CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

Getting in shape is always near the top of New Year’s resolution lists, and 2026 is no exception. With a renewed focus in the New Year comes shifts in workout routines, purchasing, and motivations. Notably, one of the most important trends to watch in the year ahead is the growing link between fitness and connection among a key segment of exercisers: Gen Z. For them especially, the desire for human interaction now extends well beyond ab workouts, as they increasingly see health and wellness as a social experience. Here’s what you need to know about 2026 fitness trends:

Workout Preferences Shift Toward Yoga, Fitness Subscriptions, and Classes

A survey of exercise routines reveals that cardio (32%) and strength training/weight lifting (28%) still play a leading role in regular exercise routines; however, interest in cross-training (up 3 percentage points to 11%), competitive sports (up 2 points to 11%), and yoga/Pilates seeing the largest increase of four points (from 13% to 17%).

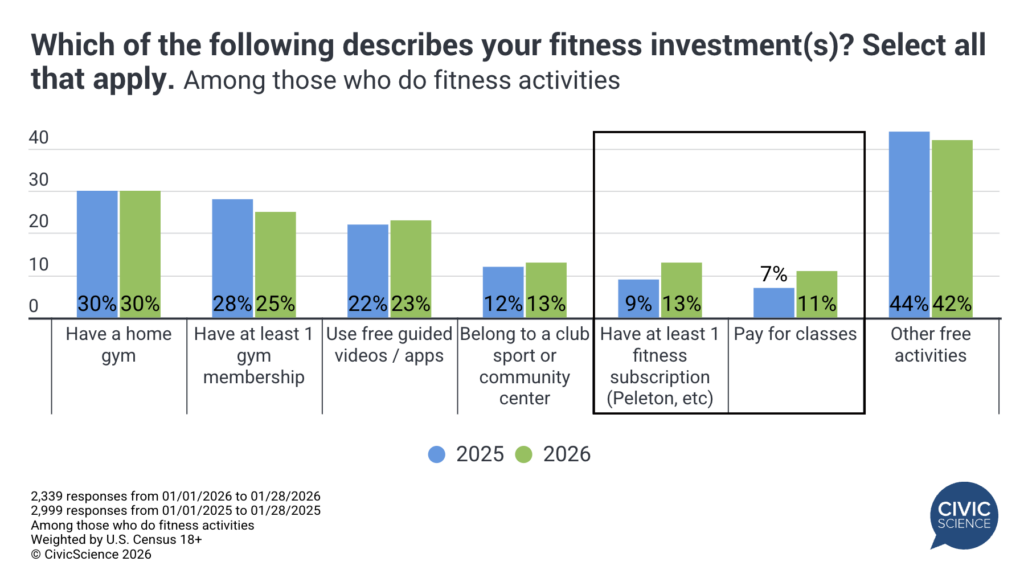

How consumers invest in fitness is also on the move. For instance, Americans who exercise are so far less invested in gym memberships than they were this time last year. Instead, more exercisers are paying for classes or have at least 1 fitness subscription, such as the Peloton app, Burn Boot Camp, or Daily Burn. Consumers are also slightly more invested in club sports or community centers this year.

