This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Although the latest reports show that inflation continued to cool in September, food prices are still a significant pain point for consumers. The effects of high prices can be seen in the restaurant industry, as restaurants grapple with increased business costs and more price-conscious consumers.

All of the data point to consumers pulling back spending on dining out in the last year, whether that’s purchasing less expensive meals, dining out less often, or forgoing restaurants altogether. CivicScience tracking shows that dining out is the leading category where many Americans are cutting costs, followed by apparel. In Q3, 55% of U.S. adults said they were cutting back spending on dining out, up from 52% in Q1.

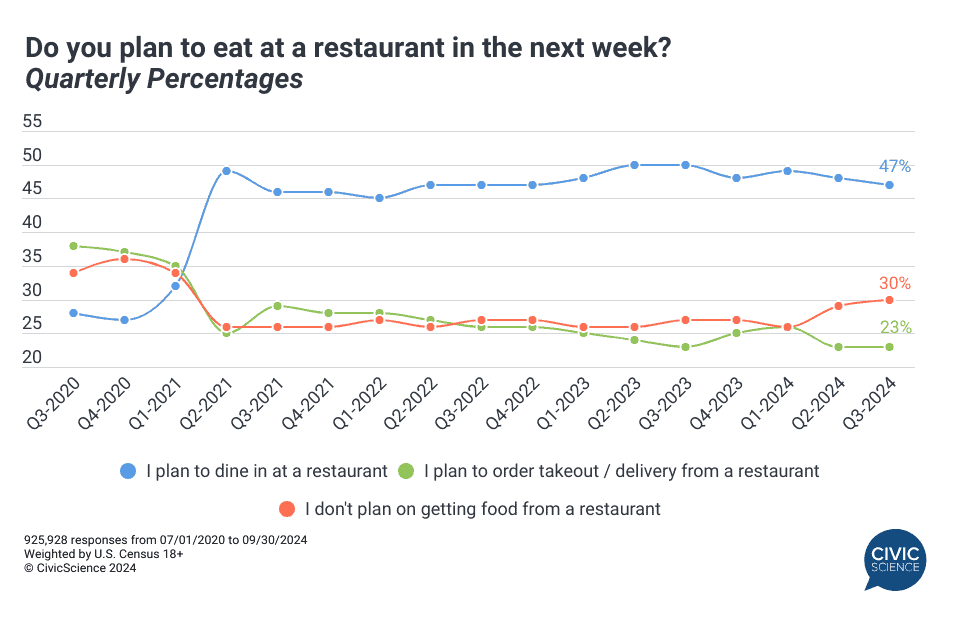

When asked about dining out at restaurants, 47% of U.S. adults in Q3 said they were planning to go to a restaurant ‘in the next week’, the lowest point since 2022. The issue now is that consumers aren’t making up for the loss in takeout, as they were when things started sliding last year – that percentage reached a low of 23% over the summer and has remained low ever since. Rather, a growing percentage are refraining from restaurant ordering, as 30% of people in Q3 didn’t plan to get food from a restaurant, which is a high not seen since the height of the pandemic in the first quarter of 2021.

Weigh In: Is eating at home more economical?

How are people cutting back?

