CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As consumers continue to navigate economic uncertainty, health and wellness stand out as a rare area of resilience. Recent CivicScience data shows that it is the only category studied in which intent to increase spending in 2026 outweighs intent to cut back. In every other category, the percentage of consumers who plan to spend less exceeds the percentage who plan to spend more. That resilience, however, isn’t one-size-fits-all, as consumers define health and wellness purchases differently. Here’s what the latest data shows:

Ways Consumers Are Increasing Health and Wellness Spending

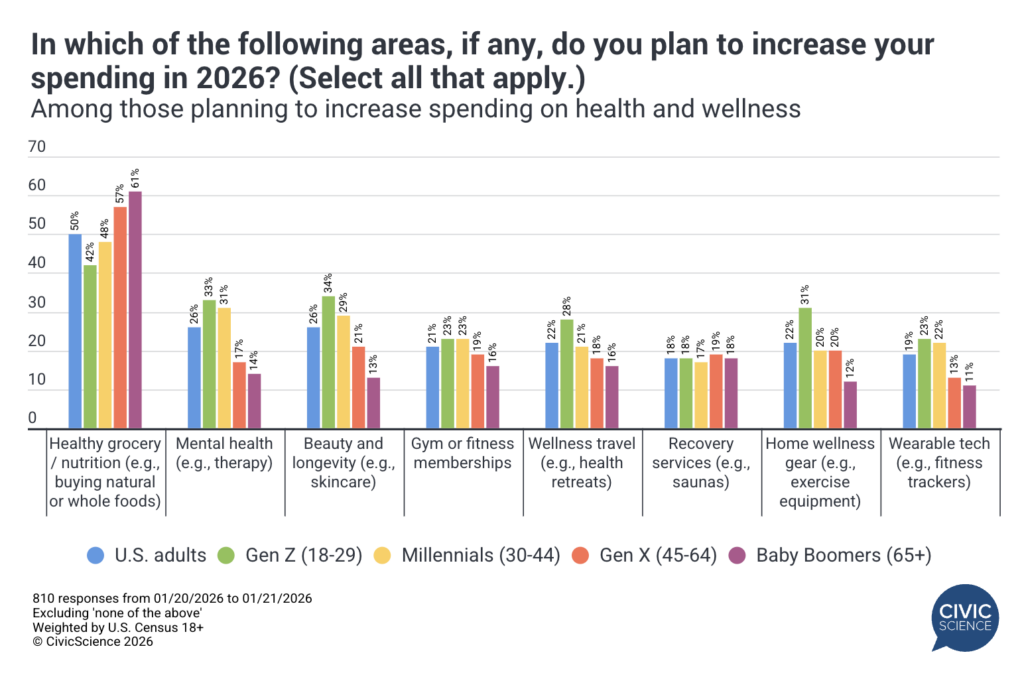

Among those who say they plan to increase health and wellness spending this year, food and nutrition leads by a wide margin. Half expect to spend more on healthy groceries and nutrition products, making it the most common form of investment in personal health.

Mental health-related purchases, such as therapy and meditation apps, follow at 26%, alongside beauty and personal care purchases. Overall, consumers are prioritizing wellness purchases that fit naturally into everyday routines, rather than discretionary or occasional splurges.

However, there is a clear generational divide in how these budgets are allocated. While older demographics lean heavily toward dietary health, Gen Z is diversifying spending across beauty, mental health, home wellness equipment, and wellness-focused travel, signaling a shift toward a more holistic, lifestyle-integrated definition of well-being.

