A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. CivicScience clients and partners have access to our millions of daily survey responses, allowing them to generate actionable, forward-looking strategies. See what you’re missing here.

There have been many themes throughout 2025 so far, but two words have become truly inescapable when examining this year in the economy: tariffs and uncertainty. Each is connected and continues to lead to far-reaching implications in nearly all aspects of society. One of the key areas feeling the ripple effects is the job market, all of this against the backdrop of an ongoing surge in AI technology that may threaten jobs further.

Older Americans, especially those 55 and above, are often overlooked in retail and job data analysis, yet they are feeling the impacts just like any other generation. Ignoring them risks missing how their buying power intersects with job insecurity, changing retirement plans, and more. Acknowledging their role helps frame the broader challenges shaping today’s workforce and economy.

Many Expect to Have to Work Past Retirement Age, With Income the Primary Reason

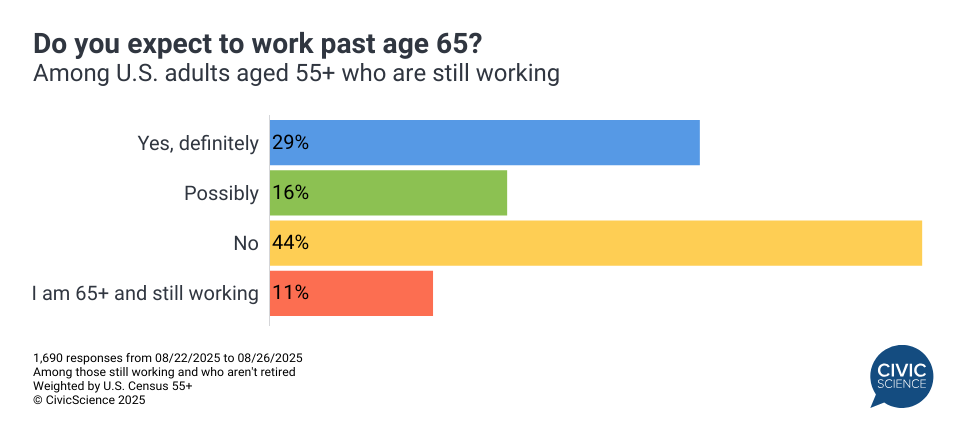

As the cost of housing converges with tariff-driven price hikes on everyday expenses, retirement isn’t what it used to be anymore. Looking at CivicScience data through the lens of American workers 55 and older reveals a harsh reality: Nearly 3 in 10 of the 55+ crowd who are currently employed believe they will ‘definitely’ have to work past the typical retirement age of 65. Moreover, another 16% feel they ‘possibly’ will have to work past 65. Additionally, more than 1 in 10 of those 65+ say they’re currently working already.

These expectations are clearly driven by necessity as 68% of respondents say that their main reason for expecting to work past 65 is for a steady source of income and/or access to benefits. Income-related reasons far outpace those who cited a desire to keep up their mental fitness, pursue new interests, or be a part of a community.

Let Us Know: Do you plan on retiring at the age of 65?

Uneasiness About Employment and Impact of AI

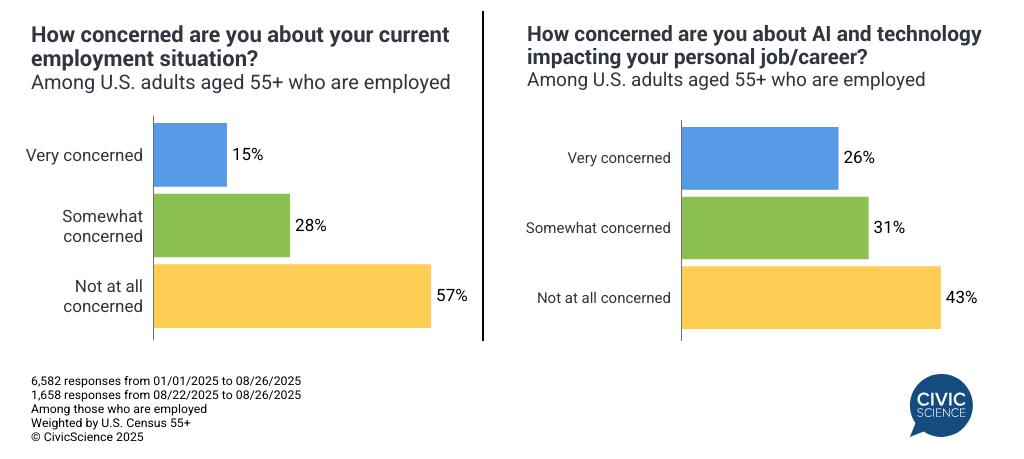

Amid market volatility, a slowing job market, and the growing impact of AI, Americans across all age groups are understandably uneasy about their employment. CivicScience data show that 56% of employed U.S. adults are at least ‘somewhat’ concerned about their current job situation. Among those 55 and older, the share is lower at 43%, but concern is rising: up 19% from the same January-August period in 2024 (36%). This increase includes a four-point jump in those who are ‘very’ concerned, and reflects potential implications for the upcoming winter holiday season. For instance, CivicScience data show 35% of employed workers 55+ who holiday shop say they will spend less on the holidays this year than last year (19% say they will spend more this year).

Speaking of technology, workers in the 55+ demographic are particularly concerned that AI will eventually impact their personal jobs and careers—as many as 56% harbor at least some sort of concern, and more than one-quarter are ‘very’ concerned.

Job Market Pessimism Takes Hold

But Americans 55+ aren’t just uneasy about their current jobs—they’re also increasingly pessimistic about the prospect of finding a new one. In January, 20% felt it would be ‘easier’ to secure a position in the next six months; by late August, that had fallen to 14%. Over the same period, the share who expected it to be ‘more difficult’ has risen sharply—up 19pp since January. Recent jobs report data likely isn’t helping to ease these concerns.

Older Americans aren’t counting themselves out if they happen to find themselves without a job and unable to secure a new one. When CivicScience asked the 55+ crowd what they would most consider doing in this scenario, more than a quarter said they’d pursue part-time or seasonal work (excluding ‘does not apply’). Freelancing and gig work also earn noteworthy consideration, but it’s particularly striking that as many as 1 in 5 respondents say they would take matters into their own hands and start their own business. Even amid uncertainty, this highlights that older Americans are willing to take risks and create opportunities for themselves.

The concerns facing Americans 55 and older—ranging from AI and job market volatility to the need to work past traditional retirement—are having a tangible impact on their financial security and day-to-day decisions, including holiday spending. Yet many are considering and are ready to take proactive steps, from part-time or gig work to entrepreneurship, highlighting both the seriousness of their challenges and the resilience with which they’re confronting them.