As we approach Halloween, ghosts, ghouls, and all things haunted are spooky for kids. Often, American adults’ biggest fears are around the subject of money—no matter the time of year.

From unexpected out-of-pocket expenses to a drop in your credit score, or losing your job and income stream, what people may consider the most financially frightening is likely tied to other factors in their lives.

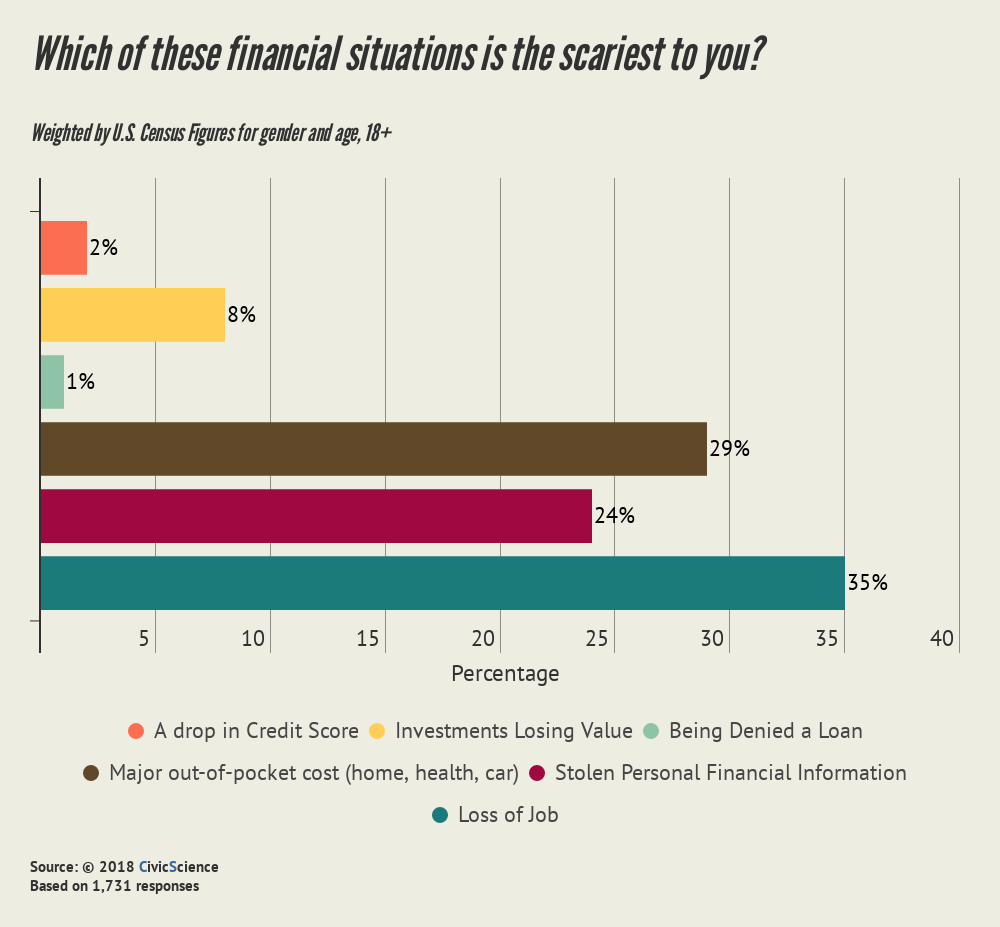

Research firm CivicScience asked over 1,800 Americans about what they deem to be the scariest financial situation.

Excluding those who indicated they weren’t sure, see the chart below. Losing a job is the top answer (35%), followed by unexpected (and out-of-pocket) health, home, or car expenses (29%), as well as having your personal information compromised (24%).

Only 8% were frightened most by the idea of their investments losing their value.

CivicScience felt certain life stage drove the choice respondents selected.

Different Fears Over the Years

It appears that is the case. Credit score drop is of the most concern to Millennials, probably because they need a healthy score to get things later in life, like a mortgage, car, or a credit card. Baby Boomers are the most concerned about investments losing their value, which of course is likely because they are of, or close-to, retirement age.