Mental Health Resets

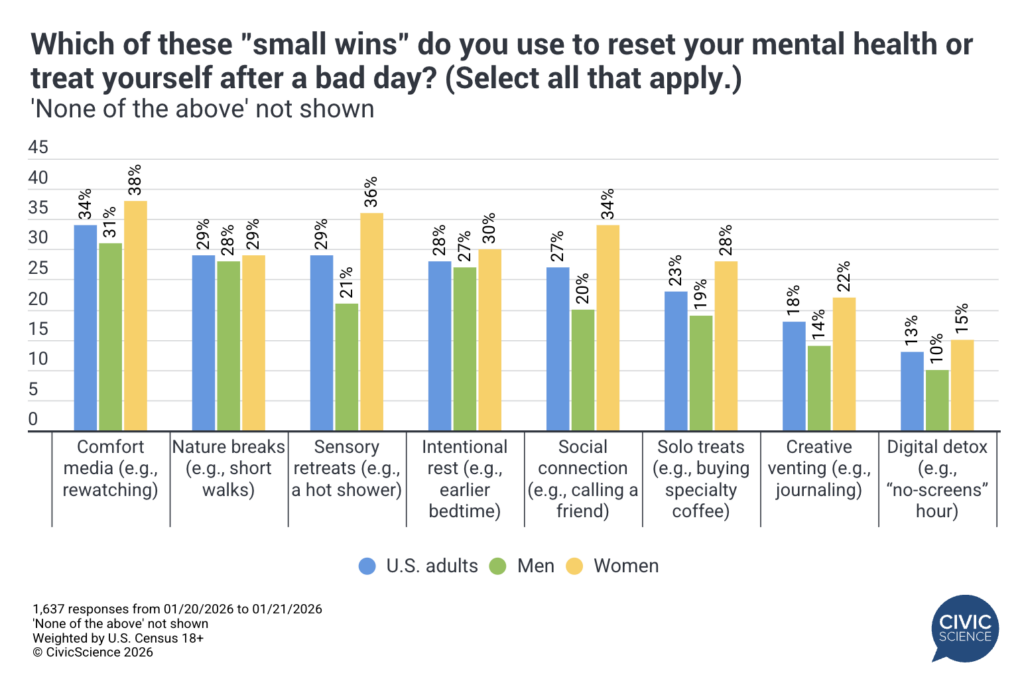

When addressing mental health and emotional recovery specifically, consumers favor low-cost, accessible “resets” such as comfort media, nature walks, and sensory retreats. The data reveal distinct demographic preferences for coping mechanisms. Women, for example, are notably more likely than men to unwind through sensory retreats, social connection, or buying themselves a small treat.

These coping preferences also diverge meaningfully by generation. Millennials gravitate toward nostalgic media, while Baby Boomers prioritize social connection. For younger consumers, mental health maintenance is increasingly proactive and expressive, characterized by a preference for digital detoxes and creative venting through journaling, doodling, or hobby crafting.

The Kind of Insights CivicScience Delivers

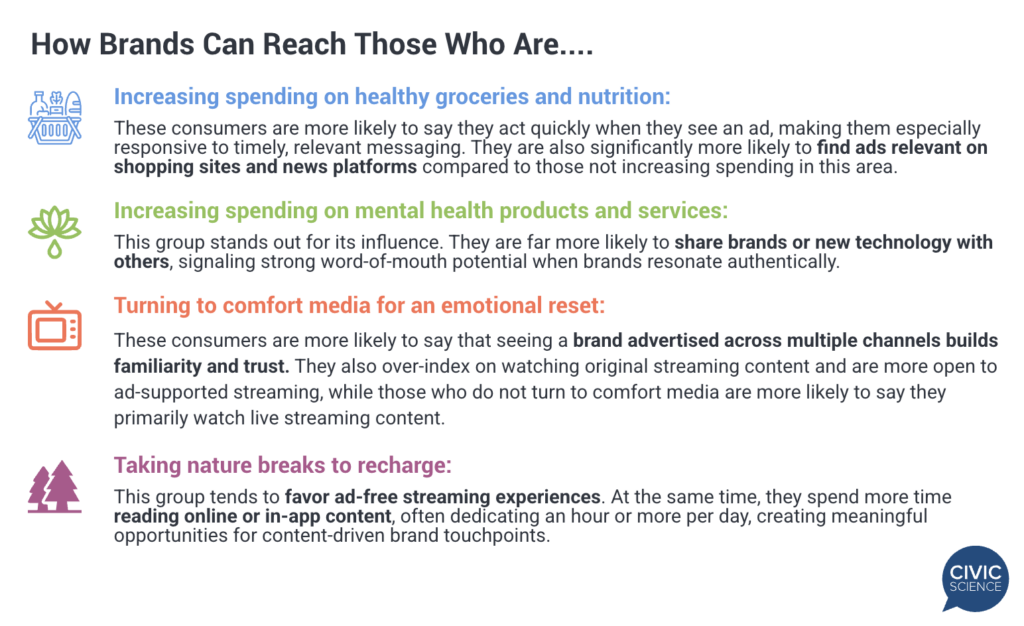

CivicScience helps brands build precise audience segments, such as those increasing health and wellness spending, and connect with them at the right moment online.

Overall, the data show that health and wellness continue to play a meaningful role in how consumers prioritize spending and shape daily habits. As definitions of wellness vary, so do the ways these priorities show up online – reinforcing the value of understanding not just who consumers are, but how they engage around what matters to them.