Spending on Home Fitness Routines

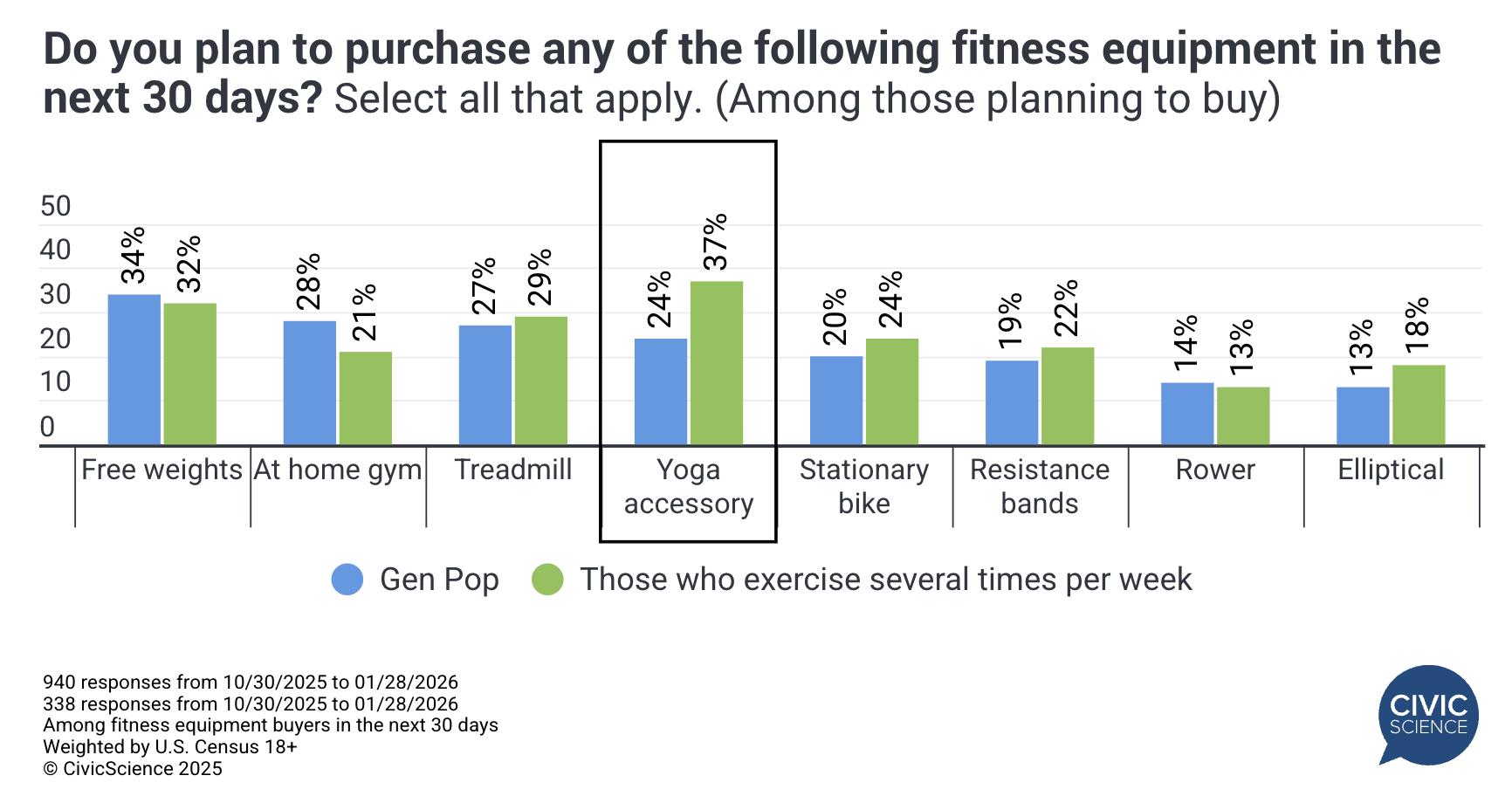

Coinciding with lower spending on gym memberships, about one-third of U.S. adults tell CivicScience they plan to buy fitness equipment in the near future. Free weights are the most likely item among these planned purchases, followed by treadmills, general home gym equipment, and yoga accessories.

Interestingly, those who work out most frequently (several times a week) over-index the Gen Pop in buying yoga accessories by 13 points, followed by ellipticals (+5 points ), and stationary bikes (+4 points), whereas the gap is narrower in other categories.

These near-term fitness equipment buyers represent a high-value segment – they’re nine points more likely than the Gen Pop to have ‘a lot’ of their paycheck leftover after paying bills. Consumer-reported data reveal that advertisers hoping to reach these equipment buyers should prioritize emotional messaging, as buyers are more than three times as likely as non-buyers to say emotional ads resonate most. Video is also critical for discovery: 48% of buyers use video platforms (online, social, streaming, TV) to research products and make purchase decisions, compared to just 14% of non-buyers.

