac reported that the average rate on a 30-year mortgage fell below 3.0% for the first time last week, to 2.98%.