The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

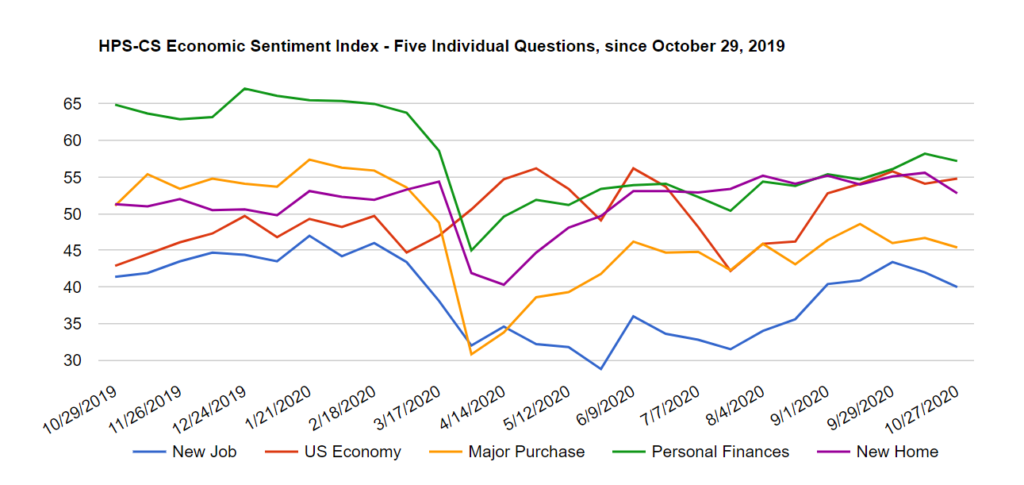

Consumer economic sentiment saw its first decline in over two months as the country experiences an uptick in new COVID-19 cases, averaging 71,000 new cases a day over the past week. The latest reading of the HPS-CivicScience Economic Sentiment Index (ESI) declined 1.3 points to 50.0, marking its first drop in confidence since August 18 and mirroring the month-long decline beginning in late June as the nation experienced a COVID “summer surge.”

The decline in confidence over the past two weeks comes as the rise in new virus cases has many experts concerned the country is entering a third wave of the COVID outbreak heading into the winter months, with states in the Midwest and Mountain West bearing the brunt of the increase. Congressional deadlock over a new round of stimulus funding and rising case levels are helping drive market uncertainty and inching the nation closer to the expiration of enhanced programs for unemployed workers in December.