Today, CivicScience data show only about 1-in-3 Americans consider themselves to be healthy eaters – an eight percentage point decline since the start of the COVID-19 pandemic. Much of this decline is due to inflation and economic circumstances rather than food preference – 42% of respondents say they don’t eat more healthily primarily because they lack the money and/or time to do so. That’s far greater than the 26% who say they simply prefer less healthy foods, which has fallen four points after peaking in 2021.

Answer Our Poll: Do you think healthy eating can become an unhealthy obsession?

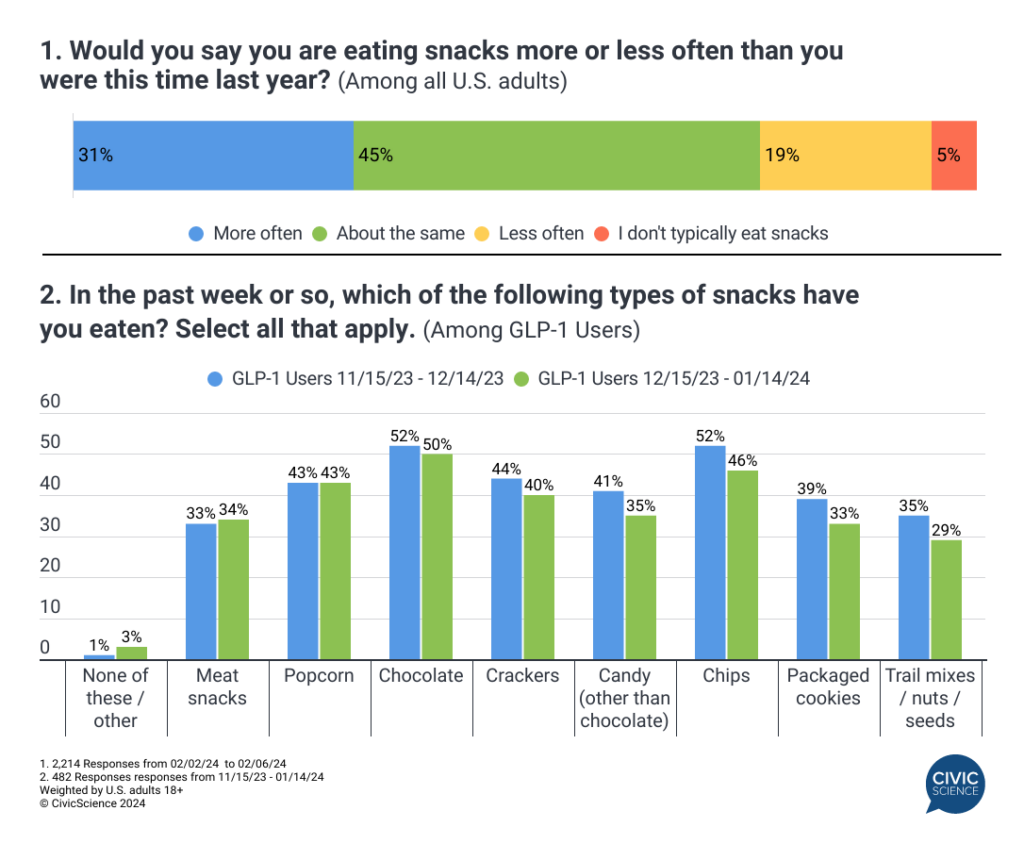

But the higher costs at the grocery store haven’t prevented another shift seen in the data: increased snacking. More than 3-in-10 Americans report they’re eating snacks more often today than they were this time last year. Conversely, 19% of respondents say they’re eating snacks less often.

However, that doesn’t appear to ring true for all consumers, at least on a more short-term basis – the latest edition of the CivicScience Ozempic and GLP-1 Consumer Tracker shows snacking in most snack food categories is down among GLP-1 users. Still, users continue to prefer unhealthier options.

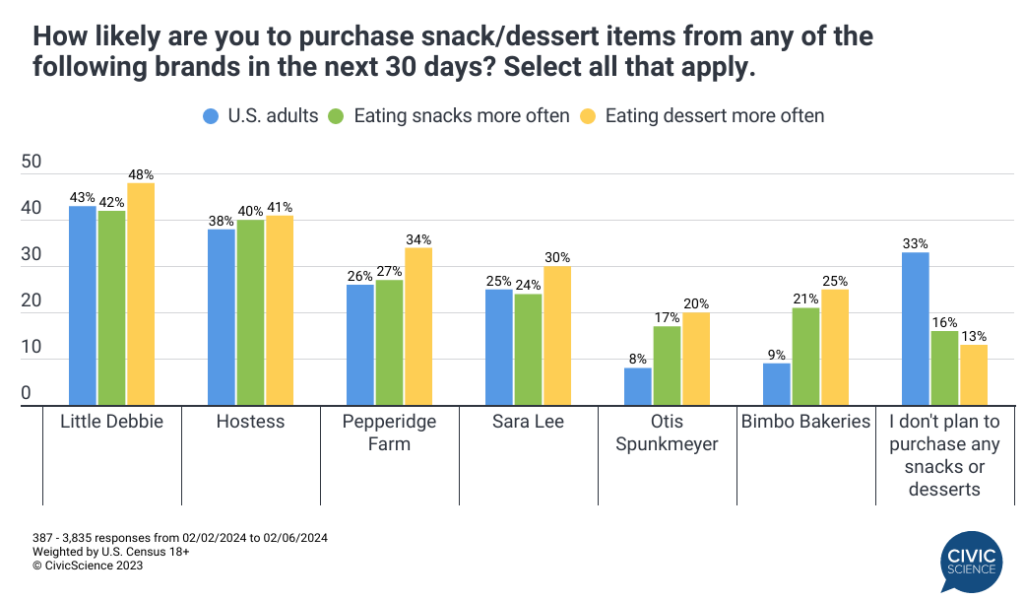

In addition to snacking, 27% of U.S. adult consumers say they’re eating dessert ‘more’ often now than before the pandemic (compared to 16% who have dessert ‘less’ often). With the shifts toward increased snacking and desserts among the U.S. Gen Pop, which brands are consumers likely to reach for at the store in the days ahead?

Among popular prepared and frozen dessert items, Little Debbie and Hostess are the convincing leaders as the brands most likely to be in shopping carts of the Gen Pop, those who are snacking more often in the past year, and those eating dessert more often than before the pandemic. That’s followed by Pepperidge Farm and Sara Lee. While the positioning of these brands changes very little across the three consumer buckets, Bimbo Bakeries and Otis Spunkmeyer enjoy significant bumps in purchasing intent among those who are eating snacks and desserts more often today.

Americans are more open to snacking and desserts despite their top 2024 New Year’s resolutions to improve food and diet and still high inflation. But with 18% of Americans using or planning to use Ozempic and other GLP-1 weight loss drugs for weight loss, and another 14% using or planning to utilize these medications for purposes other than weight loss, will snacking trends be impacted as the calendar flips deeper into 2024?

Answer Our Poll: How often do you eat frozen desserts?

Continue following these trends and gain in-depth insights into Ozempic/GLP-1 users with the Ozempic and GLP-1 Consumer Tracker. Sign up now for a free preview of this monthly syndicated report.

But the insights don’t stop there, CivicScience clients have access to our database of over 500K ongoing polling questions. See it in action.