CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

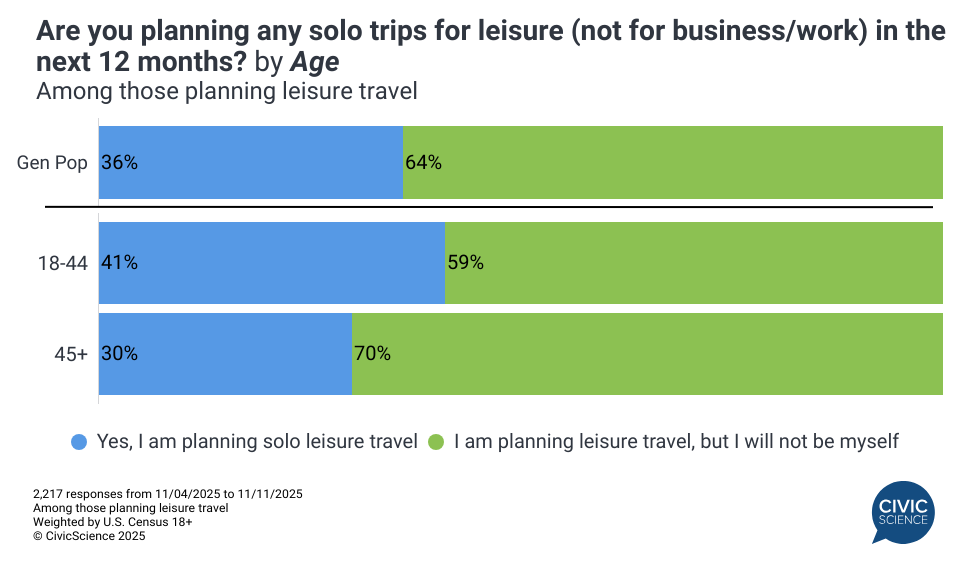

As the travel industry navigates economic uncertainty and government shutdown-related disruptions, many Americans are still setting their sights on getaways in the year ahead. New CivicScience data reveal that 53% of U.S. adults intend to travel for leisure within the next 12 months. Solo travel accounts for a notable share of these travelers – among travelers, 36% say they plan to travel solo, while 64% plan to travel with someone else. Solo travel intent is particularly pronounced in travelers in the under-45 demographic, with the percentage planning to go it alone jumping to 41% among them.

As solo travel becomes a growing share of leisure travel plans, it presents new opportunities – particularly among younger consumers – for brands, advertisers, and media publishers to connect with an independent-minded traveler audience.

What Solo Travel Intenders Say About Travel Preferences

Diving deeper into the first-party audience insights available through CivicScience’s millions of daily responses, consumers planning to travel alone within the next year reveal a few characteristics that will shape their planning:

- Keeping Closer to Home: This year, solo travelers are opting to stay closer to home. Thirty-five percent say the furthest they plan to go is out of state, but within their region of the U.S.—up from 29% in 2023. Twenty-three percent, meanwhile, expect the furthest they’ll travel is within their current state. Just 13% expect to travel internationally, down from 20% in 2023, while 29% will venture outside their region of the country, a slight one-point uptick from two years ago. State/national parks also feature prominently — additional data show that 49% of solo travelers intenders say they visit state or national parks at least a few times per month.

- Balling on a Budget: More than 8 in 10 solo travel planners report they would be likely to consider less convenient or comfortable options when booking travel, to stay within their budget. This data coincides with an additional CivicScience survey, which finds that 77% of solo traveler planners use travel discount sites, such as Travelocity and KAYAK.com.

- Priorities shaping plans: Zooming in specifically on the top three factors that drive their accommodation choices, price and location emerge as unsurprising leading influencers. The accommodations’ ratings round out the top three, followed by amenities and room setup.