Those who worry about compromised financial information are more likely to be Baby Boomers, and those who fear losing their job are predominantly Gen Xers, followed by Millennials.

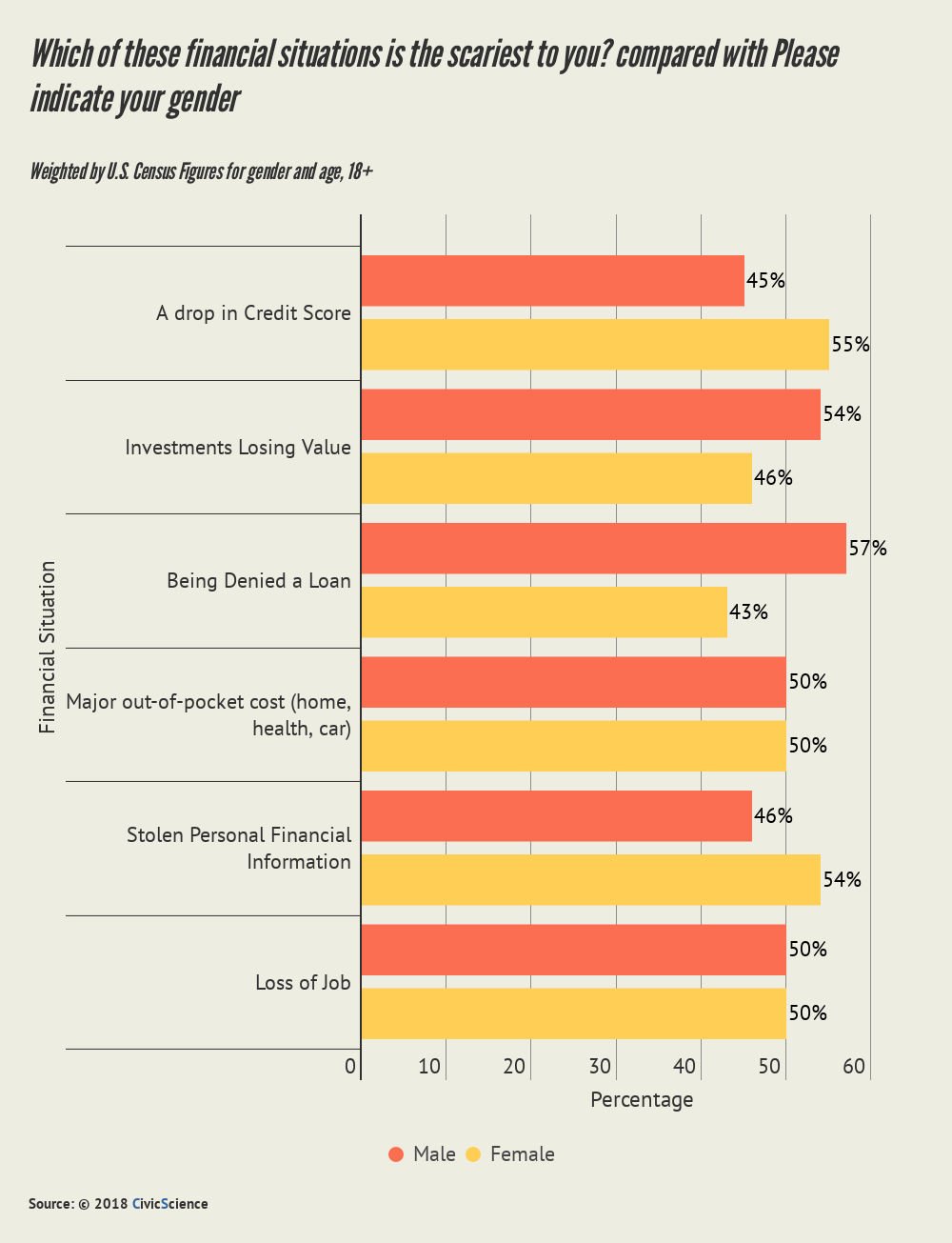

Gender Roles

Women appear to be more concerned than men over maintaining a strong credit score, and the safety of their personal financial information. Men, on the other hand, are more concerned about their investment value, and being denied a loan. It’s split by gender for the scariest circumstances among respondents (major out-of-pocket cost and loss of job).

