Tax season is underway, setting a tone for the months ahead. Retailers can benefit from knowing what expected refunds look like this year and how people plan to spend them. What’s more, consumers may be paying increased attention to their refund this year, considering the upcoming presidential election.

Here are five key trends to know about tax season from the CivicScience InsightStore™:

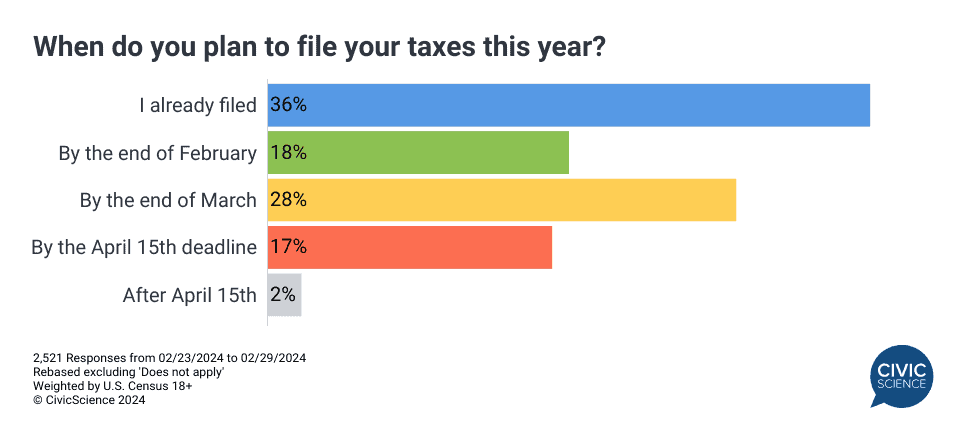

1. Nearly two-thirds have yet to file.

Among U.S. adults who plan to file their 2023 taxes, 36% have already filed while 64% say they have yet to file. The majority of taxpayers plan to have their taxes in by the end of March, with March being the most popular month for filing. Just 17% say they will wait until the April 15 deadline.

Some have a head start. Nearly 1-in-4 consumers say they began preparing their taxes earlier this year than last year.

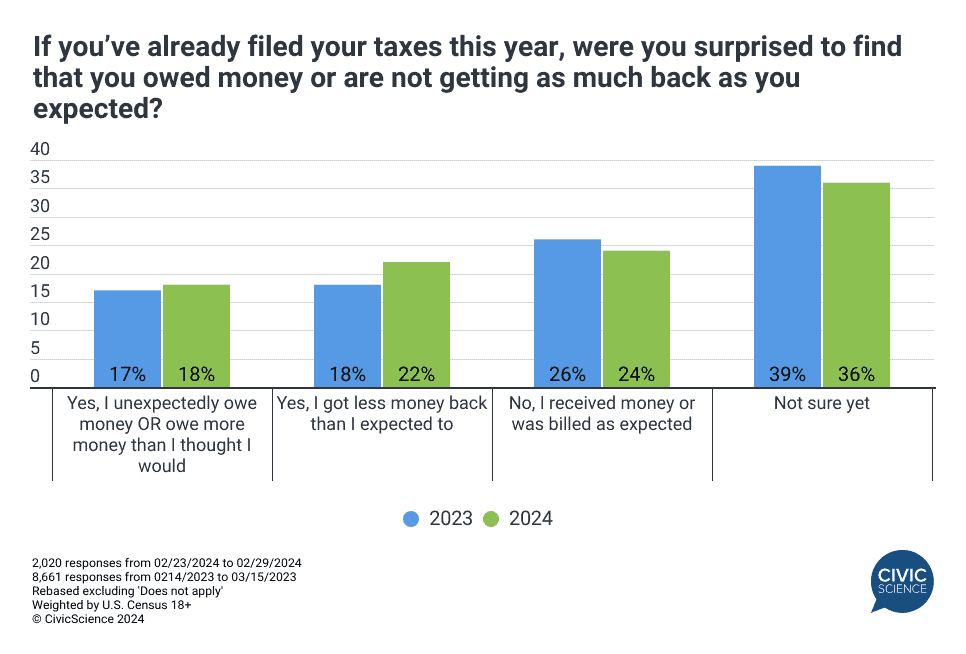

2. More filers say tax refunds are lower than expected.

Although it’s still early in the season, 22% of filers report they received a lower-than-expected tax refund so far, up four points from last year. An additional 18% found that they either owed money unexpectedly or owed more money than they were anticipating, comparable to 2023.

That could continue to change, given that the majority of Americans still need to file. The IRS expects the average refund to be higher this year, after reporting earlier in the month that refunds would be much lower.

Join the Conversation: How much do you expect your tax refund to be this year?

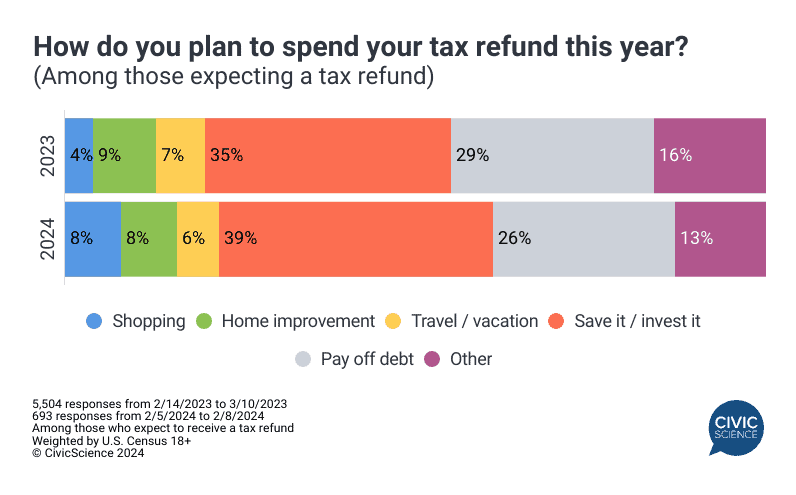

3. Consumers have shifting priorities for how to use their tax refund this year.

Thirty-eight percent of U.S. adults expect to receive a tax refund this year, similar to last year (39%). Paying down debt is somewhat less of a priority this year compared to last year, although a greater percentage plan to put their refund toward savings and investments. Also notable, consumers are twice as likely to use their tax refund for shopping, although recent consumer spending data suggest it’s more likely that people will be purchasing essentials rather than going on a shopping spree.

4. Tax refunds are important for many Americans.

For the majority of households, receiving a tax refund isn’t just a nice bonus, but an essential payout that they’re counting on. New CivicScience data find that 53% of U.S. adults say their tax refund is ‘somewhat’ to ‘extremely’ important to their overall financial health, with 24% citing it as ‘extremely’ important.

Take Our Poll: Do you think your tax rate is appropriate?

5. Distrust in the government spending of tax dollars is rampant.

Taxes and tax refunds are among the top economic issues that voters are concerned about this election cycle. An overwhelming 70% of Americans say they distrust the government to spend tax dollars ‘wisely,’ one aspect of broader declining institutional trust.

Check back in March for additional tax season coverage. For more in-depth insights, learn how you can get ahead of the curve with the CivicScience InsightStore™ – get in touch.