Health Coaching Makes Small, Steady Progress

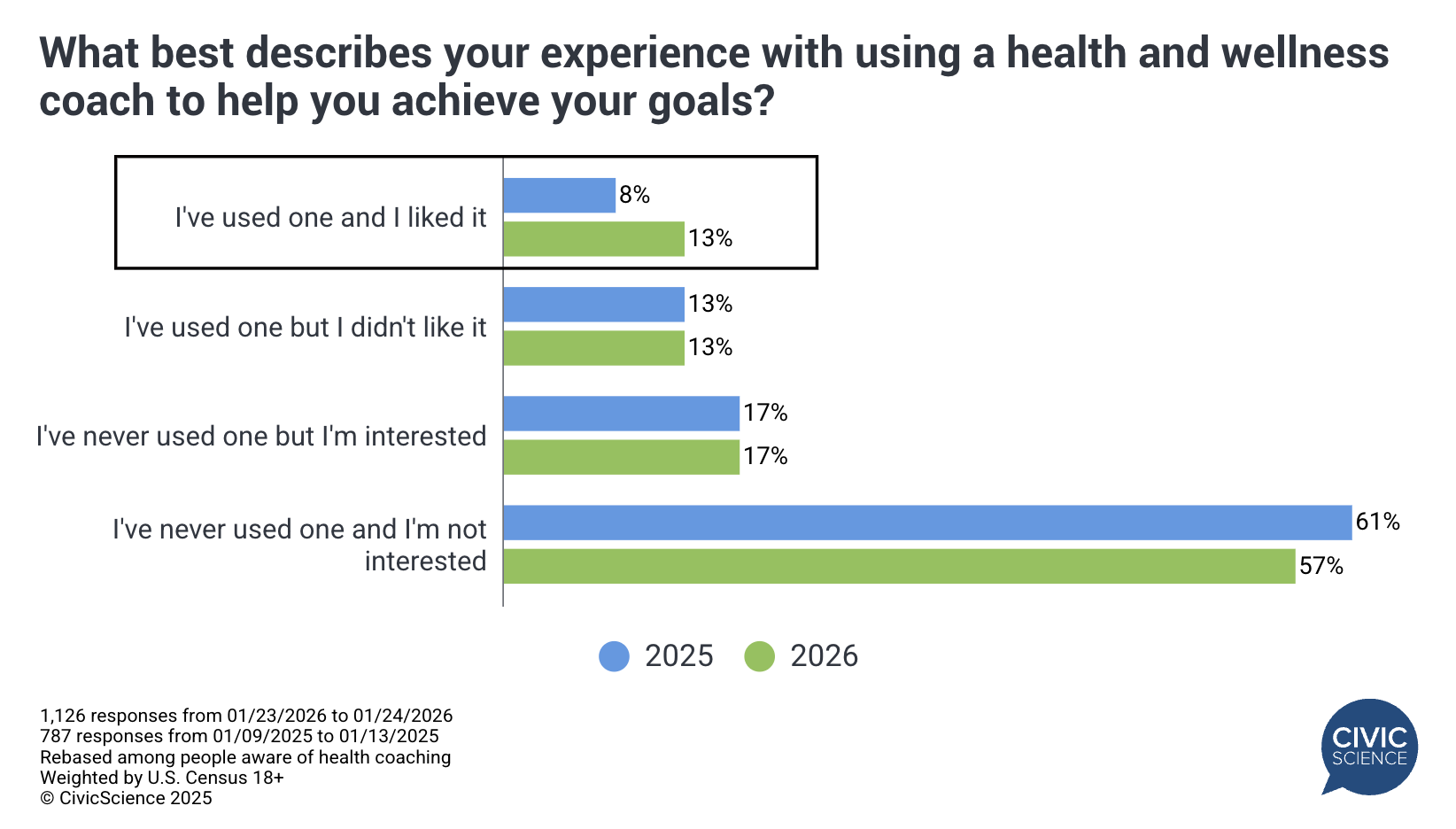

Another area where consumers are open to spending is seeking the support of a health and wellness coach. New data show that the use of health and wellness coaching increased from 21% last year to 26% this year. What’s noteworthy here is that the percentage of people who were satisfied with a health coach increased at a higher rate than those who were not satisfied. Additionally, intent to seek out a health coach has remained about the same year-over-year, so we can expect another bump in both use and satisfaction in the future. The desire for a health coach aligns with the broader trend of people seeking connection, not just getting fit.

These Trends Only Amplify Further Among Gen Z

America’s youngest adult consumer group, those aged 18 to 29, tends to diverge notably from the Gen Pop. Not only do they outpace the Gen Pop in reporting that they exercise with any frequency (76% to 68%, respectively), but they also outrank all age groups by at least six points.