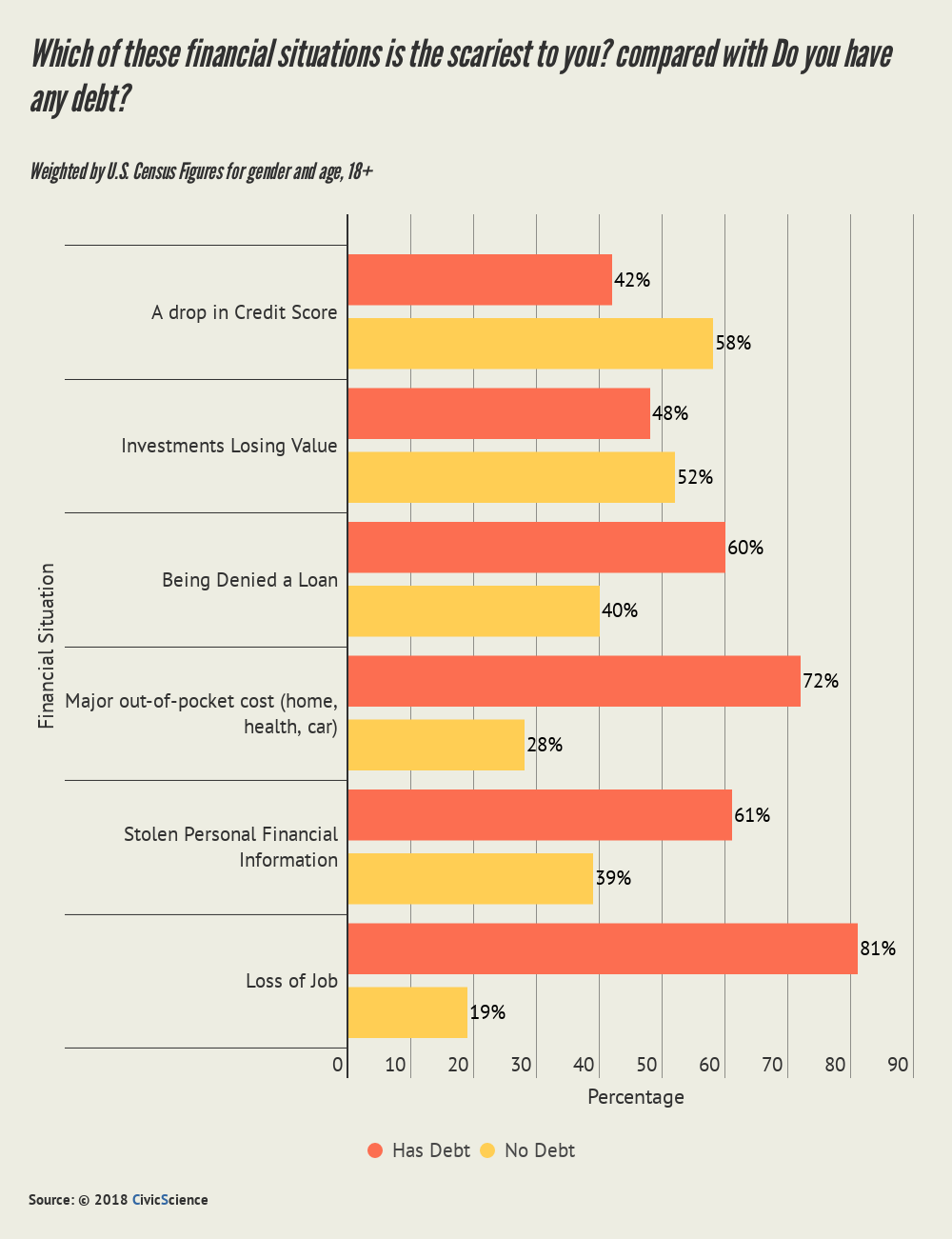

The Debt Factor

81% of those who say losing their job is scariest have debt of some kind, and 72% of those who fear unexpected expenses do, too.

