CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

The New Year is just around the corner, as is the annual conversation around New Year’s Resolutions. Who will make them, and what will they pledge? New survey data show that plans to make resolutions are up by three percentage points from this time last year, with nearly 70% of respondents 18+ intending to create one. Gen Z leads in overall resolution-making–a trend that’s held true since last year–as do those making $50K or less and those who are only partially sticking to their 2025 resolutions.

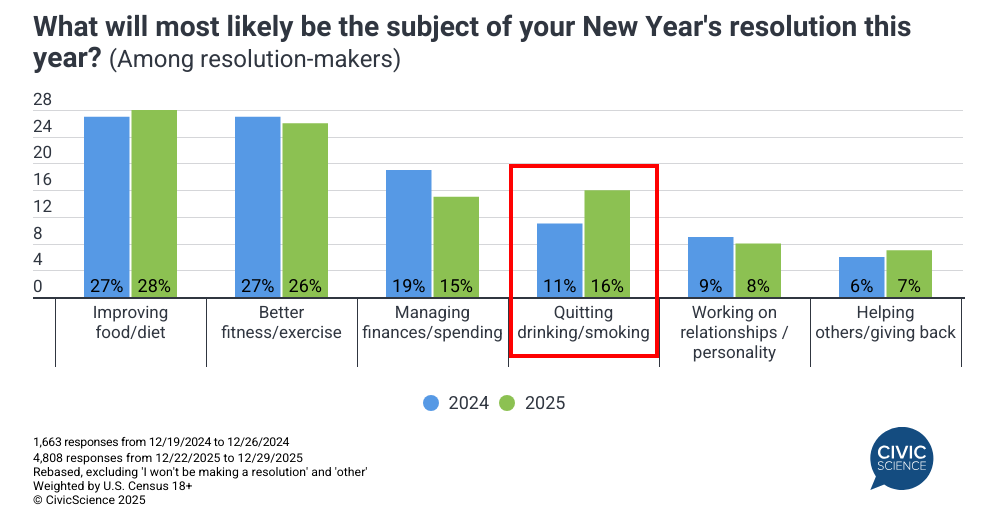

When it comes to resolution topics, two consistently lead the pack: improving food and diet and creating a better fitness and exercise routine. As respondents look ahead to 2026, improving food and diet slightly outpaces exercise and fitness as the most popular resolution topic (28% vs 26%).

However, the most significant change comes in the percentage of those planning to quit drinking or smoking, which has jumped to the third most common choice. This resolution has seen a five percentage point increase in the last year alone and now stands at its highest level seen since CivicScience began studying resolutions more than 10 years ago. This trend aligns with the overall declining interest in drinking alcohol and is one that appears likely to impact New Year’s Eve plans.

Resolution Intent Shapes Near-term Exercise Equipment Interest

With fitness ranking in the top three resolution categories for 2026, it’s worth noting that more than half (52%) of resolution-makers say they own or have access to home exercise equipment. And that percentage is primed to grow as another 16% tell CivicScience they plan to buy soon. Yoga accessories and treadmills hold the slim lead among resolution makers planning home exercise purchases in the next 30 days.

Resolution-Makers Seek Convenience in the Kitchen and Consider GLP-1 Medications for Weight Loss

When it comes time to eat, resolution-makers aren’t interested in a challenge. Instead, this group of consumers leads in grocery and food delivery usage. They’re also the most likely to be meal kit users and intenders, demonstrating that even when they do cook, they’re looking for ease.

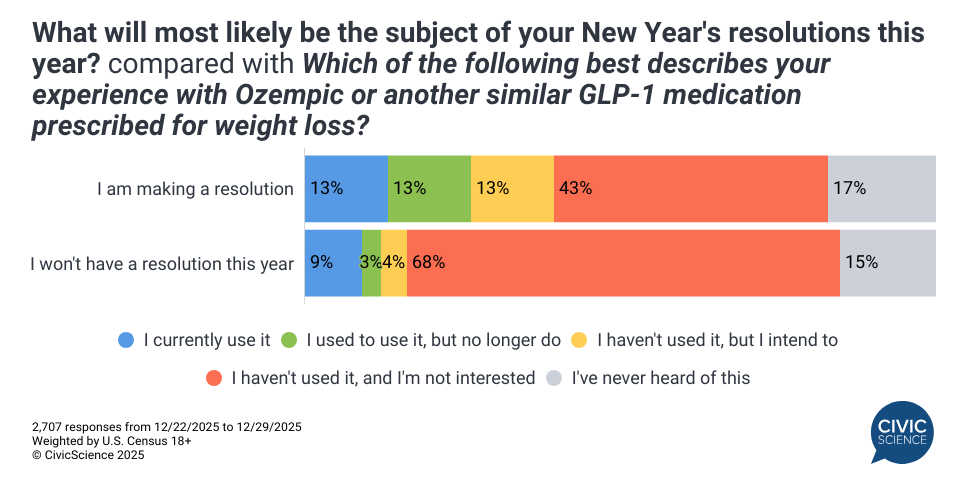

In a similar vein, resolution-makers are 3.5 times more likely than non-resolution makers to be interested in using a GLP-1 medication to lose weight and nearly twice as likely to have used or currently used one. Beyond the kitchen, CivicScience data also show that GLP-1 users demonstrate unique behaviors in terms of how and when they spend.

When the clock strikes midnight and Americans ring in the New Year, many will opt to set resolutions for 2026, with the goal of improving their diet and fitness or quitting old habits. As they do so, how and what they consume will evolve to meet their needs. And the brands and advertisers looking to meet consumers before they buy will want to stay tuned in to the latest insights to stay ahead of consumer behavior in 2026.