The PNC-CivicScience Investor Sentiment Index (“ISI”) is a “living,” survey-based measurement of U.S. adults’ current attitudes and expectations related to the U.S. financial markets, investment climate, and market outlook. The primary goal of the ISI is to monitor changes in consumer and investor attitudes, to better anticipate investment trends, market movements, and overall U.S. economic health.

A Snippet of Our Latest Reading:

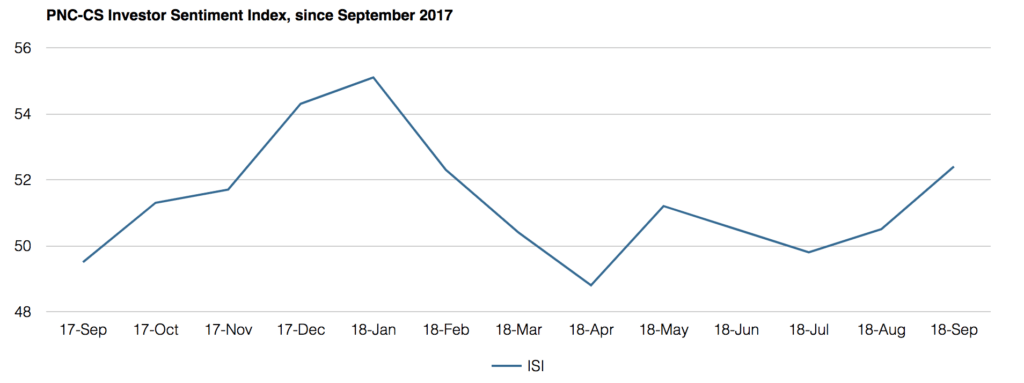

The PNC-CivicScience Investor Sentiment Index (PNC-CS ISI) ticked higher again in September, reflecting further upward momentum. Investor optimism, as measured by the poll, has reached its highest level since January 2018. After peaking in January at 55.1, sentiment began to fade, falling to a 2018 low of 48.8 in April. Since then, the index has fluctuated within a fairly narrow range, however, the September reading of 52.4 reflects growing optimism after August’s reading of 50.5 was also an increase from the prior month.

The September 2018 results reflect a fairly sizable uptick in optimism from poll participants. Trade war uncertainties with China escalated further, with the imposition of an additional 10% tariff on $200 billion worth of goods. While still manageable, mounting tariffs could have some impact on U.S. consumers, and, in turn, economic growth. Current estimates put the cumulative effect of all U.S. tariffs imposed or announced at approximately 0.32% of GDP spread over the remainder of 2018 and 2019. That said, trade progress with Mexico, and now Canada recently resulted in a new multilateral trade agreement between the three countries. Further signs of broad economic strength include second-quarter U.S. GDP being revised up to 4.2% from 4.1%, reflecting upward revisions to business investment and net trade, as demand was pulled forward on trade tensions. Additionally, the latest figures on capital expenditures show an increase of 12.9% year over year. This implies that corporations are still confident in the continuation of the economic cycle, and therefore willing to reinvest back in their businesses.

Earnings estimates continue to look very strong for the second half of 2018, and investors appear to be focused on the positive fundamental story playing out within the United States. Stocks have recovered all of what was lost earlier in the year, and continue to press higher. The S&P 500® total return in September was 0.57%, adding to the already robust year-to-date return of 10.56%. U.S. markets continue to benefit from a strong economic backdrop, historically robust earnings, and late-cycle fiscal stimulus.

In a widely anticipated move, the Federal Reserve (Fed) voted to raise the federal funds effective rate by 0.25% at its September meeting, pulling the short-term benchmark rate to a target range of 2.00-2.25%. The central bank reinforced its expectations for one additional hike in 2018, three in 2019, and one in 2020. The federal funds target rate has tightened financial conditions over the last year but remains below the federal funds neutral rate, or the rate at which monetary policy is estimated to be neither conducive to nor restrictive of economic growth. For each of the last six recessions, monetary policy was restrictive (the federal funds target rate exceeded the neutral rate) for an average of 25 months prior to recession, suggesting that current conditions remain favorable for continued expansion.

Check out the full reading.