The data indicate that unexpected financial events are scariest to those in debt. Someone has to pay the bills, but maybe they are nearly maxed out already—loss of income or a broken water heater could set them over the edge. They may not have the savings.

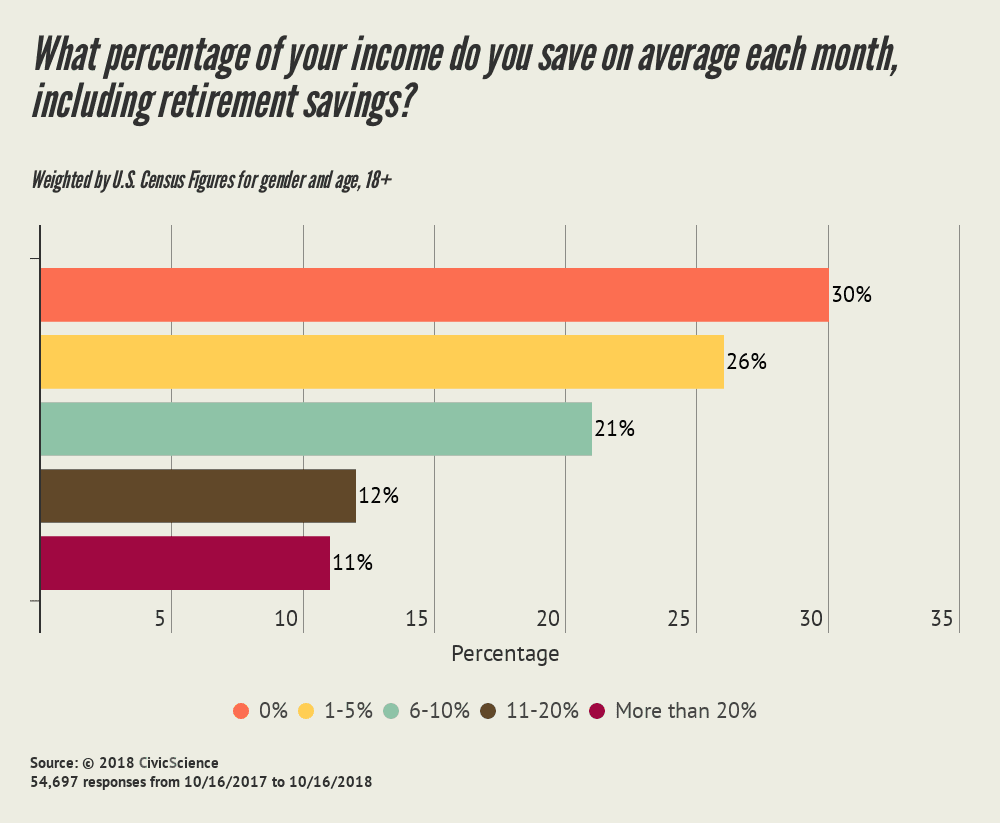

Savings

CivicScience has collected responses from Americans on how much they put away each month, shown here are responses collected in the past year:

30% of American adults don’t put anything away. Talk about scary. The majority put between 1 and 10% away.

What about savings, compared with fears?

Those who save less, worry more about the costs of life that could come up unannounced. It goes to show that a large portion of Americans are likely just getting by.