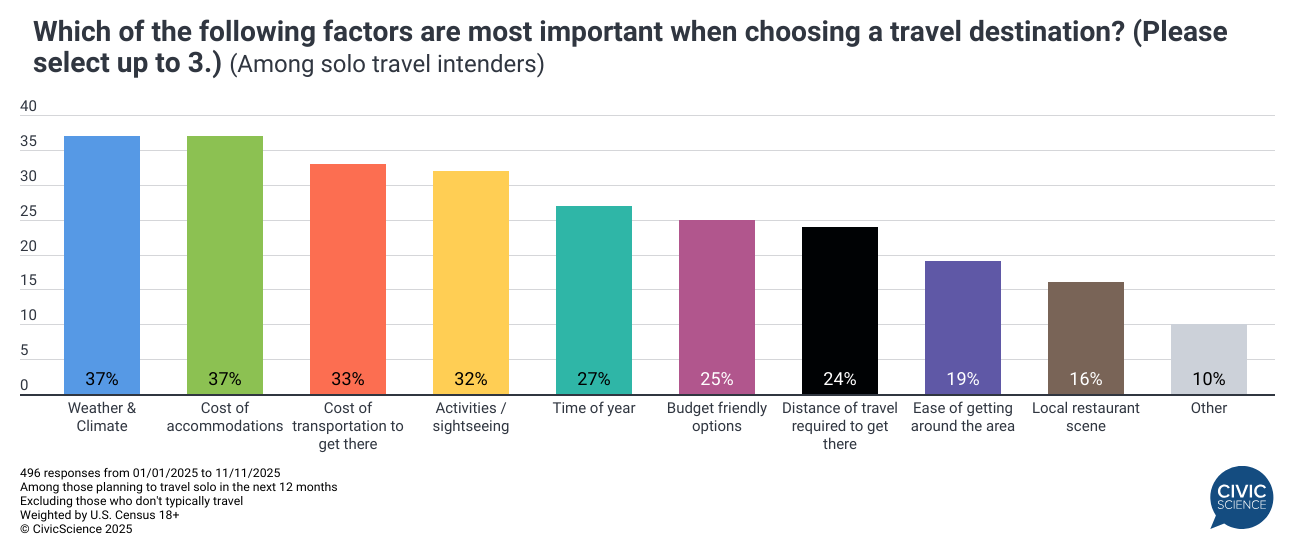

When asked to select the top three factors when choosing a travel destination, weather & climate, as well as the cost of accommodations, emerge as frontrunners. These are followed closely by a near equal share who cite the cost of travel to get there and the activities and sightseeing at the destination. Meanwhile, the local restaurant scene and the ease of getting around the local area are of much less importance.

Solo Travelers Are Also…

Sober-curious: Seventy percent of solo traveler planners aged 21+ who drink alcohol say they are at least ‘somewhat’ curious about an alcohol-free lifestyle. They’re also 25 points more likely than those traveling with others to say they plan to take at least one dry (alcohol-free) vacation this year.

Treating Themselves: Solo travelers are more likely to splurge on themselves, with their leading splurge purchases being an expensive meal and physical pampering via a salon or spa. Further emphasizing the importance of decompressing and unwinding, they are far more likely than those traveling with someone else to report practicing self-care frequently.

Shopping & Rewards Focused: They’re more active with online retail shopping compared to last year, with 49% saying they’re shopping online now more than they did at this time last year. Among those who holiday shop, they’re most likely to say they plan to spend the most with either big-box stores or small, locally owned businesses. Finally, those with credit cards are well-versed in using credit card rewards, as more than half redeem their rewards at least every few months.

Through this glimpse into consumer travel intent, it’s clear that solo travel will play a key role in the upcoming leisure travel market. These travelers are focused on treating themselves, embracing self-care, and exploring alcohol-free experiences, while staying active in online shopping and maximizing travel deals and credit card rewards. Brands and advertisers that align with these priorities can effectively engage a growing, independent-minded traveler segment.

Create Dynamic Audience Segments

Build, monitor, and activate segments like this, grounded in what consumers report themselves. With CivicScience’s consumer-reported intent data, brands can find and engage the right consumers at the right time, on the right channels.