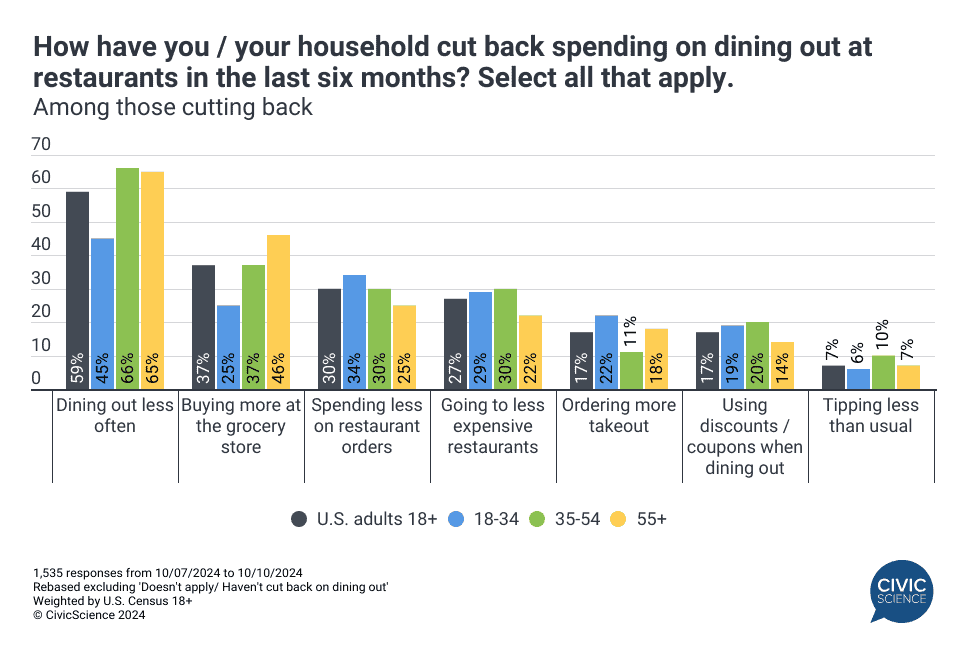

The leading way people are cutting back on restaurants is by dining out less often. New polling data found that 59% of consumers who are cutting back spending on restaurants report they’re dining out less frequently. Yet, there are several other strategies people are using to eat out but save dollars. Thirty percent are spending less in general at restaurants and 27% are ordering from less expensive restaurants. Just 17% say they’re ordering more takeout, which is a fraction in comparison to the other ways people are saving.

Respondents over age 35 are much more likely than younger adults to dine out less often, while those under 35 are more likely to pull back how much they’re spending on restaurant orders and order more takeout.

Trading Off for Groceries

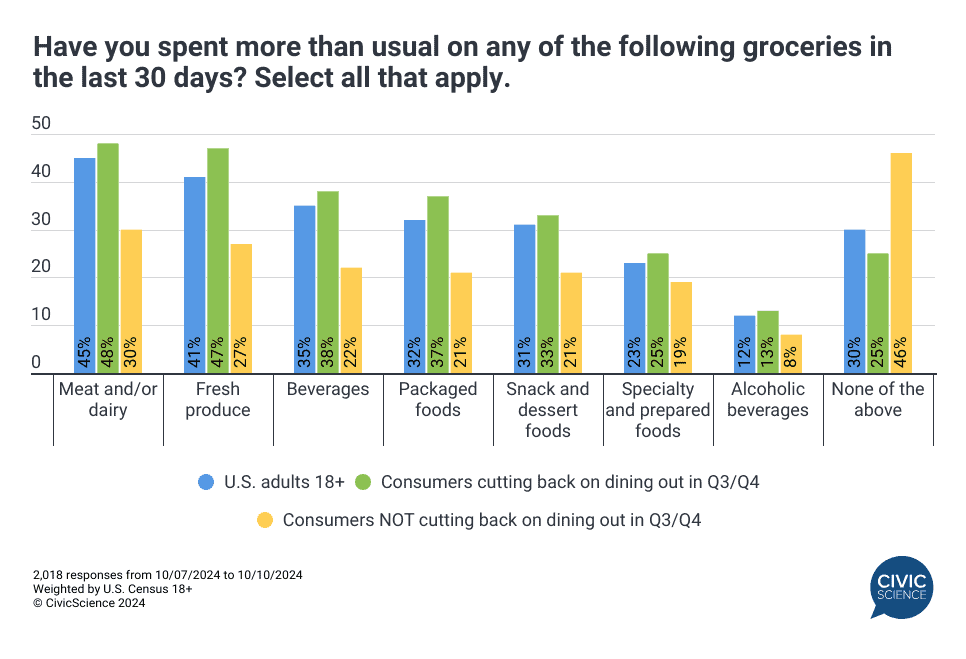

As seen above, more than one-third of people are trading off dining-out dollars for spending more at the grocery store, likely seeing their dollars go a lot further in groceries and meal prep at home. Dining at home is a rapidly rising trend. Circana estimates that 86% of eating occasions were sourced from home in the last year. Likewise, a CivicScience study from June found that 57% of consumers were eating at home more than usual, up from 51% in 2019.

When it comes to which types of groceries they’re spending more on, meat and dairy are the top categories, followed by fresh produce. Consumers who report they’ve cut back on dining out are more likely to spend more than the general population across all grocery categories studied, with the biggest differences in fresh produce and packaged foods. They’re significantly more likely than people who have not cut back on dining out to increase their grocery spending.

Take Our Poll: How much money do you typically spend on groceries a month?

While consumers are looking for ways to save on restaurant spending, the trend could show early signs of stabilizing. Although Americans who plan to dine out at restaurants has fallen quarterly, the percentage of people eating at home more than usual (including takeout) has remained stable over the last three quarters.

That said, the presidential election outcome is likely to impact how consumers are spending and anticipate spending on restaurants in the months ahead. Americans are largely divided between what they view as the leading cause of high prices at restaurants in the U.S.: 27% say ‘increased operating costs,’ 27% say ‘U.S. economic fiscal policy,’ and 20% say ‘corporate price gouging.’