More Money, More Bills

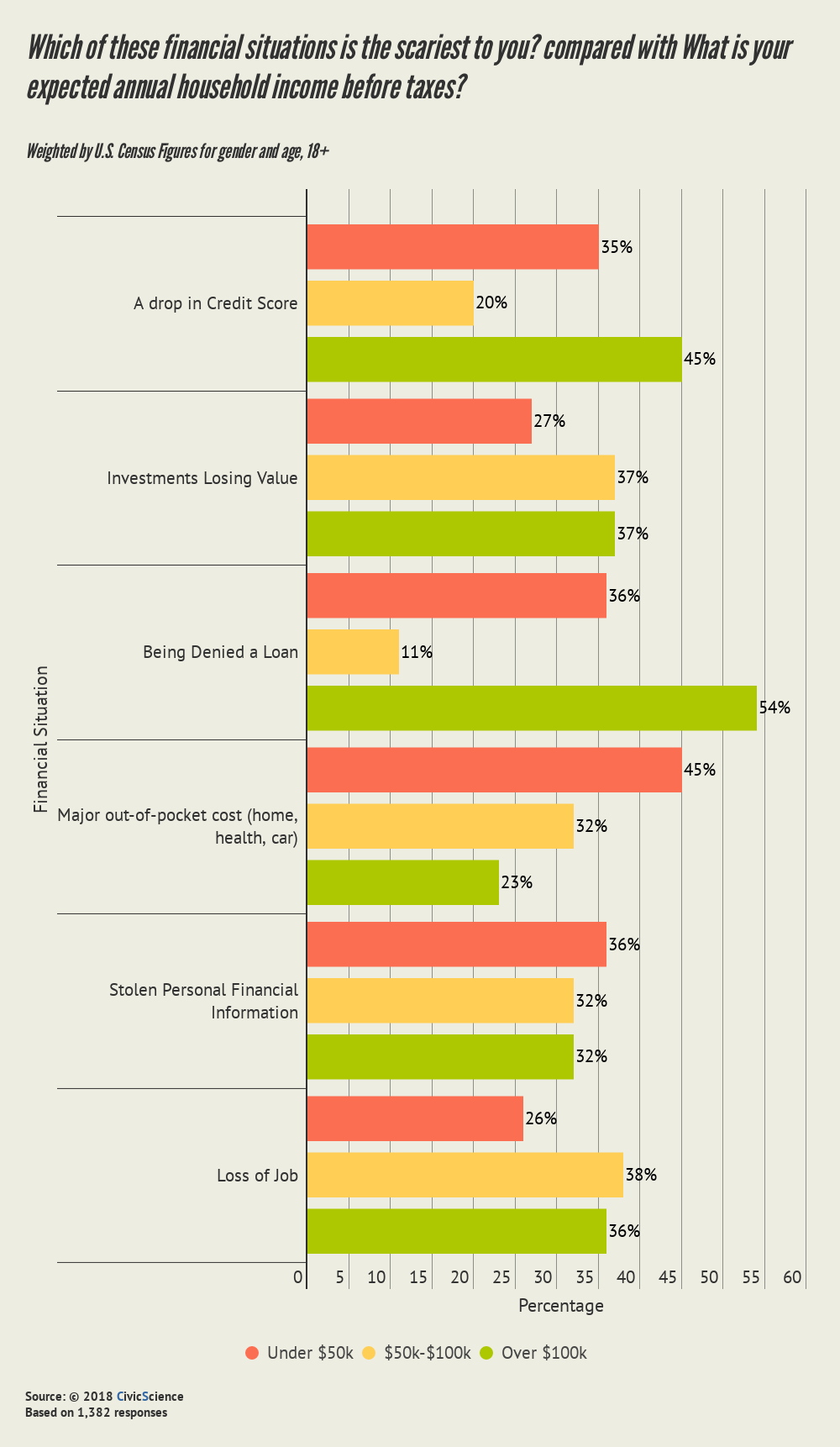

Those in all three income brackets fear losing their job, but surprisingly it’s not as likely for the under $50k bracket. It very well could be that the more money one makes, the more (over) extended they’ve become with finances.

