This is just a glimpse of the insights available to CivicScience clients. Want to see the full picture? Let’s talk.

For months, CivicScience has been tracking Ozempic and GLP-1 medication usage to better understand its impact on consumer preferences. Although brand names for the drugs – such as Ozempic and Wegovy – are becoming ever-more present in the American consciousness, awareness of the term GLP-1 remains low, especially when lacking context around weight loss.

The latest data in the Ozempic and LP-1 Consumer Tracker underscores the most up-to-date information on awareness and usage, lifestyle changes, and the potential ramifications on retail, food and beverage, and other industries. Here are three key takeaways from our most recent Ozempic & GLP-1 report.

Take Our Poll: Would you ever use a weight loss drug like Ozempic?

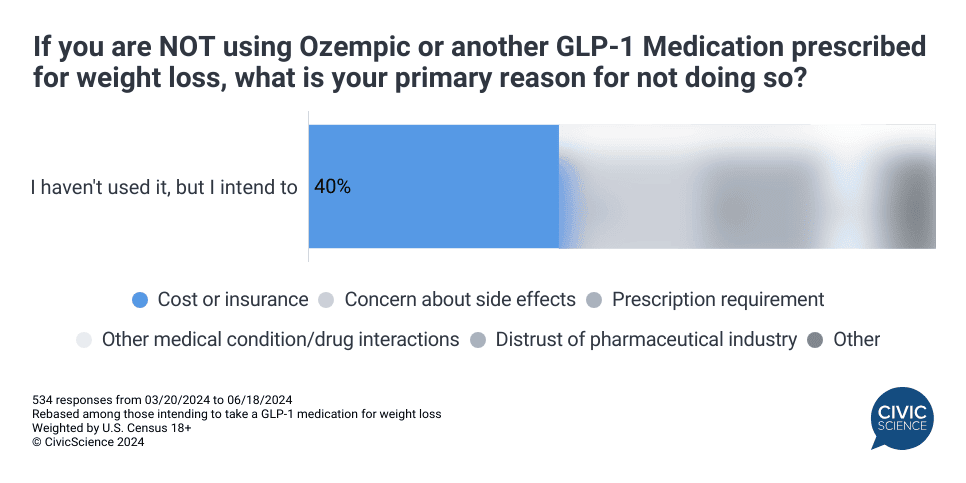

1. Price Is a Pain Point

Currently, Americans pay substantially more for weight loss drugs than Europeans. A recent article revealed that while Ozempic costs $936 a month for Americans, those in the UK pay just $93. It likely comes as no surprise, then, that 12% of Americans indicate cost as the biggest obstacle to taking Ozempic or another GLP-1 medication. This percentage increases to 40% among those who intend to take the drug in the future. The second-biggest concern is regarding side effects.

Get the full data set in the GLP-1 Consumer Tracker.

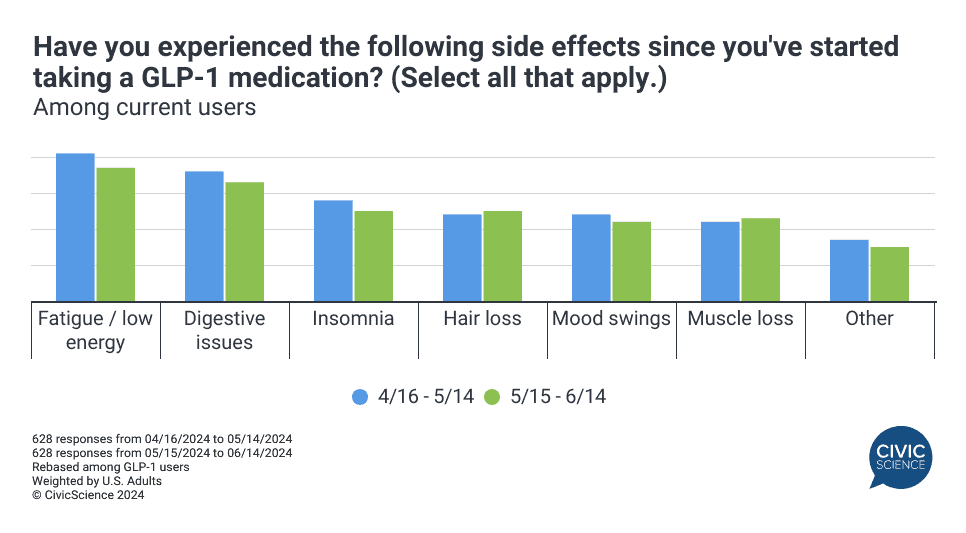

2. Sideswiped by Side Effects

As it stands, 44% of current GLP-1 users reported moderate or severe side effects, with fatigue and low energy ranking as the most common symptoms. Given that nearly half of GLP-1 users plan to take the medication – which is considered a “forever drug”– for the long-term or indefinitely, the ongoing impact of symptoms is worth taking note.

Join the Conversation: Do you have a positive or negative view of Ozempic for weight loss?

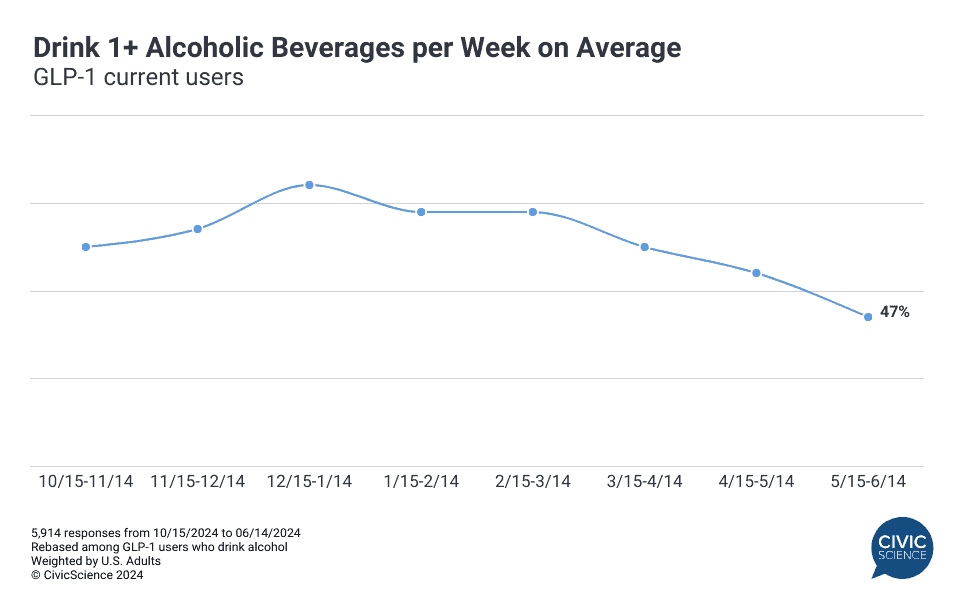

3. Alcohol Consumption Continues to Decline

Alcohol consumption among current GLP-1 users is at a record low after months of steady decline, with 47% of GLP-1 users drinking at least one alcoholic beverage per week. With current users being frequent beer drinkers, a continued drop in alcohol consumption could impact the industry.

As Ozempic and other GLP-1 medications become increasingly present in the mind of the American consumer, the nuances around interest, usage, and impact become increasingly apparent. Stay up-to-date on in-depth insights with the monthly CivicScience Ozempic and GLP-1 Consumer Tracker. Get started with a free preview.