As such, they are far more likely to support this active lifestyle by buying fitness supplies and accessories. Sixty-three percent of 18- to 29-year-olds plan to buy fitness equipment in the next 30 days, nearly double the rate among the Gen Pop.

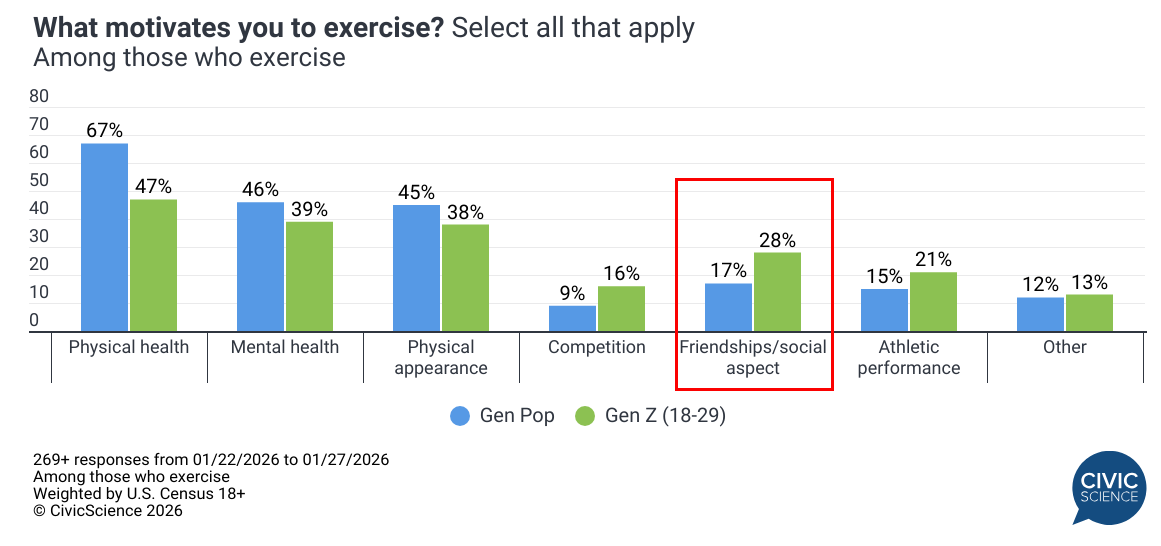

While “traditional” drivers of exercise – physical health, mental health, and physical appearance – continue to be key motivators for working out, Americans are increasingly citing other reasons. Since 2024, slightly more folks say they are motivated to exercise by the social aspect of the activity. Gen Zers tell CivicScience that they are particularly influenced to exercise by the social aspect of exercise, 65% more than the average person.

As fitness habits shift in 2026, consumers — particularly younger adults — are actively reevaluating how they work out and where they spend. This moment of change presents a key opportunity for brands to reach audiences as preferences take shape.