Economic Outlook

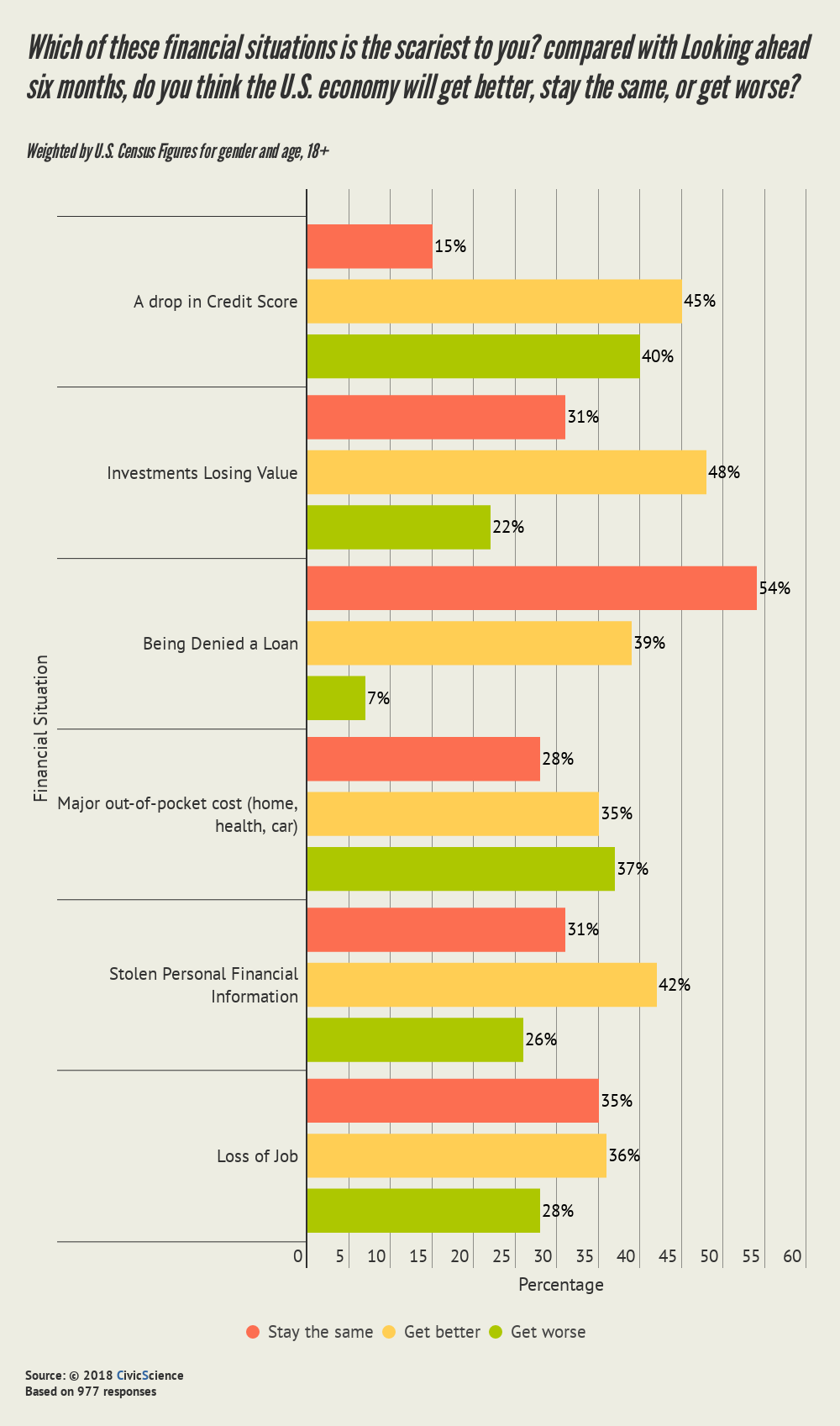

It appears one connection to some of this is economic outlook.

The majority of people who worry about an unexpected financial situation think the economy will either stay the same or get worse. Only about ⅓ of the respondents in each of the two answer groups (major out-of-pocket cost and losing your job) have a positive economic outlook for the next six months.

Finances are a scary topic, no matter how big your salary. Unexpected costs are often unavoidable, but likely the scariest the younger you are. And when it comes down to it, saving more money would likely help cull these fears, but it’s not a reality or an option for some, and doesn’t calm the nerves of others.